To open long positions on GBP/USD, you need:

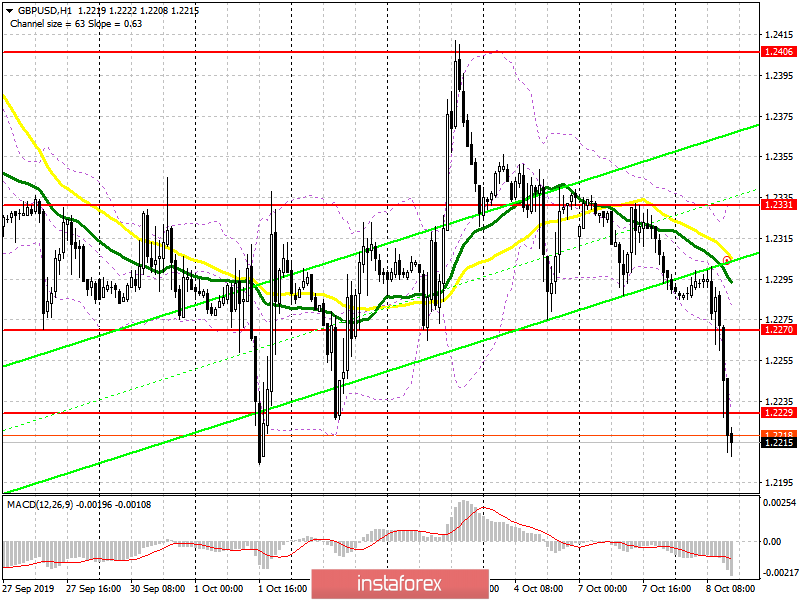

Today, it became known about the conversation between Boris Johnson and German Chancellor Angela Merkel, the results of which are not comforting. Merkel made it clear that the EU is not satisfied with the Brexit scenario that was proposed by the UK government last week, which led to a sharp decline in the pound. The breakthrough of the important support levels, which I paid attention to in my morning forecast, also forced the bulls to retreat from the market. At the moment, it is best to return to long positions only after a successful attempt to consolidate GBP/USD above the resistance of 1.229, which will lead to an upward correction in the area of the maximum of 1.2270, where I recommend taking the profits. But given the current position of the UK, it is best to return to buying as low as possible from lows around 1.2189 and 1.2150.

To open short positions on GBP/USD, you need:

Sellers coped with the morning task, and the breakthrough of support in the area of 1.2270-80 led to the demolition of a number of stop orders and a stronger downward movement, which I discussed in more detail here. Now, the goal of the bears is to hold the resistance of 1.2229, and the formation of a false breakdown there in the afternoon will be an additional signal to increase short positions in GBP/USD. The breakdown of the support of 1.2189, to which the pound is now striving, will weaken the positions even more, which will collapse the pair to the lows of 1.2150 and 1.2112, where I recommend taking the profits. The return of GBP/USD to the resistance of 1.2229, with bad data on producer prices in the US, can lead the pound to the resistance of 1.2270, from where it can be sold immediately on the rebound.

Indicator signals:

Moving Averages

Trading is below 30 and 50 daily averages, indicating a further bearish market.

Bollinger Bands

In the case of an upward correction, the average border of the indicator around 1.2280 will act as a resistance.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20