The euro rose to new weekly highs amid rumors that the US and China have agreed on a currency pact as part of a common agreement. However, the negotiations themselves, or rather, their official part will begin today a little later, and what they will lead to one can only guess. Most likely, the parties will not come to a single agreement, which will put pressure on risky assets and strengthen the position of the US dollar.

Today's publication of the minutes of the European Central Bank meeting made it clear that the split in the ranks continues to increase. Leaders in September disagreed about the need to resume a program for buying bonds worth 2.6 trillion euros. This will add problems to the new head of the ECB Christine Lagrade, as the lack of consensus on this issue could negatively affect the economic growth of the eurozone. Let me remind you that Lagarde will officially take office on November 1. This is exactly when the ECB should start buying bonds in the amount of 20 billion euros per month. Seven ECB executives disagreed with the stimulus package, including the heads of central banks in Germany and France.

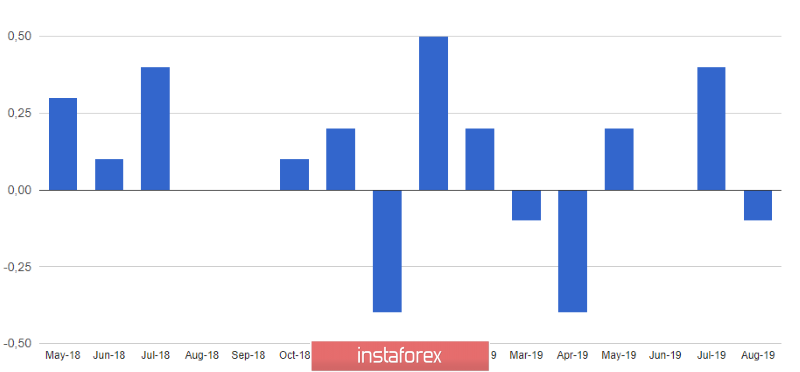

Today a report came out that testified to the reduction in the positive foreign trade balance of Germany, which occurred due to a fall in exports. A report by the Federal Bureau of Statistics indicates that Germany's foreign trade surplus amounted to 18.1 billion euros in August 2019, while economists expected the surplus to reach 18.9 billion euros. Exports fell 1.8% compared with the previous month and amounted to 109.2 billion euros, while imports grew by 0.5% and reached 91.1 billion euros. Economists had expected exports to fall by only 1.0% in August.

As for the technical picture of the EURUSD pair, further growth will depend on the breakout of resistance at 1.1035. If this happens, buyers of risky assets can see an update of highs in the areas of 1.1070 and 1.1110. In case of pressure on the pair after negotiations between the US and China, a breakthrough of intermediate support at 1.1000 will increase the pressure on the trading instrument, which will lead to a test of the lows 1.0950 and 1.0900.

GBPUSD

The British pound ignored data that showed a decrease in the growth of the UK economy in August this year compared with July. However, given the three-month period, recession has yet been avoided. Good activity in the services sector managed to level the weakening of production activity.

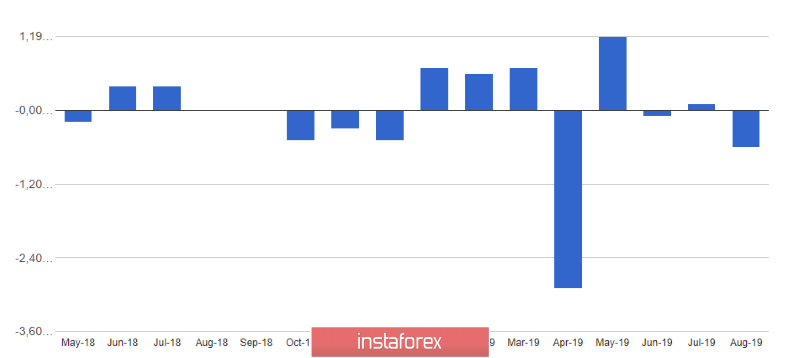

According to the UK National Bureau of Statistics, UK GDP in the 3rd quarter of this year grew by 1.2% year on year. If we take separately the report for August of this year, the gross domestic product of Great Britain fell by 0.1% due to a decrease in industrial production.

Data on a sharp decline in industrial production in the UK in August this year was also a surprise to traders. The report indicates that the volume decreased by 0.6% compared with July and by 1.8% compared to the same period in 2018. Economists had forecast a decline of only 0.1% and 0.9%, respectively. The largest decline in production in August was recorded in the manufacturing industry, where the indicator immediately fell by 0.7% and 1.7% compared with August 2018.

However, today traders will pay special attention to the meeting of British Prime Minister Boris Johnson and Irish Prime Minister Leo Varadkar, which has already begun. At it, the premieres will try to agree on the conditions of the border with Northern Ireland, however, as a number of experts note, negotiations will most likely fail again, which may renew pressure on the British pound, which is not optimistic after the publication of data on economic growth and industrial output production.

As for the technical picture of the GBPUSD pair, another unsuccessful attempt to break above the resistance of 1.2240 leaves the market on the side of the pound sellers. A break of the month's low and, concurrently, a large support level of 1.2195 will lead to the demolition of a number of stop orders of buyers and the trading instrument to fall to new local lows in the areas of 1.2150 and 1.2100. In case of successful negotiations, the bulls can regain their positions, and growth will be limited in the region of the highs of 1.2290 and 1.2350.