The US labor market report, at first glance, came out pretty strong. The number of new jobs in September increased by 136 thousand, which is slightly less than forecasts, but the weak negative was more than blocked by the revision of +45 thousand of the indicators of the previous two months. In addition, a clear plus is the reduction in unemployment from 3.7% to 3.5%, which is a 50-year low.

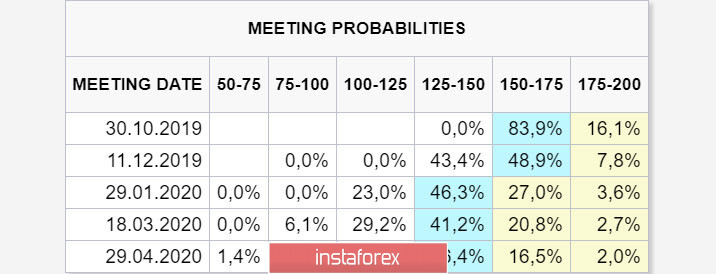

Now, it would seem that the dollar should respond to such a strong report with growth, because the probability of two more Fed rate cuts this year has decreased. However, the market behaved in exactly the opposite way - the dollar remained in the range, and the probability of a rate cut in October, according to the CME, reached 83.9%:

The hint lies in the indicator, which is key to inflationary expectations. We have repeatedly noted that, despite the fact that inflation is close to the target of 2%, expectations about the purchasing activity of the population are significantly overstated. Weak ISM reports published last week showed a decline in business activity, which was reflected in the immediate drop in stock indices. Yields on inflation-protected Tips 5-year bonds are at 3-year lows, which means no less investors 'conclusion that Trump's tax reform has not led to an increase in consumer activity.

Well, like a cherry on the cake - zero growth in average wages in October and a decline in annual growth rates from 3.2% to 2.9%. These data indicate that no growth in consumer activity can be expected, inflation will decrease, which means that the need to lower the Fed rate is growing, which was recorded by the CME futures market.

Lower rates, in turn, mean the approach of a recession. In the short term, stock indices may continue to grow, as the decline in unemployment eliminates the negative effect of the weak ISM PMI report, however, as the date of the FOMC meeting approaches, it becomes clear for Fed officials that the reasons for continuing hawkish rhetoric are disappearing before our eyes. On Friday, two heads of the Fed's regional offices, Clarida and Kaplan, simultaneously announced that the Fed was ready to "act accordingly" to support the declining economy, and these statements would help lower demand for the dollar.

EUR/USD

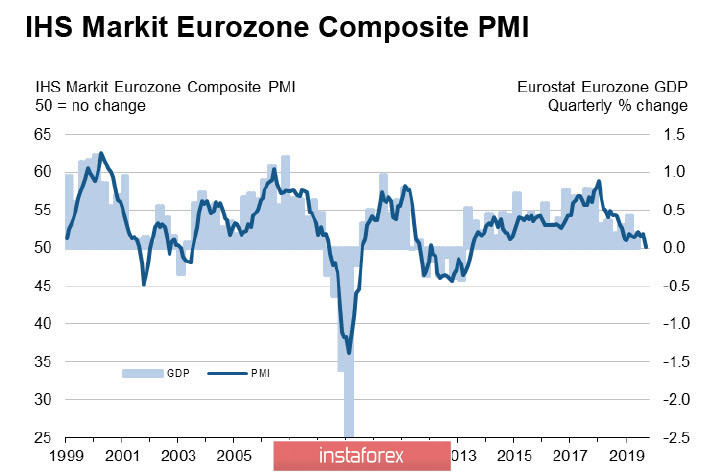

The eurozone economy continues to slow down. The composite PMI index in September came close to the critical point of 50p, which is the lowest for more than 6 years, the maximum decline in production was recorded for 7 years, and the growth rate in the services sector was the lowest since the beginning of the year.

The growing risk of recession increases the likelihood that the ECB will consider more aggressive measures to support the economy.

The growth of the euro is constrained by the boundary of the 1.1015 / 20 channel and support 1.0923. On the other hand, the level 1.1015 / 20 can form a reversal signal downward, breaking through it will strengthen the growing impulse. But a decrease to the middle of the range under current conditions seems a little more likely.

GBP/USD

The coming week will be crucial for choosing a scenario for which the development of the situation with Brexit will go. So far, the most probable is the extension of the deadline until January 2020, after which early elections will be held.

Last week, the EU rejected Johnson's plan by setting up a counter proposal on safeguards for compliance with the Ireland Agreements. The deadline for reaching a decision is October 11, since it will take time to include the final plan on the agenda for the EU leaders summit on October 17-18.

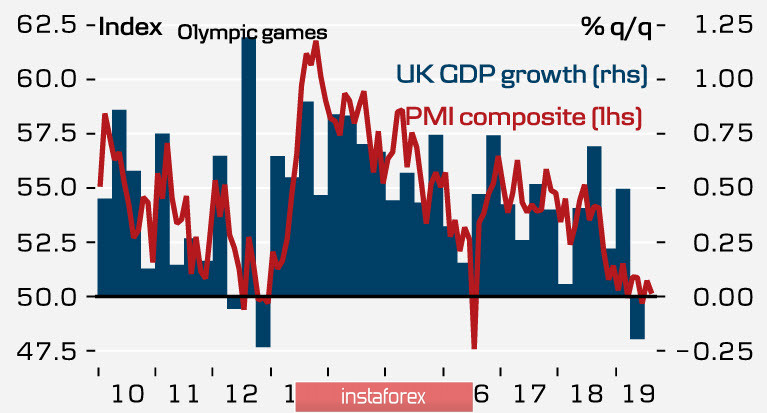

It is the situation around Brexit that so far controls the pound, while the economic situation in the UK indicates a slow slide into a recession.

Most likely, the pound will continue to trade in the range until October 11, since there are no events planned to form a trend before this date. The borders of the range are wide - support is found at 1.2210, while resistance is at 1.2582. The formation of the base in the region of 1.2260 / 70 and growth attempt are slightly more likely by the end of the week.