Brexit is once again in the spotlight, although Downing Street 10's official reaction to a letter from an anonymous official from the prime minister's office has never been. Instead, a statement was made to suspend negotiations between London and Brussels. At the same time, the parties quite cheerfully engaged in an exchange of accusations of each other in the breakdown of negotiations. According to London, the reason is that Brussels suddenly took an extremely tough stand on the border between Ireland and Northern Ireland. In turn, Brussels claims that there are no changes in its position, since he outlined his point of view on the border between Ireland and Northern Ireland immediately as the negotiations on Brexit began, which began after the referendum. Since then, there have been no changes. Brussels claims that it is London that is constantly changing its position on one or the other issues, and cannot make constructive proposals in any way. In general, the nature of the recriminations fully coincides with the content of the letter written by an anonymous source from Downing Street 10. In any case, it was officially announced that the negotiations had reached an impasse. For investors, this is a clear signal that the hard Brexit is becoming more and more real. So it is not surprising that the pound went down quite confidently, because this scenario implies that it is the British economy that will suffer the greatest losses. Moreover, their scale is difficult to predict.

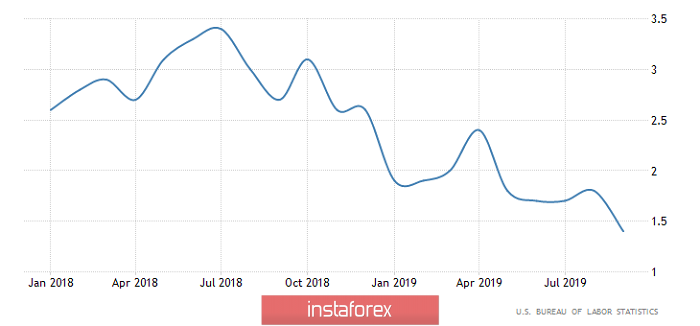

However, the pound's loss could be much larger if not for the data on producer prices in the United States. It was predicted that their growth rate will remain unchanged, but in fact, they slowed down from 1.8% to 1.4%, which indicates a high potential for reducing inflation itself. It was these fears that held back the weakening of the pound.

Producer Prices (US):

Today everyone is looking forward to the release of the text of the minutes of the last Federal Open Market Committee meeting, but before it JOLTS data on open vacancies will be published, the number of which should be reduced from 7,217 thousand to 7,191 thousand. Given the general nervousness regarding the expected recession, a decrease in the number of open vacancies will be perceived as a clearly negative factor, so that the dollar will lose its position. But do not forget that Brexit is weighing on the pound, so its strengthening will be more symbolic. The content of the text of the minutes is unlikely to drastically change the situation. While all the media are only busy with the fact that they are waiting for a recession, the Federal Reserve, through the mouth of Jerome Powell, has officially announced that it does not see any signs of this same recession. That is what will be reflected in the text of the minutes. So everything will remain even.

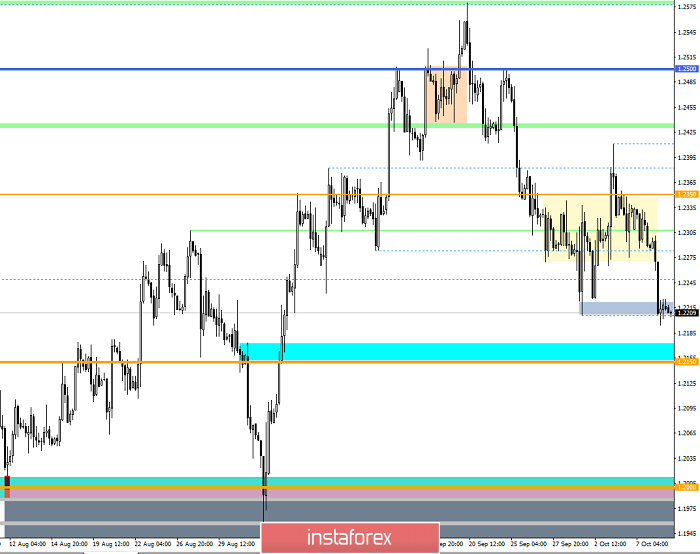

Nevertheless, the GBP/USD pair managed to overcome the 1.2270/1.2350 accumulation holding more than a week, breaking through the lower boundary as expected. In fact, we saw an impulsive jump that led us to the previously found support point of 1.2200, where the level was again confirmed and has formed a local stagnation. Looking at the trading chart in general terms, we see that not everything is so bad, the main downward trend begins to revive and the oblong correction has almost been won back by half. The main support point is in the range of 1.1957/1.2000, but it is still far from it.

It is likely to assume that the stagnation within 1.2200 (+/- 25 p) will not last very long and if the price is consolidated below 1.2190, we will quickly be pulled towards the next level of 1.2150, where it is possible that we are already waiting for a rollback/correction.

Concretizing all of the above into trading signals:

- We consider long positions in case of a change of interests and price consolidation higher than 1.2240. Another scenario is considered if the pivot point is near the level of 1.2150.

- We consider short positions in case of a clear consolidation of the price below 1.2190, with the prospect of a move to 1.2150.

From the point of view of a comprehensive indicator analysis, we see that indicators unanimously signal sales at all major time intervals. To a greater extent, this is due to yesterday's momentum and the lack of proper correction.