On Friday morning, Asian stocks rose after two days of falling. The growth is due to the reaction of the US stock market to weak statistics, which increases the possibility of another reduction in the base rate.

Another positive factor contributing to the recovery is the expectation regarding the upcoming meeting between the US and China on October 10-11. Markets assess the likelihood of a temporary trade agreement as high, since this outcome is in the interest of both parties. Moreover, risky assets can take advantage of positive expectations and win back some of the losses in the short term. At the same time, experience shows that any interim agreement lasts hardly longer than a month - the contradictions between the USA and China are much deeper and can hardly be resolved without significant losses of one of the parties.

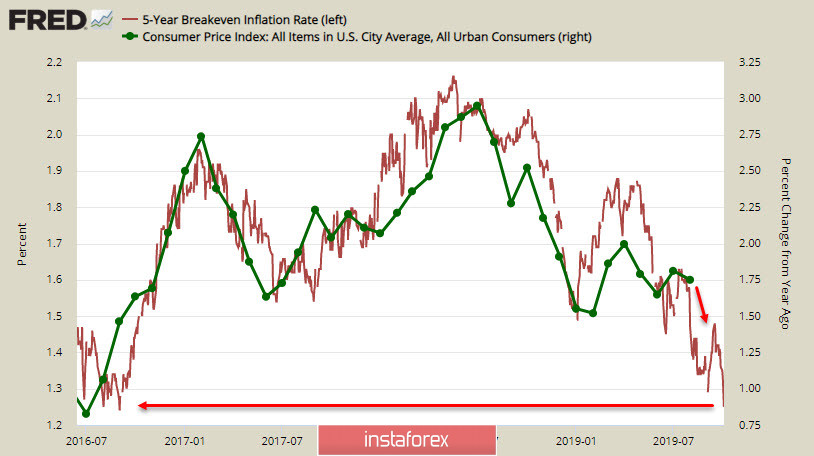

Thus, US positions can greatly weaken. Inflation data in September will be published on October 10. Forecasts are currently neutral, but markets may be very disappointed after the publication - the yield of 5-year tips bonds fell to a 3-year low:

A sharp decline, in turn, is a reaction of investors to weak ISM reports. After a failed production report on Thursday, an index was published on the services sector, which declined from 56.4p to 52.6p. The result was much worse than expected, and despite the fact that the index is still in the positive zone, the current value is minimal since June 2016, and further dynamics are beyond doubt.

Falling tips yields sharply increases the likelihood of a further decline in inflation. If the report on the labor market turns out to be worse than expected today, then the markets may have a clear understanding that the approaching recession in the United States is caused not by external, but purely internal reasons, to which the Fed will have to quickly respond with measures to mitigate monetary policy.

Together, these expectations lead to an increase in demand for risky assets in the short term.

NZDUSD

This week, most of New Zealand's economy indicators look neutral. The threat of another reduction in the RBNZ rate is small, inflationary expectations remain stable, and there is no tendency to reduce them.

At the same time, nothing has changed in the long run - a quarterly study of NZIER business opinions shows a further decline in business confidence in the 3rd quarter. A net 35 percent of enterprises expect general economic conditions to deteriorate, and this is the lowest level since March 2009.

Kiwi, as expected, updated the minimum. A further decline is doubtful, and thus, the kiwi goes into the side range. The support level is 0.6265, while resistance level is 0.6348. Out of range will occur mainly under the influenced by external factors.

AUDUSD

RBA, as expected, lowered the rate to 0.75%, which is another record low. Since the market was expecting a decline, the RBA decision did not cause strong Australian sales. The support zone 0.6674 / 86 stood firm again , and now, the Australian currency has a chance to develop corrective growth. The resistance for which will be the level of 0.6820.

The support for the possible growth of the Australian currency are macroeconomic indicators. The NAB online retail sales index returned to strong growth (+ 5.7%) in August compared with July, the Commonwealth Bank and AiG PMI indices remained at the August levels in September, despite negative forecasts. In addition, the raw materials price index in September showed an increase of 1.8% with a forecast of a fall of 17.7%. Ai Group's performance indicators for the manufacturing and service sectors, on the other hand, provide encouraging signs of improvement in some segments of the economy.

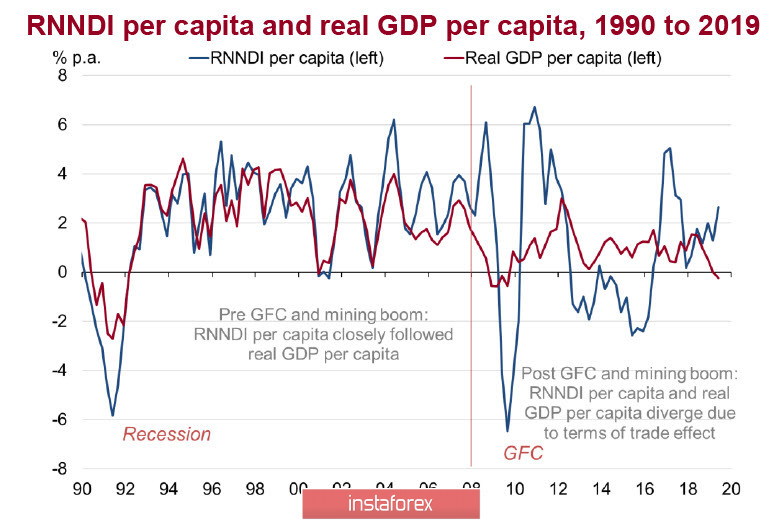

Despite weak GDP growth, real net national disposable income (RNNDI) per capita looks confident. Therefore, there is reason to hope for strong consumer demand and inflation.

At this stage, the RBA completed the declined cycle, so the down impulse is weakened. Now, the fate of the Australian dollar will be decided by the pace of slowdown in the global economy, and if these rates increase, the AUD will inevitably resume its decline.

In the coming weeks, trading will go mainly in the lateral range. The probability of another assault on support 0.6674 / 86 is small.