4-hour timeframe

Technical data:

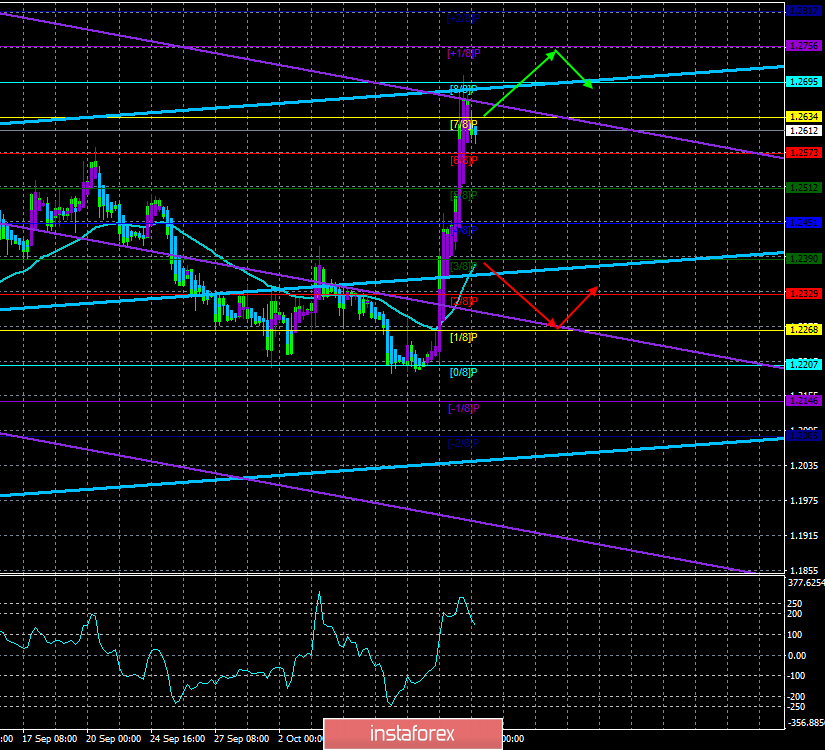

The upper channel of linear regression: direction – up.

The lower channel of linear regression: direction – down.

The moving average (20; smoothed) – up.

CCI: 143.1862

In the article "preview of the week", we said that this week will be entirely devoted to events in the UK. Several important macroeconomic reports will be published, which will remain in the background since the EU summit on Brexit starts on October 17, at which the future fate of the UK, Brexit and, possibly, Boris Johnson will be decided. We have repeatedly written that at the moment, Johnson has no significant victories at the helm of the country. Whatever the Prime Minister did, it ended in failure and defeat. However, in recent weeks, some "top officials" of the European Union began to declare and hint that a "deal" with London is still possible. True, all of them immediately noted that it will still be very difficult to reach an agreement, but there are still some chances. It is not surprising that Boris Johnson continues to chant that he intends to make a deal. Just a few weeks ago, Johnson said in all his interviews that he would not ask for a delay, and the UK would leave the EU on October 31 anyway. Johnson's rhetoric is changing at about the same rate as that of Donald Trump. Thus, we, the participants of the forex market, can only wait for news from the EU summit. At the end of last week, the pound rose by 450 points thanks to the information that Leo Varadkar and Boris Johnson held a dialogue, after which they said that Brexit with a "deal" is still possible. From our point of view, this reaction of the market is unreasonable, as we have already witnessed hundreds of similar statements. There were moments when Brexit was on the verge of completion when Theresa May's project lacked the approval of a few dozen votes. Now, the pound has risen in price as if the parties have already signed an agreement and now there is only a formal part. Either there is some information that is not available to the masses, or traders reacted too zealously to the banalest message. We are still leaning towards the first option and urge to be careful with any deals this week. On Monday, October 14, no important economic publications are planned either in the States or in the UK, but we all understand that at any time Donald Tusk, or Angela Merkel, or Jean Claude Juncker can give an interview, there are a lot of actors in Brexit, and report something that the pound will easily pass 450 points already down. Thus, we recommend continuing to keep a "finger on the pulse".

From a technical point of view, the pound/dollar pair worked out the Murray level of "8/8" – 1.2695 and rebounded from it, starting a round of corrective movement, which in the future can continue to the level of 1.2451. However, this week, everything will depend on the news, and they can begin to arrive at the disposal of traders today.

Nearest support levels:

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

Nearest resistance levels:

R1 –1.2634

R2 – 1.2695

R3 – 1.2756

Trading recommendations:

The GBP/USD pair is likely to start correcting today after two days of growth. Thus, the bulls need to at least wait for the correction to be completed to resume buying the pound. Question: when and where will the correction be completed? And will data from the EU summit start arriving by then?

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue line of the unidirectional movement.

The lower channel of linear regression – the purple line of the unidirectional movement.

CCI – the blue line in the regression window of the indicator.

The moving average (20; smoothed) – blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi – an indicator that colors bars in blue or purple.