Forecast for October 11:

Analytical review of currency pairs on the scale of H1:

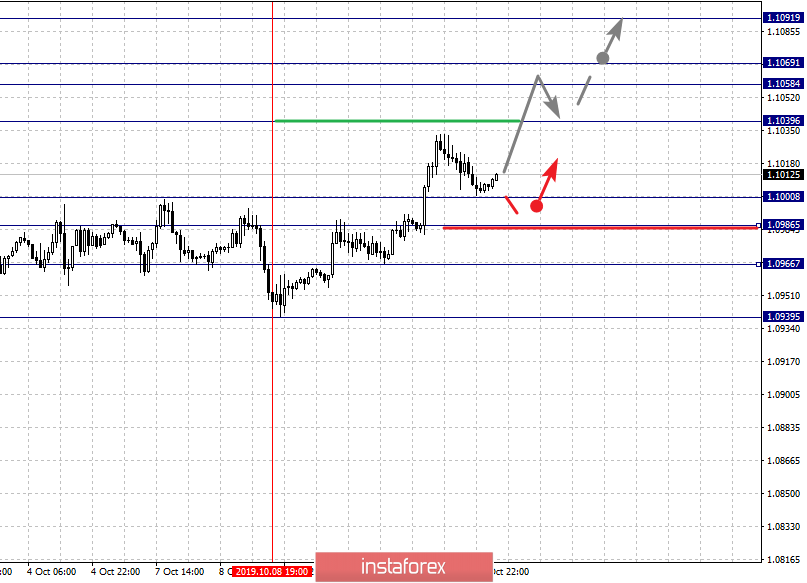

For the euro / dollar pair, the key levels on the H1 scale are: 1.1091, 1.1069, 1.1058, 1.1039, 1.1000, 1.0986, 1.0966 and 1.0939. Here, we determined the subsequent goals for the top from the local ascending structure on October 8. The continuation of the movement to the top is expected after the breakdown of the level of 1.1039. In this case, the target is 1.1058. Price consolidation is in the range of 1.1058 - 1.1069. We consider the level of 1.1091 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range 1.1000 - 1.0986. The breakdown of the last value will lead to a long correction. Here, the target is 1.0966. This level is a key support for the top. Its passage at the price will lead to the development of a downward movement. In this case, the target is 1.0939.

The main trend is the medium-term upward structure from October 1, the local structure from October 8.

Trading recommendations:

Buy: 1.1040 Take profit: 1.1058

Buy 1.1070 Take profit: 1.1090

Sell: 1.1000 Take profit: 1.0987

Sell: 1.0984 Take profit: 1.0966

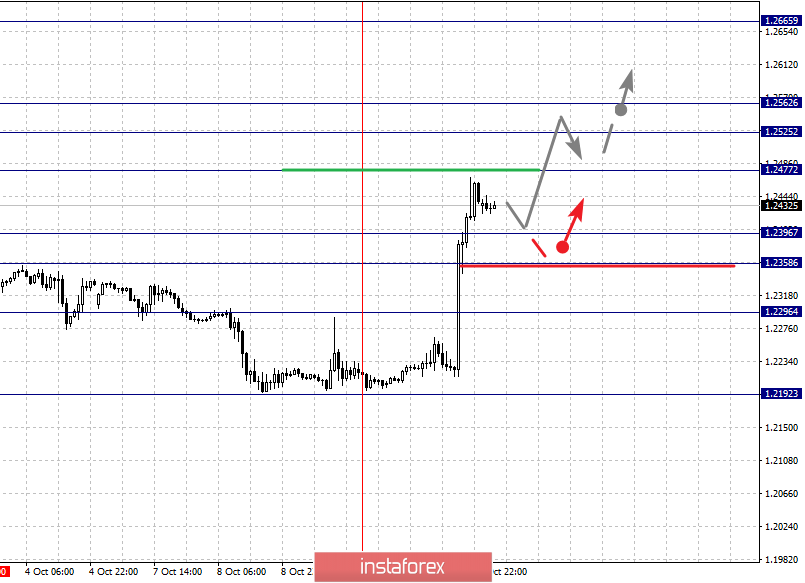

For the pound / dollar pair, the key levels on the H1 scale are: 1.2665, 1.2562, 1.2525, 1.2477, 1.2396, 1.2358 and 1.2296. Here, the ascending structure of October 9 is considered to be a potential initial conditions for the ascending cycle. The continuation of the movement to the top is expected after the breakdown of the level of 1.2477. Here, the target is 1.2525. Short-term upward movement, as well as consolidation is in the range of 1.2525 - 1.2562. The breakdown of the level of 1.2562 should be accompanied by a pronounced upward movement. Here, the target is 1.2665.

Short-term downward movement is expected in the range of 1.2396 - 1.2358. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2296. This level is a key support for the top.

The main trend is the formation of the ascending structure of October 9.

Trading recommendations:

Buy: 1.2478 Take profit: 1.2525

Buy: 1.2563 Take profit: 1.2665

Sell: 1.2396 Take profit: 1.2358

Sell: 1.2355 Take profit: 1.2297

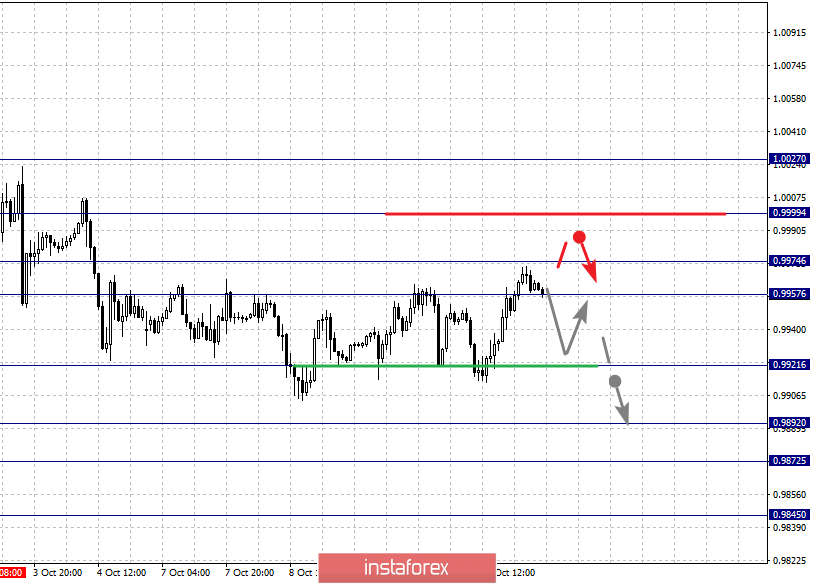

For the dollar / franc pair, the key levels on the H1 scale are: 1.0027, 0.9999, 0.9974, 0.9957, 0.9921, 0.9892, 0.9872 and 0.9845. Here, we follow the development of the descending structure of October 3. The continuation of the development of the downward trend is expected after the breakdown of the level of 0.9921. In this case, the target is 0.9892. Price consolidation is in the range of 0.9892 - 0.9872. For the potential value for the bottom, we consider the level of 0.9845. Upon reaching which, we expect a pullback to the top.

Short-term upward movement, as well as consolidation, are possible in the range of 0.9957 - 0.9974. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9999. This level is a key support for the downward structure. Its breakdown will have the potential for the development of the upward movement. Here, the potential goal is 1.0027.

The main trend is the descending structure of October 3.

Trading recommendations:

Buy : 0.9976 Take profit: 0.9999

Buy : 1.0003 Take profit: 1.0027

Sell: 0.9920 Take profit: 0.9892

Sell: 0.9870 Take profit: 0.9845

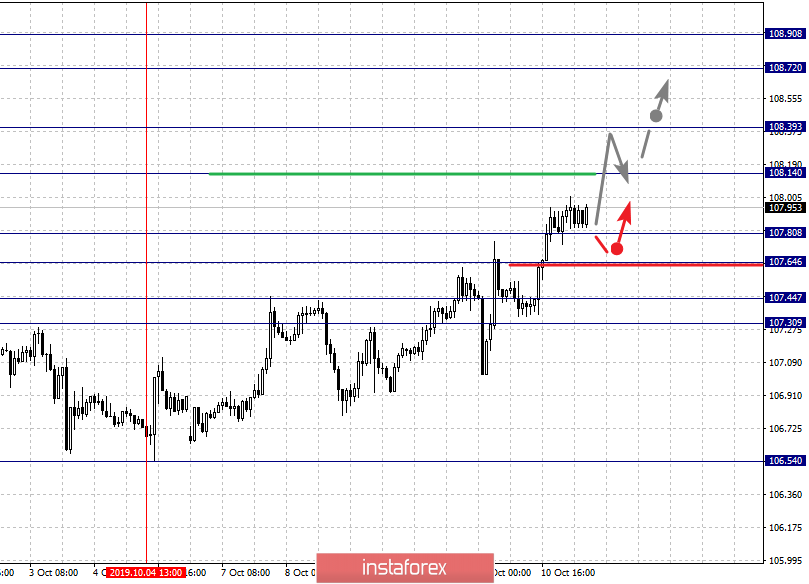

For the dollar / yen pair, the key levels on the scale are : 108.90, 108.72, 108.39, 108.14, 107.80, 107.64, 107.44 and 107.30. Here, we are following the development of the upward cycle of October 4. The continuation of the movement to the top is expected after the breakdown of the level of 108.14. In this case, the target is 108.39. Price consolidation is near this level. The breakdown of the level of 108.40 should be accompanied by a pronounced upward movement. Here, the target is 108.72. For the potential value for the top, we consider the level of 108.90. Upon reaching which, we expect a consolidated movement, as well as a pullback to the bottom.

Short-term downward movement is expected in the range of 107.80 - 107.64. The breakdown of the last value will lead to an in-depth correction. Here, the target is 107.44. The range 107.44 - 107.30 is the key support for the top.

The main trend: the upward cycle of October 4.

Trading recommendations:

Buy: 108.15 Take profit: 108.36

Buy : 108.40 Take profit: 108.70

Sell: 107.80 Take profit: 107.65

Sell: 107.62 Take profit: 107.45

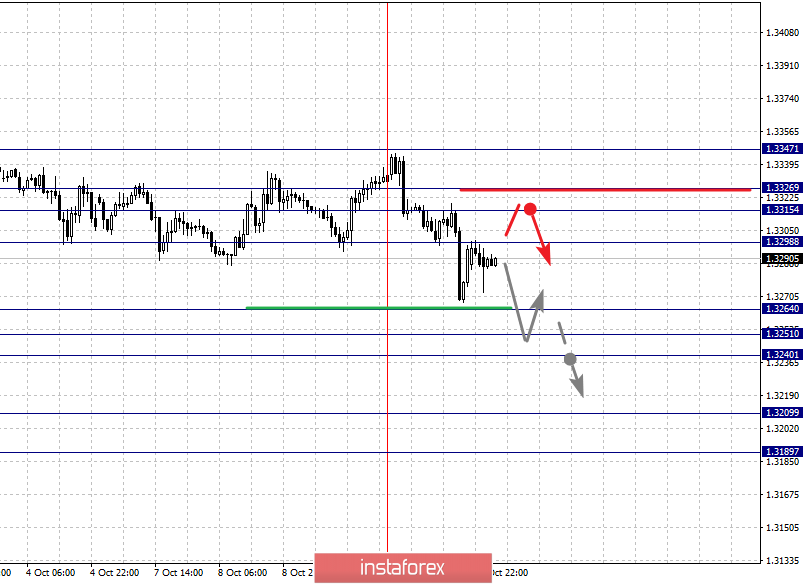

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3326, 1.3315, 1.3298, 1.3264, 1.3251, 1.3240 and 1.3209 and 1.3189. Here, we are following the formation of the potential for the downward movement of October 10. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3264. In this case, the target is 1.3251. Price consolidation is near this level. Passing at a price of the noise range 1.3251 - 1.3240 will lead to the development of pronounced movement. Here, the goal is 1.3209. For the potential value for the bottom, we consider the level of 1.3189. Upon reaching which, we expect consolidation, as well as a rollback to the top.

A correction is expected after the breakdown of the level of 1.3298. Here, the target is 1.3315. The range 1.3315 - 1.3326 is the key support for the downward structure from October 10. Its passage at the price will lead to the formation of a local upward structure. In this case, the target is 1.3347.

The main trend is the formation of the downward movement potential of October 10.

Trading recommendations:

Buy: 1.3300 Take profit: 1.3315

Buy : 1.3326 Take profit: 1.3345

Sell: 1.3264 Take profit: 1.3251

Sell: 1.3240 Take profit: 1.3210

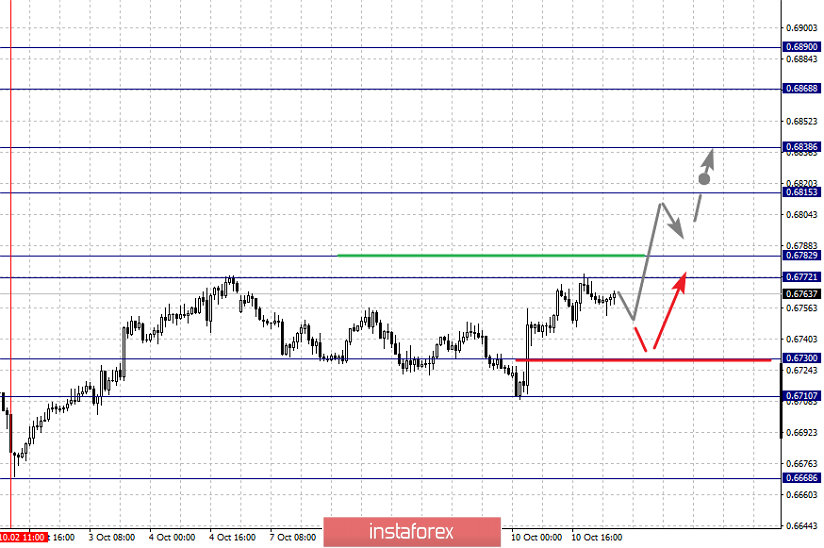

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6868, 0.6838, 0.6815, 0.6782, 0.6772, 0.6756, 0.6730 and 0.6710. Here, the price has formed a local potential for continuing the development of the upward trend of October 2. The continuation of the movement to the top is expected after the passage at the price of the noise range 0.6772 - 0.6782. In this case, the target is 0.6815. Short-term upward movement, as well as consolidation is in the range 0.6815 - 0.6838. For the potential value for the top, we consider the level of 0.6868. The movement to which is expected after the breakdown of the level of 0.6840.

Consolidated movement is possibly in the range of 0.6730 - 0.6710. The breakdown of the latter value will have a downward trend. Here, the potential target is 0.6668.

The main trend is the upward structure of October 2, the local structure for the top of October 9.

Trading recommendations:

Buy: 0.6782 Take profit: 0.6815

Buy: 0.6817 Take profit: 0.6836

Sell : 0.6730 Take profit : 0.6712

Sell: 0.6708 Take profit: 0.6670

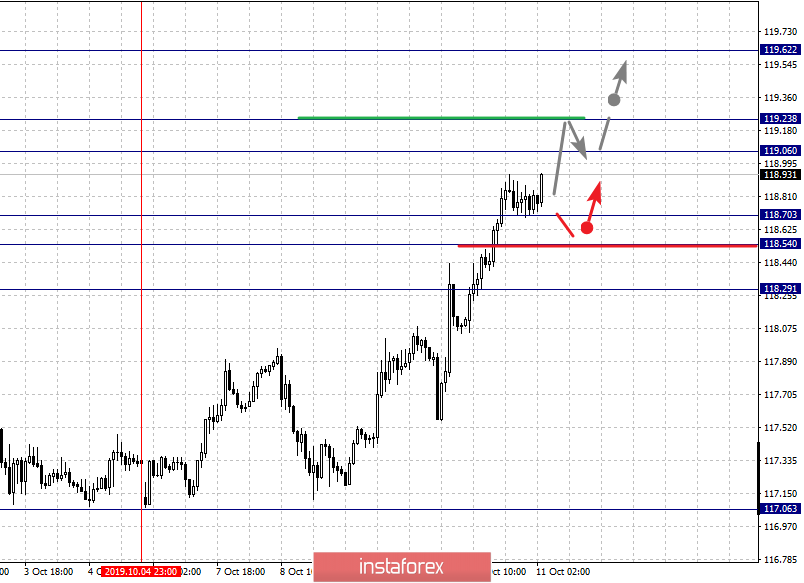

For the euro / yen pair, the key levels on the H1 scale are: 119.62, 119.23, 119.06, 118.70, 118.54 and 118.29. Here, we are following the development of the upward cycle of October 4. Short-term upward movement is expected in the range 119.06 - 119.23. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 119.62. We expect a rollback to correction from this level.

Short-term downward movement is possibly in the range of 118.70 - 118.54. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 118.29. This level is a key support for the top.

The main trend is the upward structure of October 4.

Trading recommendations:

Buy: 119.07 Take profit: 119.23

Buy: 119.25 Take profit: 119.60

Sell: 118.70 Take profit: 118.55

Sell: 118.52 Take profit: 118.30

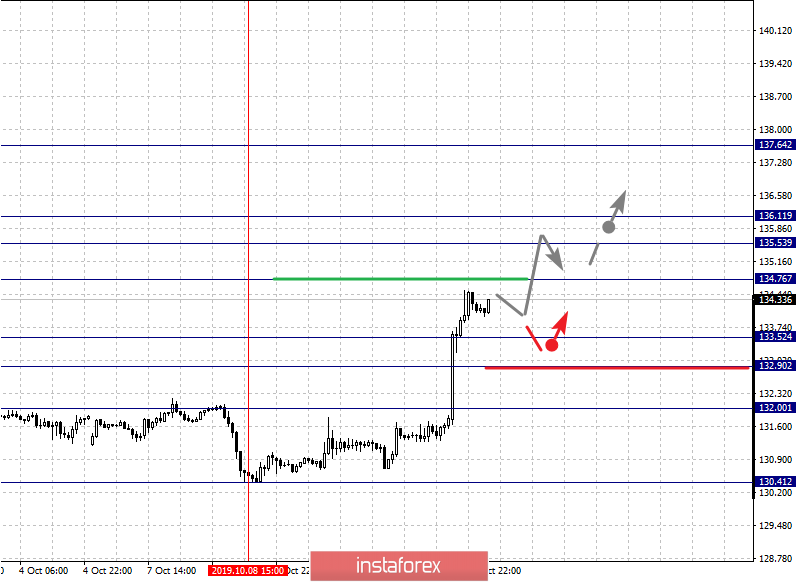

For the pound / yen pair, the key levels on the H1 scale are : 137.64, 136.11, 135.53, 134.76, 133.52, 132.90 and 132.00. Here, we are following the formation of the expressed initial conditions for the top of October 8. The continuation of the movement to the top is expected after the breakdown of the level of 134.76. In this case, the target is 135.53. Price consolidation is in the range 135.53 - 136.11. The breakdown of the level of 136.11 should be accompanied by a pronounced upward movement. Here, the goal is 137.64. We expect consolidation near this level.

Short-term downward movement is possibly in the range of 133.52 - 132.90. The breakdown of the last value will lead to a long correction. Here, the target is 132.00. This level is a key support for the top.

The main trend is the formation of medium-term initial conditions for the top of October 8.

Trading recommendations:

Buy: 136.76 Take profit: 135.50

Buy: 136.11 Take profit: 137.60

Sell: 133.50 Take profit: 132.90

Sell: 132.85 Take profit: 132.00