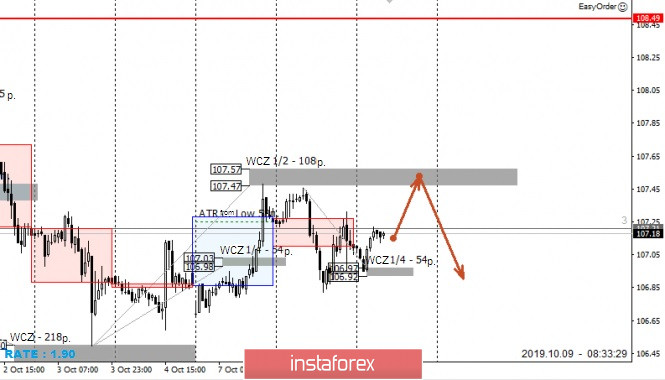

Yesterday's decline of the pair led to the test of the WCZ 1/4 106.97-106.92. Holding the price above this zone indicates a set position in both directions. The resistance is WCZ 1/2 107.57-107.47. Its test will again look for a pattern to sell the instrument. The target of the downward movement remains the October minimum.

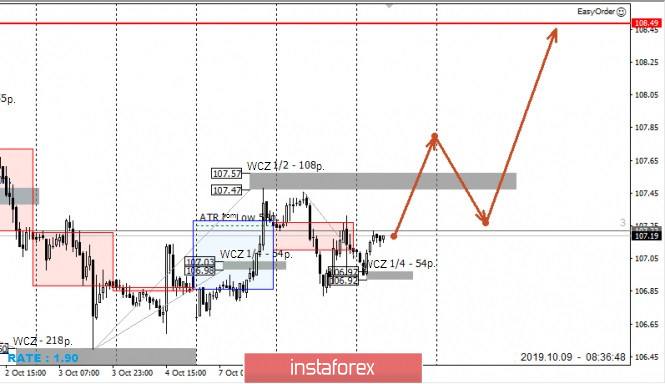

Working in the flat implies a partial closure of positions on opposite borders. Closing trades above weekly extremes will be required to exit the flat.

To break the downward structure, it will be necessary to close the US session above the level of 107.57. If this happens, then purchases will come to the fore, and the first goal of growth will be the maximum of the last month. The probability of implementing this model is 30%, which makes it auxiliary.

Daily CZ – daily control zone. An area formed by important data from the futures market that changes several times a year.

Weekly CZ – weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ – monthly control zone. An area that reflects the average volatility over the past year.