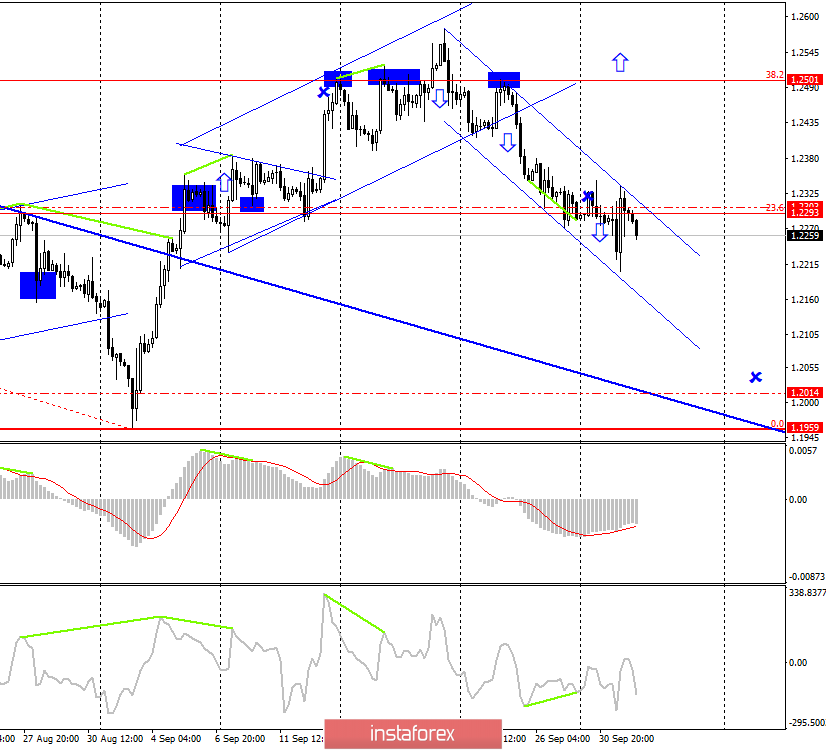

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a rollback from the low, the growth to the corrective level of 23.6% (1.2293), but at the moment, it is ready to resume the fall. A new downward channel has been built, within which the movement of the pound/dollar pair continues. As before, I expect the pair to drop, as the information background remains negative for the pound.

The events taking place in the UK are becoming more and more like a farce. For a long time, British Prime Minister Boris Johnson, with all his actions, showed that the agreement on Brexit is not the most important step for him. Either the Prime Minister understood that it was impossible to reach an agreement or simply did not want any agreement. However, in recent days, information has unexpectedly arrived that conservatives are still developing a mechanism that will be called upon to replace the so-called Backstop. I already wrote about its essence in yesterday's article. There is nothing to add to this. On paper, everything looks beautiful, but what are the chances that he will suit the European Union? What are the chances that it will be approved by the UK Parliament? So it turns out that the European Union, Parliament, and Boris Johnson are in different parts of the world and are not moving towards each other to find a solution that will suit everyone and finally allow the Kingdom to leave the European Union. Parliament needs a soft exit from the EU, with an agreement. Boris Johnson – any exit. The European Union – a soft way out, but with completely different conditions, not those offered by London. If the media had not heated the weekly thesis that the parties are continuing negotiations, that there are certain chances for an agreement, this situation would be called a "dead end".

However, the internal wars between Parliament and the British Government are also unclear what will end. In general, we get a picture with a mass of different options for the development of events and with a huge uncertainty of the future for both the country and its currency. Under such conditions, it is still extremely difficult to count on the growth of the pound. And then there is a possible reduction in the key rate by the Bank of England, which again is quite logical against the backdrop of worsening economic reports. Yesterday, for example, the index of business activity in the UK manufacturing sector was frankly bad, although it exceeded slightly the expectations of traders. Today, an index of business activity in the construction sector will be released, but nothing favorable is expected from it either.

What to expect from the pound/dollar currency pair today?

The pound/dollar pair performed a reverse consolidation under the correction level of 23.6% (1.2293), but it is uncertain again. Thus, it is not a fact that the fall will continue, although the information background speaks in favor of such an option as a new trend channel. One thing is clear – buying the pound is now even riskier than selling. A report on the number of new jobs in the US will also be released this afternoon, which may also affect the movement of the pound/dollar pair on October 2.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.

Forecast for GBP/USD and trading recommendations:

I do not recommend buying the pair shortly, as the pair can now perform a maximum rollback to the top.

I recommend considering the pair's new sales with the target of 1.2014, as the closing was made at the level of 23.6%, with the stop-loss order above the level of 1.2308, but the closing is still uncertain.