The expected decrease in production activity in the eurozone and data that generally coincided with the forecasts of economists - all this kept the European currency from a new wave of decline against a number of world currencies, including the US dollar. It is important to note that the report on the reduction in inflation in the eurozone was also ignored, which is yet another evidence of a slowdown in economic growth in the eurozone.

According to Markit, the PMI Purchasing Managers Index for Italy's manufacturing sector dropped to 47.8 points in September this year from 48.7 points in August. Economists had forecast the index at 48.0 points.

In France, a similar index also declined. According to the report, the PMI Purchasing Managers Index for France's manufacturing sector in September came close to 50 points and amounted to 50.1 points compared to 51.1 points in August this year. Economists had expected the index to fall to 50.3 points.

The PMI Purchasing Managers Index for German manufacturing was of key importance. Activity continued to decline, reaching the next low, which indicates the onset of a technical recession in the economy. According to Markit, the index fell even further, to 41.7 points in September against 43.5 points in August this year. Economists had forecast the index at 41.4 points.

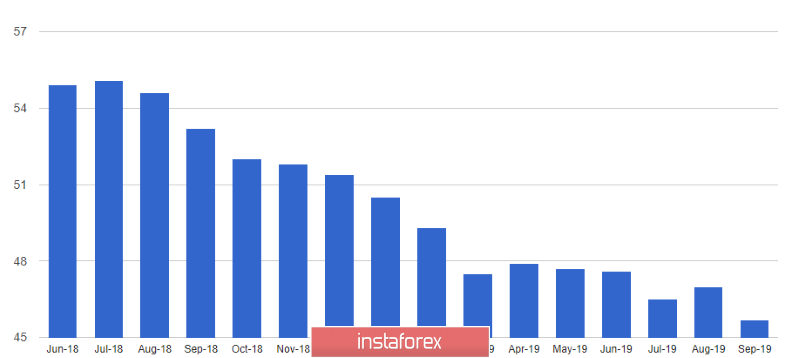

The ongoing trade war between the US and China, as well as a slowdown in economic growth, together with a sharp decline in exports, all led to a slowdown in production activity in developed countries. However, most of the problems are observed in the eurozone. The report indicates that the PMI purchasing managers index for the eurozone manufacturing sector fell to 45.7 points in September against 47 points in August. Let me remind you that an index value below 50 points indicates a decrease in activity. Economists forecast this indicator at 45.6 points.

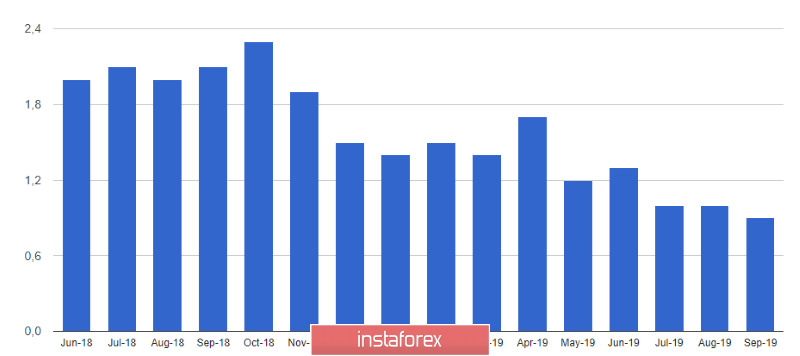

Surprisingly, traders also ignored inflation data. So, in September this year, the annual inflation rate in the eurozone slowed even more. The inflation rate is one of the "headaches" of the European Central Bank, which requires a reduction in interest rates, which are already at zero. Will the next stage of the economic stimulus program, which will begin to operate in November this year, help? Only time will tell.

According to published official data, in September 2019, compared with the same period last year, consumer prices in the eurozone rose only 0.9% after rising 1.0% in August. The basic consumer price index, which does not take into account the volatile categories of goods, grew by 1% over the same period. The target level of the ECB is just below 2%.

Today's statement by Federal Reserve representative Charles Evans was ignored by traders. In an interview, Evans said the United States is still on track for 2.25% GDP growth this year, as unemployment will continue to remain at current low levels. The Fed representative expects that a softer monetary policy will keep the economy on the right track, as well as spur inflation, which is gradually moving to its target level.

As for the technical picture of the EURUSD pair, it remained unchanged. The market is under the control of sellers, and the EURUSD pair is gradually approaching the next major support level of 1.0870. Its breakthrough will only increase pressure on risky assets, which will open a direct path to a low of 1.0840. With an upward correction of the trading instrument, the resistance at 1.0905 will limit the growth, while a larger level can be seen in the range of 1.0930.

GBPUSD

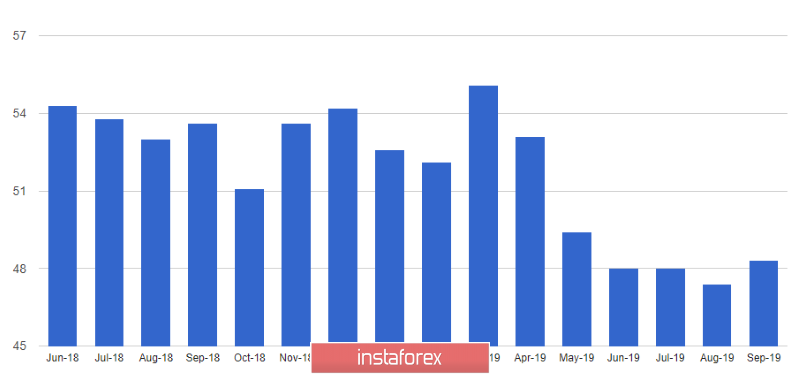

The pound continues to decline. The report on weak activity in the manufacturing sector, which also saw a very rapid reduction in the number of jobs, put pressure on the pair. According to a survey by purchasing managers and IHS Markit, the PMI for purchasing managers for the UK manufacturing sector rose to 48.3 points in September, but remained below 50 points, indicating a decrease in activity compared to the previous month.

However, a report on the UK services sector, which accounts for more than 70% of the economy, will be more important.

A breakthrough of support in the 1.2270 area led to a further bearish trend in the pair, aimed at the levels of 1.2170 and 1.2100.