The single European currency began to gradually strengthen its position in the morning, which is largely due to nervousness regarding the content of the minutes of the Federal Open Market Committee meeting. However, in many ways, the content of this minutes itself did not change the state of things in the market, since it reflects the voiced position of the Federal Reserve, namely that no recession is expected. But oddly enough, the single European currency didn't come back, since even before the publication of the minutes' text, the weakening dollar got its justification in the form of JOLTS data on open vacancies, the number of which decreased from 7,174 thousand to 7,051 thousand. This implies a certain worsening of the situation on the labor market, as finding work has become somewhat more difficult. So a slight increase in the single European currency is quite justified.

Today, all attention is focused only on inflation in the United States, which, at the moment, is at 1.7%. Almost all forecasts indicate an increase in inflation from 1.8% to 1.9%. And if such forecasts come true, then little will be able to stop the dollar. However, if we recall the recent data on producer prices, we should not exclude the possibility of decreasing inflation, which will hit the dollar's positions incredibly, and the single European currency's growth may be explosive. Naturally, against the backdrop of inflation, no one will pay attention to the data on applications for unemployment benefits. Moreover, their total number should increase by only 2 thousand. That is, there's nothing to look at.

Inflation (US):

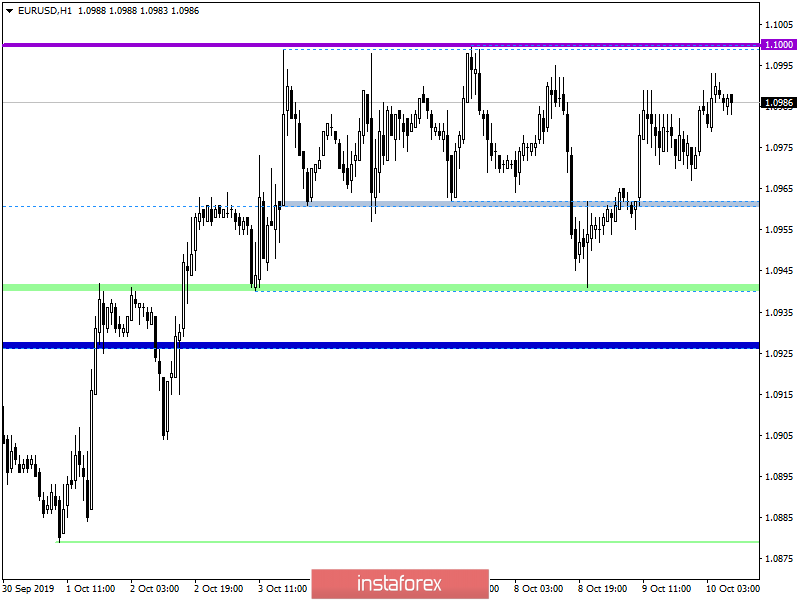

Once again, the EUR/USD pair returned to the same range of 1.0960/1.0990 (1.1000), fluctuations that held us back for more than one day. In fact, the local strike on October 8 did not lead to anything, and restrained interest in the euro/dollar remains, where the quotation accuracy again found a resistance level near the boundary of 1.0990 (1.1000). Looking at the chart in general terms, we see that the corrective move from the support of 1.0880 remains to this day, where the level of 1.0990 (1.1000) restrains buyers for a while, but there are still not enough trading forces to fully restore the downward trend. Move.

It is likely to assume that the boundaries of 1.0960/1.0990 (1.1000) will still serve the market for some time, where traders consider two methods of work at once - Rebound/Breakout.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of a clear consolidation of prices higher than 1.1000, not the shadow of a puncture.

- Short positions, we consider in case of price consolidation below 1.0980, with the prospect of a move to 1.0960.

From the point of view of a comprehensive indicator analysis, we see multidirectional interest. So, indicators at minute intervals signal sales, trying to work out the upper limit of the band. On the contrary, the hourly intervals took an upward position making a reference to the early surge in prices. Daily periods stopped and took a neutral position due to a characteristic two-way surge in prices.