The Old World is seething and only in the negative sense of the word. The thrice-damned Brexit was in the spotlight once again. Instead of some clarification from Boris Johnson regarding the contents of a letter from an anonymous source about the progress of negotiations between London and Brussels, everyone received an official statement that the negotiations were being suspended. Britain accused the European Union of taking an unexpectedly tough stance on the border between Ireland and Northern Ireland. Brussels replied that it had never changed its position on this issue, and that London was constantly changing its position on one issue or another, and could not make any constructive proposals. It came to the point that Donald Tusk announced that London did not need a deal and it was time to stop all this circus. In other words, an unregulated Brexit has become even more real, as the current situation indicates that even if London gets a reprieve, it will not give anything, since the parties are corny unable to agree on an extremely important issue.

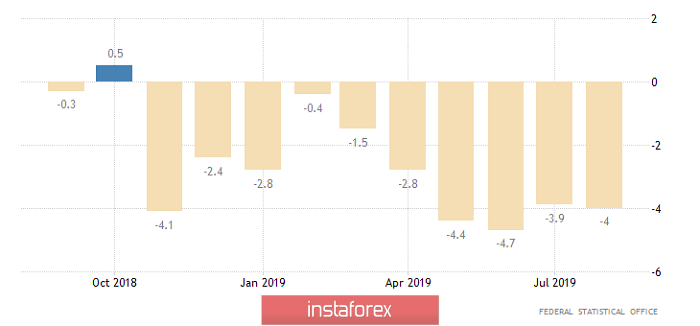

At the same time, things are confidently heading towards a real recession in continental Europe. Thus, industrial production in Germany, which until recently had decreased by 3.9%, accelerated its decline to 4.0%. And the fact that in the largest economy of the European Union, industry is declining at such an impressive pace, clearly does not add optimism. In addition, in Italy, which is the third eurozone economy, retail sales growth slowed from 2.4% to 0.7%. Meanwhile, the Netherlands, which ranks fifth in the list of the largest economies in the euro area, reported a decrease in inflation from 2.8% to 2.6%. And only in Spain, the fourth economy of the euro area, brought good news, showing an increase in industrial production growth from 1.2% to 1.7%. But in general, the picture is clearly depressing, and, indeed, the question arises that the recession will still not be in the United States, but in Europe.

Industrial production (Germany):

However, it is worth noting that both the pound and the single European currency somehow did not confidently lose their positions. The fact is that they were already supported by American statistics. In particular, we are talking about producer prices in the United States, whose growth rates have slowed from 1.8% to 1.4%. They predicted that they would remain unchanged. This is obviously a negative factor, since it indicates a high probability of a slowdown in inflation itself.

Manufacturer Prices (United States):

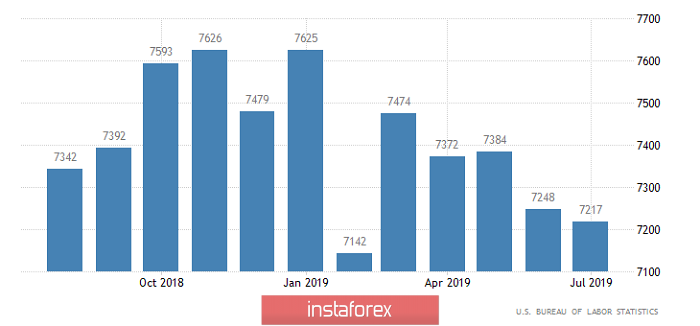

Thus far, Boris Johnson has not yet decided when exactly he will meet with the Prime Minister of Ireland, so there is no reason to wait for any news regarding Brexit. Due to this, all the attention of investors is focused to the United States, which publishes the text of the minutes of the meeting of the Federal Committee on Open Market Operations today. Before this, JOLTS data on open vacancies will be published, the number of which should be reduced from 7,217 thousand to 7,191 thousand. To some extent, this is a factor in the deterioration of the situation on the labor market, so it will have a negative impact on the dollar, which is insignificant. Honestly, the text of the minutes of the meeting of the Federal Committee on Open Market Operations will also not have any effect on the market. The fact, that hysteria about the upcoming recession in the United States does not subside in the media of agitation and misinformation, while Jerome Powell said during his press conference following the latest meeting that the regulator does not see any signs of a recession. Naturally, this is precisely what will be reflected in the text of the minutes of the meeting. However, this fact will not change the nature of publications regarding this very recession.

Number of Job Openings JOLTS (United States):

Thus, most likely, we will observe some kind of stagnation, and the single European currency will remain in the region of 1.0975.

The picture is similar for the pound. Thus, it will be trading at 1.2250, considering that there are no subsequent high-profile statements regarding Brexit.