Yesterday's unfavorable production data of the Institute of Supply Management disappointed traders and led to another concern of economists. The sharp decline in the indicator suggests that the risk of recession in the US is real, and no matter how the Fed representatives "disown" it, the problems in the manufacturing sector can spread to other industries. Reduced production could force the committee to resort to another lower interest rates in the United States at the end of this year at the December meeting. Most likely, the Fed will lower the rate by another 25 basis points.

The American President expressed his dissatisfaction yesterday, once again criticizing the work of the committee. US President Donald Trump said that the Fed's policy harms producers, and now the Fed is the main enemy for producers and the economy as a whole.

According to the data, US manufacturing activity in September 2019 declined for the second month in a row, which is a very bad signal that indicates a continued decline in global production. Problems in the manufacturing sector are observed in all developed countries against the backdrop of tensions in international trade.

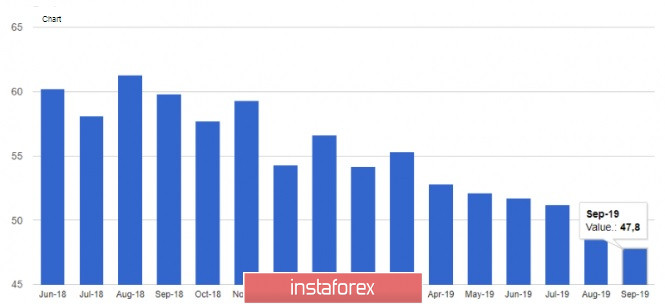

According to the report of the Institute of Supply Management (ISM), the index of supply managers PMI for the US manufacturing sector in September fell to 47.8 points against 49.1 points in August, while economists expected the index in September will be 50.1 points and will return above the level of 50 points, which will indicate its growth in the activity.

A slight increase was noted only in the sub-index of new orders, which reached 47.3 points in September against 47.2 points in August, but this does not affect the overall picture.

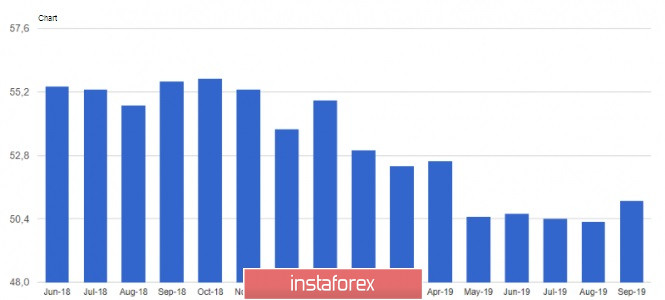

According to IHS Markit, activity in the US manufacturing sector grew in September. The report indicated that the final purchasing managers' index (PMI) for the US manufacturing sector in September 2019 was 51.1 points against 50.3 points in August. However, the average quarterly value of the index indicates very poor results. Serious problems are noted in exports, and only an increase in the volume of domestic orders will not be able to continue to support the growth of the index.

Yesterday's report on the growth of construction costs in the US passed by. According to the US Department of Commerce, construction spending in August rose to 0.1% from the previous month to $1.287 trillion. Economists had expected spending to rise by 0.4%.

Redbook retail sales data also did not lead to a surge in market volatility. The report indicated that over the 4 weeks of September, US retail sales decreased by -1.1%, but increased by 5.7% compared to September 2018. For the week from September 22 to 28, sales increased by 5.8% compared to the same period in 2018.

As for the technical picture of the EURUSD pair, at the beginning of the week, I paid attention to the false breakdown of the support of 1.0905, which will be a bullish signal. That's what happened yesterday. As soon as the bulls regained the level of 1.0905, the growth in risky assets increased significantly. Today, much will depend on data on the US labor market. A weak report will lead to a breakdown of the resistance of 1.0960 and further growth of the trading instrument to the highs of 1.1000 and 1.1030. The bearish correction in the pair will be met with strong support at 1.0910 and 1.0880.

GBPUSD

The British pound yesterday managed to regain its position after breaking the next support levels. The information that the British Prime Minister is preparing to submit a revised version of the Brexit deal in a few days to the European Union did not take long to wait for the bulls who were waiting for the most suitable moment to return to the market after a major bearish correction. The support level of 1.2270 remains, and yet another unsuccessful attempt by the bears to break below this range will only increase the demand for a trading instrument.

However, it should be remembered that even if Boris Johnson manages to get the European partners to change the terms of the deal, he may not get the support of British lawmakers, as it was under the power of Theresa May. This state of affairs does not allow the bulls to realize their potential, which will remain uncertain until October 31, when the country should officially break off relations with the EU.