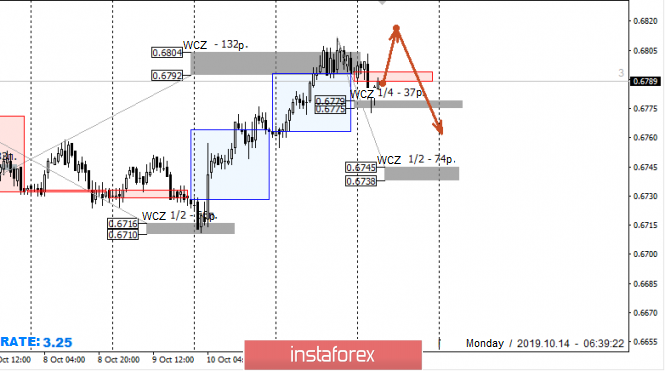

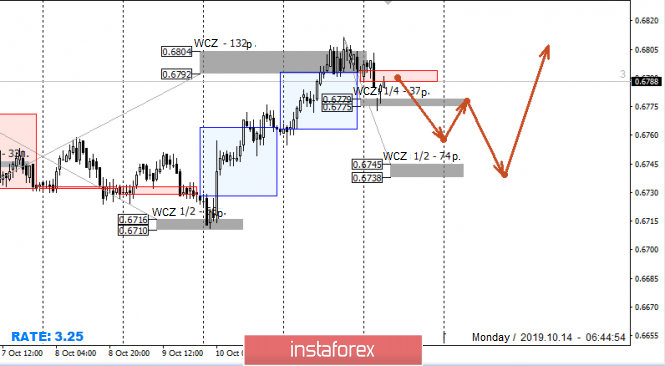

Last Friday's test of the weekly control zone 0.6904-0.6792 made it possible to fix part of the profit on a previously open long position. Further growth is more likely, but purchases from current levels cannot be called profitable, since a repeated test of the resistance zone may cause an increase in supply again.

Work in the upward direction is a priority, therefore, the pattern of "false breakdown" on a weekly control zone must be perceived as correction. Moreover, work in the correction involves quick fixation of profit at the first levels of support.

The reversal model will become relevant if the closing of today's US session occurs below the Weekly Control Zone 1/4 0.6779-0.6775. This will allow considering corrective sales to WCZ 1/2 0.6745-0.6738. The test of which will determine the further priority for the second half of the month.

Daily CZ - daily control zone. The zone formed by important data from the futures market that changes several times a year.

Weekly CZ- weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone that reflects the average volatility over the past year.