EUR/USD

Analysis:

On the chart, the pair continues to form a bullish wave, which started a month ago. The price movement is flat. From the beginning of October, the final part of the wave zigzag began. Since the end of last week, the price is adjusted.

Forecast:

Today, the current decline in recent days is expected to continue. In the process of reduction, short-term price pullbacks are not ruled out. By the end of the day, the probability of a change in direction and the beginning of the growth rate increases.

Potential reversal zones

Resistance:

- 1.0990/1.1020

Support:

- 1.0930/1.0900

Recommendations:

Sales of the euro today should be limited to the framework of the sessions. It is better to reduce the lot as much as possible, closing the deal at the first signs of a reversal. The best option would be to refrain from trading at the time of decline, buying a tool at its end.

AUD/USD

Analysis:

Over the past year and a half, the Australian dollar trend has been looking down. Since September 12, quotes of the pair began to form a wave in the dominant direction. In early October, the price rolled back up, forming a correction (B). There are no signals of its completion on the chart.

Forecast:

In the next sessions, the price will continue to move in the lateral plane. The stroke range is limited by counter zones. In the first half of the day, there may be pressure on the support, after which it is expected to change the vector and rise to the upper limit of the price corridor.

Potential reversal zones

Resistance:

- 0.6780/0.6810

Support:

- 0.6720/0.6690

Recommendations:

Trading on the pair market today is possible only within trading sessions. More promising purchases from the support zone. It is recommended to wait for the completion of the current correction and to look for the best places to sell the pair at its end.

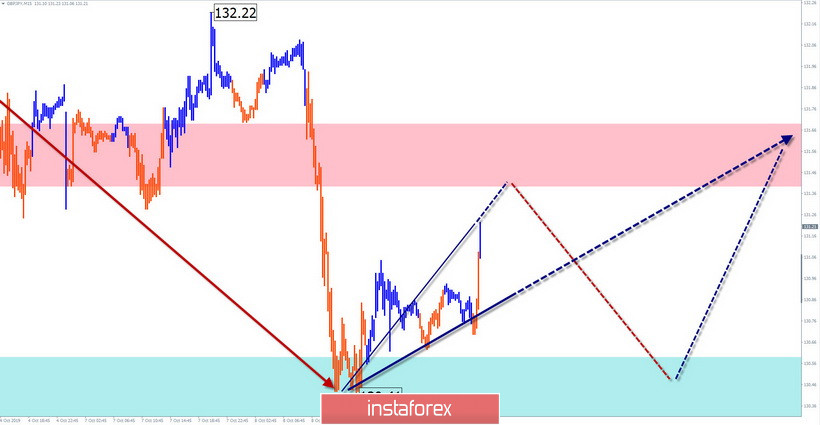

GBP/JPY

Analysis:

Since September 3, an upward wave model has been developing on the pair's chart. The section from the 13th became a correction. The price reached a strong support zone. The structure of the downward correction looks complete. Since yesterday, the upward movement has been formed with a high wave level.

Forecast:

During the next day, the formation of conditions for the reversal of the intersessional trend is expected. The nature of the movement is likely flat. After an attempt to pressure beyond the resistance zone, a second decline is expected.

Potential reversal zones

Resistance:

- 131.40/131.70

Support:

- 130.60/130.30

Recommendations:

Until there are clear signals of a change of rate in the priority of the sale. But the power reserve down is minimal. The most competent tactic would be to refrain from trading and monitor the appearance of signals to buy a pair.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted - the expected movement.

Attention: The wave algorithm does not take into account the length of time the tool moves!