Hello, dear colleagues.

Dear colleagues, due to the fairly widespread of cryptocurrencies, the trading strategy for the cycle in them will change depending on the expansion and narrowing of volatility in hourly prices. When there is no possibility of trading in the correction zones of the cycle, where the price range is quite narrow, we will proceed from the initial conditions of the main trend and trade from them on the trend. If the spread is narrow, the trading signals will be indicated taking into account the trade in the correction. Most likely, we will almost always trade on the #Bitcoin tool according to the trend from the initial conditions, and on the BTCUSD tool, we will also capture correction zones as the main trend develops, since the spread allows this to be done. In this analytics, you can always find out information when we trade by trend, and when the tool allows you to work in narrow price ranges.

Forecast for October 8:

Analytical review of cryptocurrency on H1 scale:

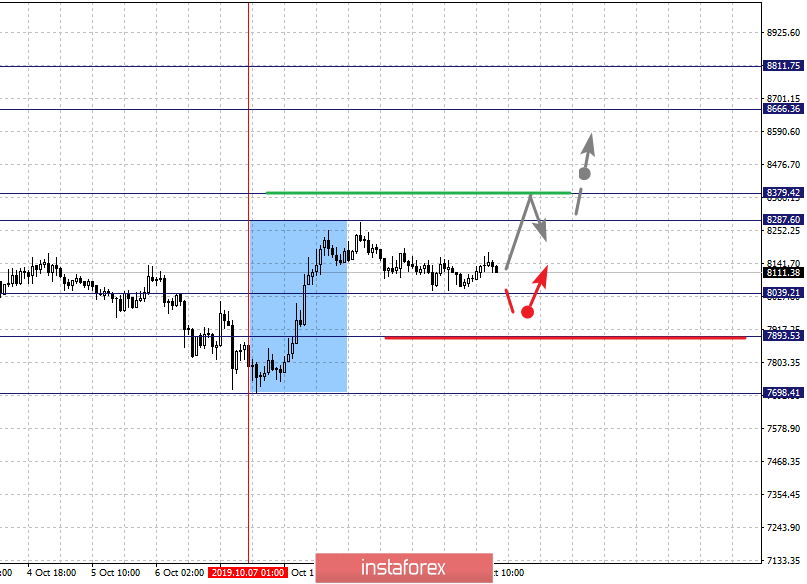

For the #Bitcoin tool, the key levels on the H1 scale are 9026.00, 8811.75, 8666.36, 8379.42, 8287.60, 8039.21, 7893.53, and 7698.41. Attention! This instrument is characterized by medium-term trend trading. As expected, the price has issued a local structure for the top of October 7. Also, this instrument has a good correlation with the euro/yen. The range for entering the market for the purchase: 7948.00 – 8380.00. We expect the development of the upward cycle after the price passes the noise range 8287.60 – 8379.42. In this case, the first target is 8666.36 and in the area of 8666.36 – 8811.75 is the price consolidation, as well as a possible pullback in the correction. We consider the level of 9026.00 as a potential value for the top, where it makes sense to close the position.

The range of 8039.21 – 7893.53 is the key support for the upward structure. Its passage by the price will lead to the cancellation of this structure. In this case, the first target is 7698.41. However, it makes sense to trade in a downward direction when local initial conditions for a downward cycle are formed.

The main trend is the initial conditions for the top of October 7.

Trading recommendations:

Buy: 7948.00 - 8380.00 Stop Loss: 7891.00 Take profit: 8666.36 To continue: Stop Loss: 8287.60 Take profit: 9026.00

Sell: Stop Loss: Take profit: To continue: Stop Loss:

At the moment, we expect the formation of local initial conditions for the continuation of the upward trend, which should happen after the breakdown of 178.09. The potential target for the top is 186.28.

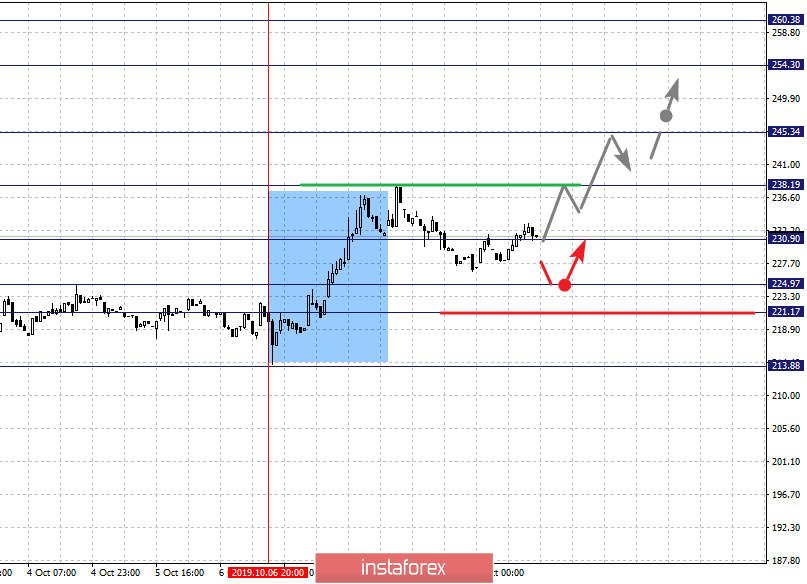

For the BTCUSD instrument, the key levels on the H1 scale are 260.38, 254.30, 245.34, 238.19, 230.90, 224.97, 221.17, and 213.88. Attention! At the moment, this instrument has the possibility of short-term transactions, as well as trading in correction zones from the main trend. At the moment, we are following the formation of the initial conditions for the top of October 6. The continuation of the upward movement is expected after the breakdown of 238.19. In this case, the target is 245.34 and near this level is the consolidation. A breakdown of 245.34 will lead to a key development of the structure. The target is 254.30. We consider the level of 260.38 as a potential value for taking profit, near which we expect consolidation, as well as a pullback in the correction.

The corrective downward movement is possible in the area after the breakdown of 230.90. The target is 224.97, from this range, we expect a key reversal to the top, so there is a good opportunity to enter the market to buy. The range of 224.97 – 221.17 is the key support for the upward structure. Its passage by the price will have the development of the downward structure. In this case, the first target is 213.88.

The main trend is the initial conditions for the top of October 6.

Trading recommendations:

Buy: 238.20 Stop Loss: 223.00 Take Profit: 245.00

Buy: 246.00 Stop Loss: 230.90 Take Profit: 254.30 or 260.00

Sell: 221.00 Stop Loss: 230.90 Take Profit: 214.00

Sell: Stop Loss: Take Profit:

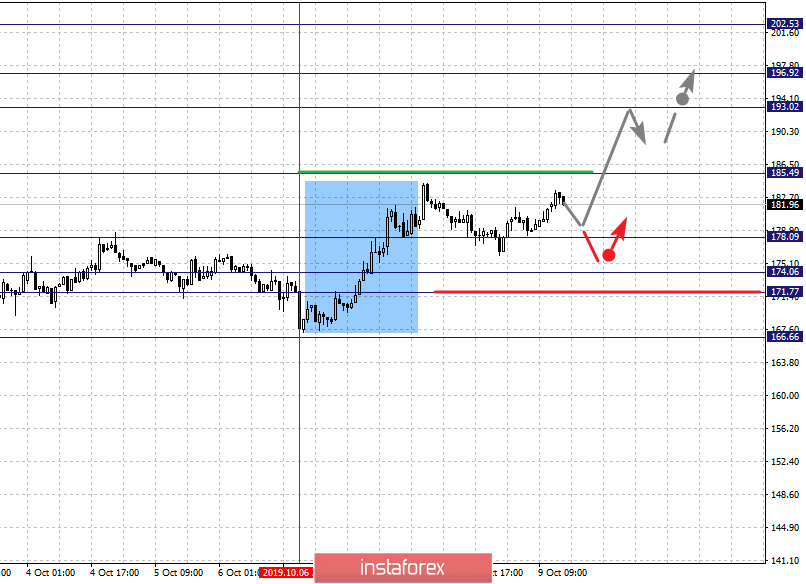

At the moment, we expect the formation of local initial conditions for the continuation of the upward trend, which should happen after the breakdown of 178.09. The potential target for the top is 186.28.

For the #Ethereum instrument, the key levels on the H1 scale are 202.53, 196.92, 193.02, 185.49, 178.09, 174.06, 171.77, and 166.66. We follow the formation of the initial conditions for the upward cycle of October 6. The continuation of the upward movement is expected after the breakdown of 185.50. In this case, the target is 193.02 and in the area of 193.02 – 196.92 is the consolidation. We consider the level of 202.53 to be a potential value for a possible hold on a purchase transaction, upon reaching which we expect consolidation, as well as a rollback to the bottom.

Going into the corrective movement is expected after the breakdown of 178.09. The target is 174.06. From the range of 178.09 – 174.06, there is a high probability of a reversal to the top and there is a good opportunity to enter the market to buy. The range of 174.06 – 171.77 is the key support for the top. Its passage by the price will lead to the development of a downward structure. In this case, the first potential target is 166.66.

The main trend is the local initial conditions for the top of October 6.

Trading recommendations:

Buy: 186.00 Stop Loss: 178.00 Take Profit: 193.00 or 202.00

Buy: Stop Loss: Take Profit:

Sell: 171.70 Stop Loss: 180.00 Take Profit: 166.00

Sell: Stop Loss: Take Profit: