Dear colleagues.

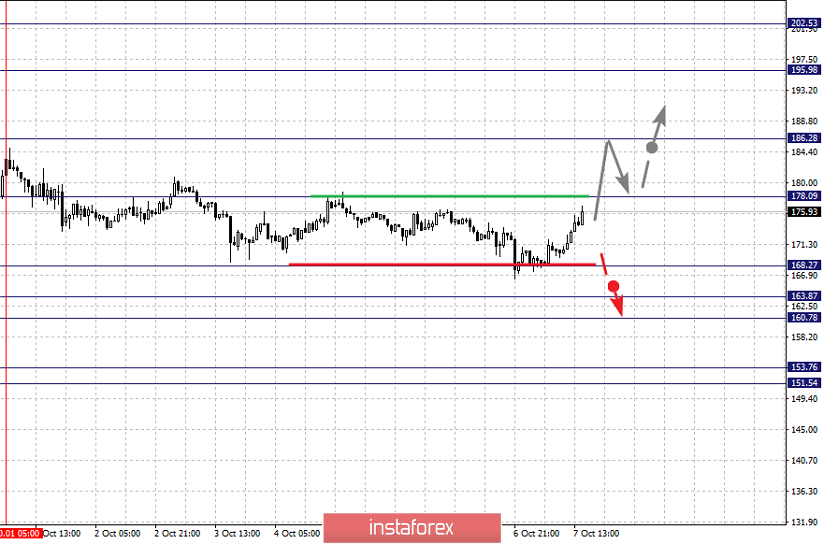

Ethereum is the most optimal instrument for intraday trading, both for working in a trend and in correction zones. The tool has a pronounced structure of the initial conditions and moderate noise of the time series. At the moment, we expect the formation of local initial conditions for the continuation of the upward trend, which should happen after the breakdown of the level of 178.09. The potential target for the top is 186.28.

Forecast for October 7:

Analytical review of cryptocurrency on a scale of H1:

For the Ethereum instrument, the key levels on the H1 scale are: 202.53, 195.98, 186.28, 178.09, 168.27, 163.87, 160.78 and 153.76. Here, the price has entered an equilibrium state: a downward structure from October 1, and we also expect the formation of a local structure for the top from October 6. We expect the continuation of the upward movement after the breakdown of the level of 178.10. In this case, the target is 186.28. The breakdown of which, in turn, should be accompanied by a pronounced upward movement to the level of 195.98. The potential value for the top is considered to be the level of 202.53. Upon reaching which, we expect consolidation, as well as a downward rollback.

Short-term downward movement is expected after the breakdown of the level of 168.27. In this case, the target is 163.87. The range of 163.87 - 160.78 is a key support for the upward structure. Its passage at a price will favor the development of a downward trend. In this case, the potential target is 153.76.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 178.10 Stop Loss: 168.40 Take Profit: 186.20

Buy: 187.00 Stop Loss: 178.00 Take Profit: 196.00

Sell: 168.20 Stop Loss: 178.30 Take Profit: 164.00

Sell : 160.50 Stop Loss: 169.50 Take Profit: 154.00