The minutes of the FOMC's September meeting published on Wednesday were interesting primarily because it made it possible to assess the depth of the split among the members of the Committee, as well as to understand what were the main reasons for reducing the rate in September.

As follows from the text of the Protocol, there are three such reasons: economic prospects, risk management and stabilization of inflation near the target of 2%. It should also be noted that the FOMC does not have a clear action plan, but on the contrary, there is a dependence on the incoming data, and therefore, each subsequent meeting is quite capable of presenting a surprise.

The economic prospects of the US economy are still assessed as positive, and the labor market as strong, but there is an increase in risks associated with the trade war and general geopolitical uncertainty.

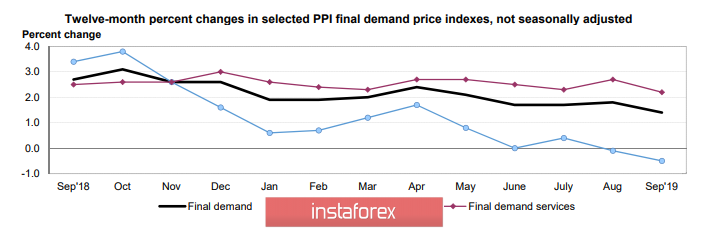

The greatest concern, albeit carefully disguised, concerns inflation as the main indicator of consumer activity. Production prices in September showed a slowdown again; they are able to stay in positive territory only at the expense of the services sector.

Tips bond yields renewed a 3-year low again, that is, there is no sign that consumer inflation data to be released today will be better than expected. In addition, the resumption of purchases of securities by the Fed may not indicate a desire to "adjust the balance sheet," says Powell, but an attempt to weaken financial conditions by providing additional liquidity in order to stimulate activity at all levels from production to consumption.

EUR/USD

Despite the fact that EURUSD recovered from a 17-month low of 1.0879, overall expectations for the European currency remain bearish.

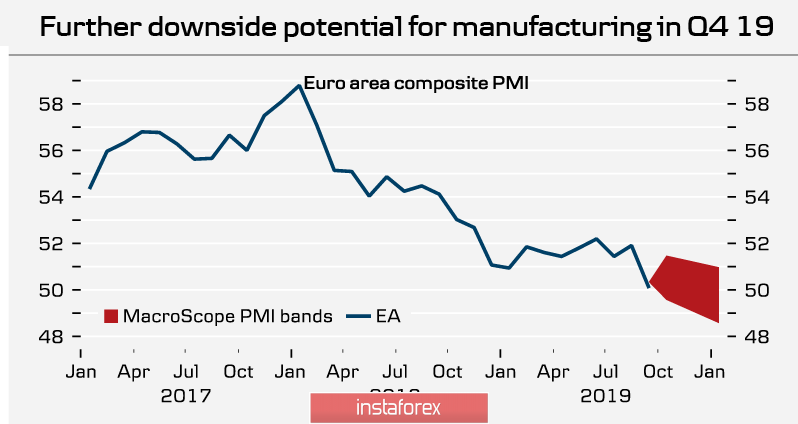

DanskeBank believes that the decline in Eurozone production will extend to the 4th quarter, as the effects of the trade war will continue to affect the supply chain, and the dynamics of orders and stocks have a negative impact on the entire production cycle.

As a result, recovery can only begin in 2020, and then only if external factors contribute to this.

The ECB holds a similar position - in a recent study, it was noted that the decline in industrial production in the eurozone was caused by increased tension in world trade and domestic events. The ECB even calls specific figures for the fall - in his opinion, 63% of the entire recession is due precisely to the trade war and the deterioration of the general world situation, that is, external factors. And if at the beginning of this cycle the main negative influence came from external markets, and domestic demand was still quite stable, then in 2019 emphasis began to shift towards internal factors, that is, investment flows are changing their direction, suggesting a further decline in consumer activity.

Thus, ECB cannot exert influence on external causes, but very much on internal ones. Studies increase investor confidence that the ECB is already prepared to respond to the eurozone economy for a range of scenarios for the introduction of stimulus measures, and these measures will be more ambitious than the market expects.

The euro continues to trade in a range pending inflation data in the US. Since the data is likely to be worse than expected, the probability of leaving above 1.10 seems high, the next resistance is at 1.1052 (50-day SMA). On the other hand, a break down below 1.0939 and further to 1.09 is possible if positive results of the US-China trade negotiations resuming today are announced.

GBP/USD

The pound is trading in range pending the publication of a large package of macroeconomic data. Reports on the trade balance and industrial production in August will be published, as well as an estimate of NIESR GDP growth rates.

The main event of the day is the meeting of Boris Johnson with the Prime Minister of Ireland Leo Varadkar. If there is no progress, namely such a result of the meeting is predicted, then the pound may go into a deep peak, breaking through support levels 1.2195 and 1.2105.