The US currency does not cease to amaze market participants. Sometimes it slightly decreases, as if allowing itself to marginally fall, and then traditionally strengthens its position. The US dollar resembles a powerful lion, imposing and confident in its strength, which nothing can shake. However, not all experts share this view.

In anticipation of trade negotiations between the US and China, the US currency, previously shaken, has strengthened again. However, the strengthening of the dollar could be very volatile, experts warn. They consider it unlikely that a mutual agreement will be reached between the two powers, since China will never agree to American oversight of its companies. Fuel was added to the fire by the fact that on the day the Chinese delegation arrived in the United States, the White House administration blacklisted 28 companies in China. As a result, the political background remains quite tense, and experts do not count on a favorable outcome of the negotiations. The current situation may negatively affect the US dollar exchange rate by cutting off its wings.

Problems with the balance of the Federal Reserve are also not in the best way reflected in the dynamics of the US currency. Economists believe that the redemption of treasury bills is one of the options for solving this issue. According to Fed Chairman Jerome Powell, the regulator is considering the possibility of such a move in order to build a balance for managing the department's reserves. The Fed chief did not directly call this measure a quantitative easing, but his statement was interpreted in this vein.

The main goal of these measures is to maintain the US economy. The White House is ready to use all appropriate means to resolve this issue. Here, the role of the dollar, which has long been considered a key figure in the economy of the United States and other countries, is very important. Its "royal" position still remains stable and demonstrates superiority over other currencies.

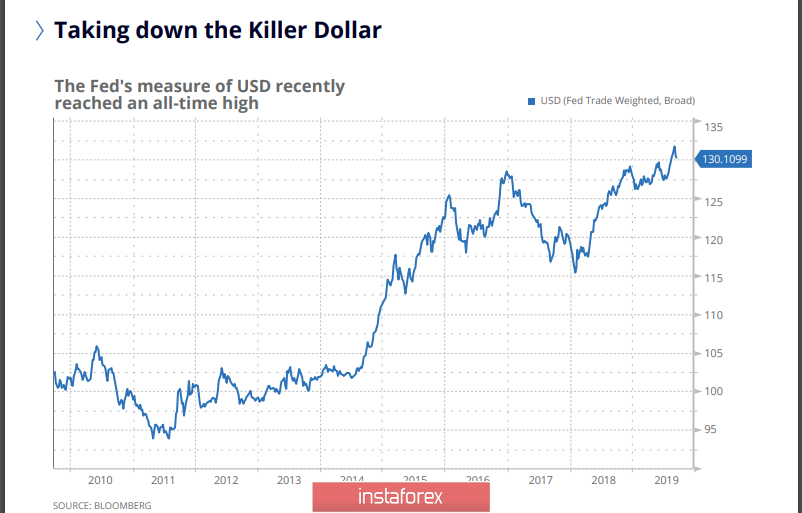

Saxo Bank analysts conducted an interesting study, offering a non-standard look at the greenback. They published a report titled "The Killer Dollar." In it, analysts gave a negative assessment of the impact of dollar hegemony on the world financial system and the global economy. Saxo Bank believes that a powerful global crisis can only slightly delay the devaluation of the US currency. Ultra-low interest rates have already proven ineffective in a number of countries, so the US will have to sacrifice a strong dollar to normalize the situation. Analysts believe that the current year will be remembered as the beginning of the end of a large-scale monetary experiment that launched a global recession, despite the extremely low interest rates in history.

According to currency strategists at Saxo Bank, global dependence on dollar financing is stifling global economic growth. Stabilization of the situation is impossible due to a shortage of dollar liquidity, analysts said. Saxo Bank economists recommend using the only financial instrument that has not yet been used in the global economy - the cheapening of the dollar. Analysts are sure that this will give respite to other currencies and help them strengthen.

A weakening dollar along with the euro will strengthen the position of the single currency, experts said. This is necessary to maintain balance, otherwise the power of the dollar threatens to drown the euro, experts said. At the moment, the EUR/USD pair is trading in the range of 1.0979–1.0982. In the moment, it fell to a critical rate of 1.0959. However, experts are confident that buyers will be able to return the euro to 1.0990-1.0992. Apparently, this forecast is coming true.

The recent breakdown of the support level near 1.0965 and the weakening activity of sellers increase the risk of a further decline in the pair's quotes. According to analysts, the bearish scenario remains a priority. The increased activity of buyers will help the resumption of growth of the EUR/USD pair, analysts said. However, the rise is possible only after overcoming resistance at 1.1000. The euro will hold on to the last, not giving the dollar a chance to weaken itself, although the forces are not equal, analysts summarize.