Yesterday can be safely called a day of bad news. The index of business activity in the UK construction sector, which was supposed to remain unchanged, declined from 45.0 to 43.3. However, the real estate market is one of the main criteria for the investment attractiveness of the United Kingdom, the immersion of this industry in the abyss of the crisis, by which the index figure below 50.0 points. This is what it is talking about, which clearly does not add optimism. However, the market reacted poorly to this. Needless to say, everything was not observed at all, since the focus is on the endless battles around Brexit.

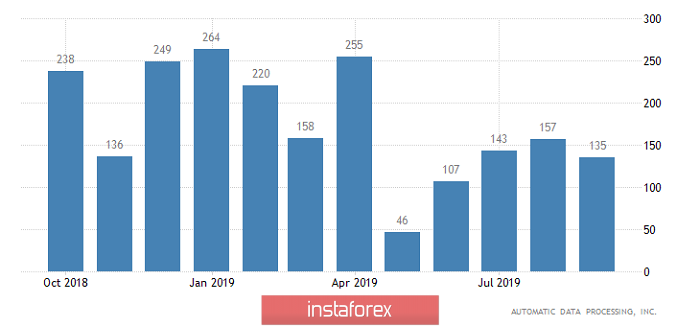

In addition, the market revived a bit later, when it became known about the revision of previous employment data from ADP, after which it became clear that this same employment did not grow by 195 thousand, but by 157 thousand in August. The data for September, in turn, came out worse than forecasts, showing growth of employment by 135 thousand instead of 140 thousand.

Employment Growth from ADP (United States of America):

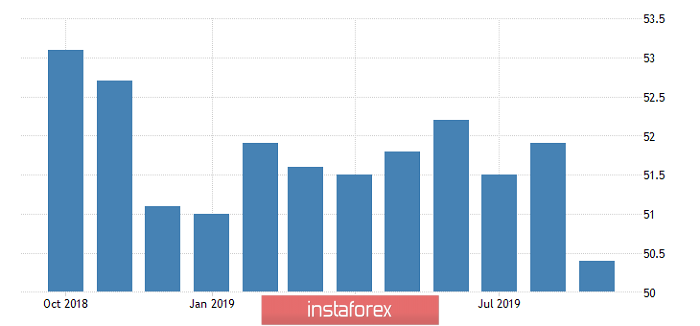

Today is the last day that investors can mentally prepare for the publication of a report by the United States Department of Labor tomorrow. But unfortunately, today is extremely saturated with macroeconomic statistics both in Europe and in the United States. Although market activity will be limited by the day off in Germany, but still, it will be extremely interesting. Thus, in Europe, the final data on the index of business activity in the services sector, as well as on the composite index of business activity will be published. In particular, the index of business activity in the services sector should decrease from 53.5 to 52.0, and the composite from 51.9 to 50.4. If you look at the main countries of the euro area, the index of business activity in the services sector in Germany may decline from 54.8 to 52.5, while the composite from 51.7 to 49.1. Anyway, these points go to the ever-increasing risks of a recession in Europe's largest economy. In France, the situation is only slightly better, since none of the indices should fall below 50.0 points. In particular, the index of business activity in the service sector may decline from 53.4 to 51.6, and the composite index from 52.9 to 51.3. What can I say, even in Italy, they expect a decrease in the index of business activity in the services sector from 50.6 to 50.4. A similar direction of movement of the index of business activity in the services sector is forecasted in Spain, however, from 54.3 to 53.8.

Markit Composite Business Activity Index (Europe):

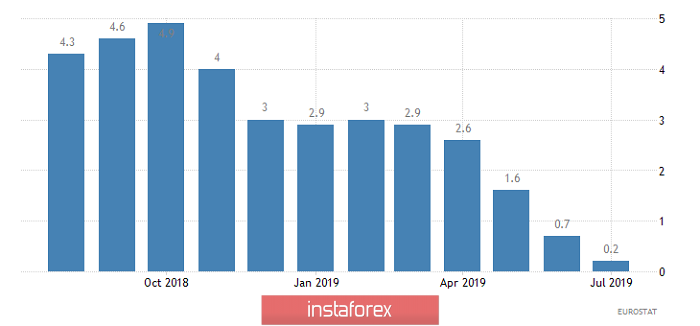

Even though such a picture can only cause horror, the bad news does not end there. Much worse than that, the growth rate of retail sales in Europe should slow down from 2.2% to 1.9%. And if you recall the recent data on retail sales in Germany, which showed an incredibly sharp slowdown in growth, there is practically no doubt that the data will turn out to be worse than expected. More so, the worst thing is that the growth rate of producer prices, which are now growing at 0.2%, may be replaced by a decline of 0.5%, which will directly indicate the prospect of a further reduction in inflation. Against the backdrop of this whole apocalyptic picture, the only thing that can please us at least somehow is the expected acceleration of retail sales growth in France from 2.7% to 3.0%. However, there is a persistent feeling that this will not affect the situation.

Growth rates of producer prices (Europe):

The situation is no less sad in the United Kingdom, where a decrease in the index of business activity from 50.6 to 50.3 is expected. But most of all, everyone is interested in Brexit. In particular, the new ingenious plan of Boris Johnson, which will be considered by the House of Commons today. Thus, we can expect many interesting surprises. That's just all previous similar visits negatively affected the pound.

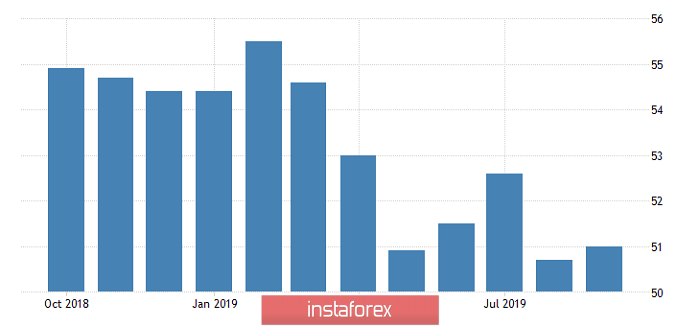

On the other side of the Atlantic, forecasts for macroeconomic statistics are noticeably better than in the Old World. Therefore, the total number of applications for unemployment benefits should be reduced by 3 thousand. In particular, the number of initial applications for unemployment benefits may increase by 2 thousand, while the number of repeated ones should decrease by 5 thousand. Nevertheless, taking into account yesterday's data on employment, there is a danger that the data will be worse than forecasts. In addition, unlike Europe, business activity indices are forecast to rise. In particular, the index of business activity in the services sector should grow from 5.7 to 50.9, and a composite index from 50.7 to 51.0. At the same time, rather positive data will be leveled by production orders, which should show a decrease of 0.2%. Moreover, fears are strong, that the general tone of the report of the United States Department of Labor will be frankly negative. Due to this, the dollar is unlikely to succeed.

Markit Composite Business Activity Index (United States of America):

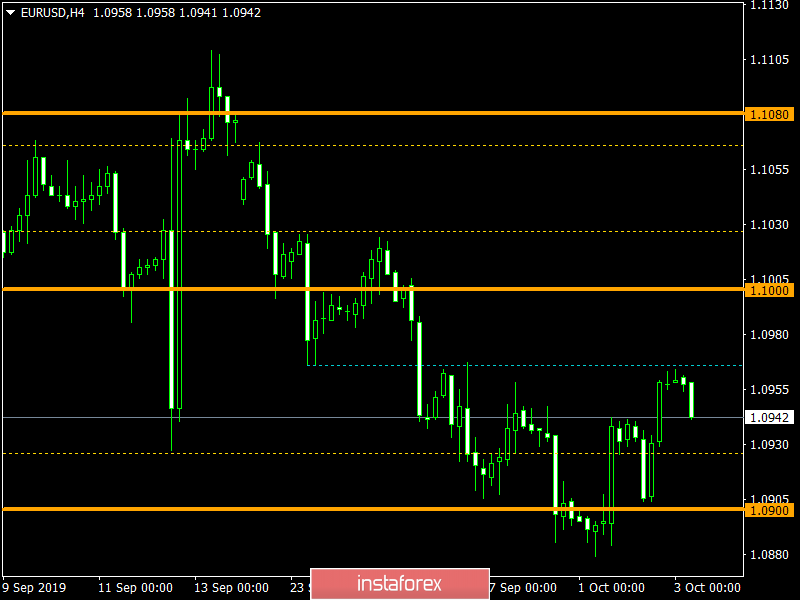

The euro / dollar currency pair after a local rebound, found a resistance level in the region of 1.0965 once again, where it initially formed a stagnation with a subsequent rebound. It is likely to assume a temporary decline to the area of 1.0930 -> 1.0920, where another stop is possible with a subsequent return.

The pound / dollar currency pair has not manifested itself since the beginning of the week. As a result, drawing the amplitude fluctuation of 1.2230 / 1.2350 It is likely to assume that walking in the given framework will still remain for some time in the market, where it is advised to take a closer look at the price fixing points.