The US dollar weakened yesterday against the euro and other world currencies after reports showed that the number of Americans applying for unemployment benefits for the first time grew for the third week in a row, and non-manufacturing activity declined slightly. Another infusion of funds under the repo procedure also weakened the position of the US dollar.

According to the US Department of Labor, the number of initial applications for unemployment benefits for the week of September 22-28 increased by 4,000 and amounted to 219,000. Economists had expected the number of applications to be 215,000. The number of secondary applications fell by 5,000 to 1,651,000.

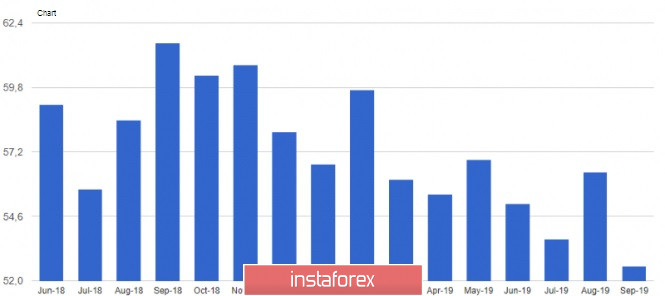

As noted above, the indicator of business activity of private companies in the US services sector, although marked by growth in September, remained close to 50 points. The weakness of the index is directly related to the slow growth of new orders. According to IHS Markit, the purchasing managers' index (PMI) for the US services sector was 50.9 points in September against 50.7 points in August. Index values above 50 still indicate an increase in the activity. Expectations for business activity remain subdued, and several companies have already expressed concerns about their prospects due to the deterioration of forecasts for the global economy.

According to the Institute for Supply Management (ISM), the PMI for the non-manufacturing sector of the United States in September fell immediately to 52.6 points, while in August was at 56.4 points.

Weak data on activity in the manufacturing sector and the service sector are further evidence that the Federal Reserve will not stop lowering interest rates, and, most likely, at the end of this year at the December meeting, it will lower the key interest rate by another 25 points.

In confirmation of the weak manufacturing sector, a report was released yesterday, which indicated a reduction in production orders. According to the US Department of Commerce, US production orders fell by 0.1% in August 2019 compared to the previous month. Durable goods orders fell by 0.2%, while orders for non-durable goods decreased by 0.3%.

As noted above, the Federal Reserve Bank of New York made another infusion of liquidity in the amount of 33.55 billion US dollars. The funds were provided through repo operations, which helps to eliminate the lack of liquidity in the short-term debt market. All the applications that the banks requested were satisfied.

Yesterday, the President of the Federal Reserve Bank of Cleveland Loretta Mester spoke, who said that low-interest rates can exacerbate financial imbalances, but financial risks are currently moderate. Mester also expressed concern that the Fed does not have a large number of tools at its disposal to deal with financial risks.

All traders' attention today will be focused not on data on the US labor market and on the report on employment in the non-agricultural sector, and the speech of Fed Chairman Jerome Powell, which will take place in the middle of the North American session. Traders will look for any hint of further interest rate cuts, which will lead to further weakening of the US dollar.

As for the technical picture of the EURUSD pair, the larger support levels are seen around 1.0935 and 1.0900. The task of buyers of risky assets is to return to the resistance level of 1.1000, which will lead to the continuation of the upward trend to the highs of 1.1030 and 1.1070.

GBPUSD

The pound fell back yesterday after breaking a large resistance at 1.2315, which now acts as a support. Statements by EU officials that the British government's proposals to overcome the stalemate in the Brexit negotiations are not credible put pressure on the pair in the afternoon. According to the representative of the European Parliament, Philip Lambert, the proposal of London contradicts the promise of the British side on the absence of a rigid border on the Irish island.

Such half measures, as well as the proposal to vest the Parliament of Northern Ireland with a veto over the establishment of uniform regulatory standards with the Republic of Ireland, mean that the EU will be obliged to open its border in case of a dispute, without achieving unification of this process. The chairman of the European Commission, Jean-Claude Juncker, spoke about these "nuances" in his recent address to Boris Johnson.

As for the technical picture of GBPUSD, despite yesterday's decline after active growth, bulls have a chance to continue the upward correction. To do this, it is necessary to regain the resistance level of 1.2370, which will strengthen the demand for the trading instrument and lead to an update of the highs in the area of 1.2440 and 1.2530. The downward correction will be limited by a large support at 1.2260.