To open long positions on GBP/USD you need:

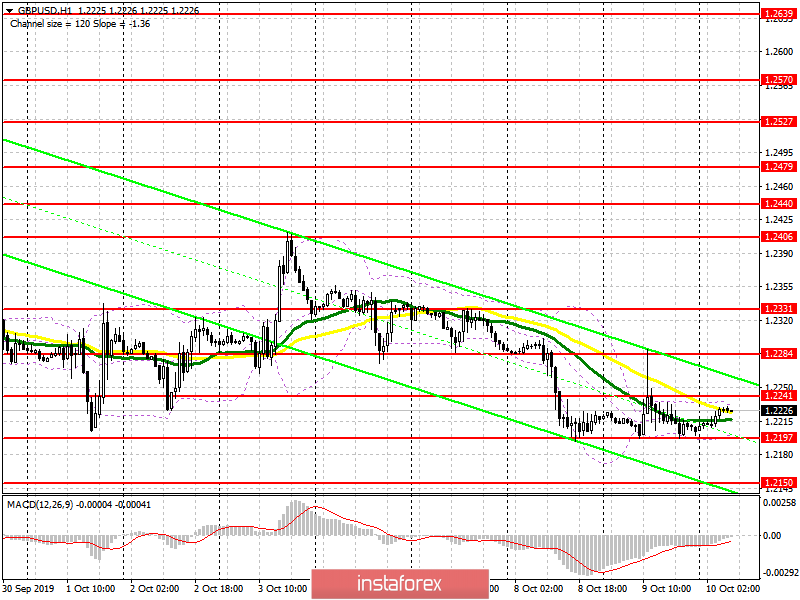

The technical picture in the pair has not changed in any way compared to yesterday's forecast, except for the support level of 1.2197. To open long positions, I recommend focusing on it, and the formation of a false breakout there will be the first signal to buy the pound. However, a more important goal for the bulls is still to return and consolidate on the resistance of 1.2241, which could not be done yesterday. Only good fundamental data on the growth rate of the UK economy will make it possible to reach a high in the area of 1.2284, and even update the larger resistance at 1.2331, where I recommend taking profits. If the situation with Brexit continues to aggravate, and most likely it will happen, it is best to consider new long positions after updating the lows in the areas of 1.2150 and 1.2112.

To open short positions on GBP/USD you need:

Selling the pound today is best done after the formation of a false breakdown in the resistance area of 1.2241. A weak report on the growth of the UK economy, along with a decrease in industrial production, will quickly return GBP/USD to the area of the lower boundary of the side channel at 1.2197, the break of which will increase the pressure on the pound and lead to the renewal of lows 1.2150 and 1.2112, where I recommend taking profits. In case the pound grows above resistance at 1.2241 in the first half of the day, you can count on short positions immediately on a rebound from a high of 1.2284. Any positive rumors related to Brexit, as it was yesterday, can lead to a breakthrough of the level of 1.2284. In this case, you can sell on the rebound from the resistance of 1.2331.

Signals of indicators:

Moving averages

Trade is carried out in the region of 30 and 50 moving average, but the probability of a bear market remains quite high.

Bollinger bands

A break of the lower boundary of the indicator at 1.2197 will increase pressure on the British pound.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20