In the financial markets, expectations for a speedy reduction in the Fed's interest rates amid signals of a slowdown in the US economy are increasing.

If on Friday, the head of the American regulator did not give a clear answer in his short commentary on the topic of Central Bank actions in the foreseeable future, but only referred to the fact that the main task of the bank was to support economic growth, then on Monday, two heads of federal banks said they supported the decline interest rates.

Atlanta Federal Reserve President R. Bostic and Boston Federal Reserve President E. Rosengren made it clear that they were prepared to consider the possibility of another cut in interest rates amid the weak employment data released on Friday that turned out to be worse than expected. Their statements turned the US stock market on Monday, trading of which began in the "red" zone.

In general, the events of the past week, and we primarily mean the publication of negative data on business activity indices in the manufacturing and non-manufacturing sectors, as well as the values for the number of new jobs in the US economy in September, seem to begin to radically change market expectations. Now, investors are more willing to believe that the risk of the US economy stalling into a recession by the end of this year will force the regulator to decide to lower interest rates twice - in October and December.

Of course, this state of affairs could not but affect the demand for defensive assets. Yields on US government bonds went uphill, and demand for gold and safe haven currencies, which fully include the Swiss franc and Japanese yen, fell markedly. It is well-founded that markets believe that the Federal Reserve is ahead of the undeclared QE4 program.

Earlier in September, when addressing the issue of liquidity in the local financial market, the Fed began pumping up the global dollar system by conducting repo transactions. In addition, it carried out purchases from banks and primary dealers of government bonds and mortgage-backed securities with a total volume of around $ 186 billion. In fact, we can say that the regulator does not publicly announce the beginning of an incentive measure. Thus, the continuation of such a policy, paired with the expected reduction in interest rates, do indeed give the right to speak of some kind of QE4.

Observing everything that happens, we believe that the risk appetite in the markets will gradually increase as investors become more and more convinced of just such a scenario. Given this, we believe that the demand for protective assets will decrease, and the US dollar will remain under pressure in the near term.

Forecast of the day:

Gold on the spot is under pressure in the wake of rising expectations of new Fed impulse measures. The growth of these sentiments will put pressure on the asset. We believe that a decline below the level of 1489.00 will lead to a drop in the price to 1484.00 with the prospect of decline to 1461.90.

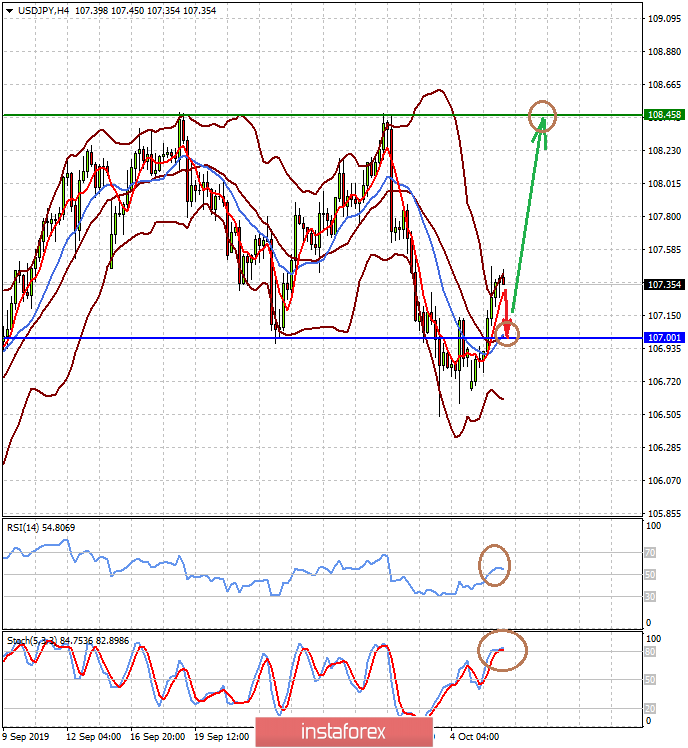

The USD/JPY pair may correct down to 107.00. We consider it possible to make purchases around this level with a local target of 108.45, since we expect growth in demand for risky assets as markets are convinced that the Fed will continue to lower rates and pump the US financial system with liquidity.