To open long positions on EURUSD you need:

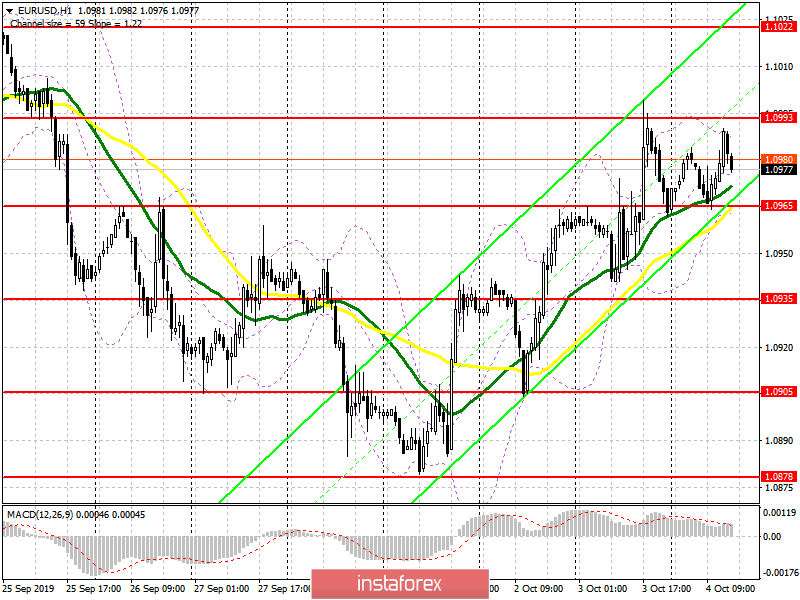

From a technical point of view, the situation in the first half of the day has not changed due to the lack of important fundamental statistics. To talk about further growth of EUR / USD, without a weak report on the number of people employed in the non-agricultural sector of the USA, will not be entirely true. Bulls need to break above resistance 1.0993, which will provide them with growth to the highs of the previous week to the area of 1.1022, where I recommend taking profits. However, the more important task for the second half of the day is to protect the support of 1.0965, on which a lot depends today. The formation of a false breakdown on it is a direct signal to euro purchases. If the bulls miss this range, you can return to long positions immediately to the rebound from a minimum of 1.0935.

To open short positions on EURUSD you need:

Sellers will be waiting for a report on the US labor market and the formation of a false breakdown in the resistance area of 1.0993. Only in this scenario we can expect a return and consolidation below the support of 1.0965, which will push EUR / USD to the minimum of yesterday at 1.0935, where I recommend taking profits. If buyers of the euro will be able to regain the resistance of 1.0993 in the afternoon and continue to move along the trend, it is best to consider short positions for a rebound from a maximum of 1.1022.

Indicator signals:

Moving averages

Trading is conducted slightly above 30 and 50 moving averages, which indicates the preservation of buyers in the market.

Bollinger bands

The breakdown of the upper border of the indicator in the area of 1.0989 will lead to a larger wave of euro growth, while a breakdown of the lower border in the area of 1.0965 will increase the pressure on the euro.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20