To open long positions on EURUSD, you need:

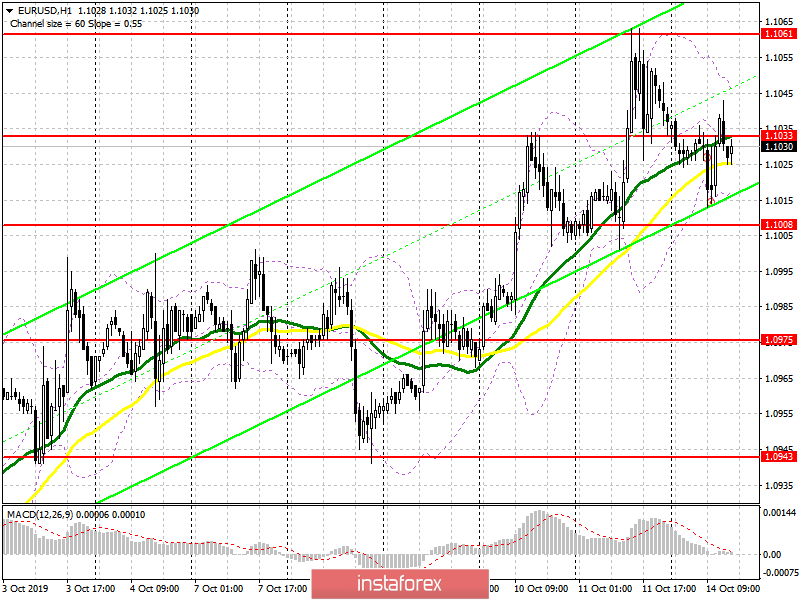

From a technical point of view, the situation has not changed compared to the morning forecast after a failed attempt to increase the euro on the background of a good report on the volume of industrial production in the eurozone. Today is Columbus Day in the US, so volatility will be very low in the afternoon. It is best to open long positions in EUR/USD after a downward correction to the support of 1.1008, or immediately on the rebound from the larger minimum of 1.0975. However, the main task of the bulls will be to return to the resistance of 1.1033, which was not possible to do in the first half of the day. Only above this level, the bulls will try to update the highs of last week in the area of 1.1061, where I recommend taking the profit. However, given the day off in many markets, it is possible to trade around the level of 1.1033.

To open short positions on EURUSD, you need:

The main task of the bears will be the return of EUR/USD to the support of 1.1008 and the breakdown of this level, which will provide the euro with new pressure that can push it to a minimum of 1.0975, where I recommend taking the profits. In the first half of the day, an unsuccessful consolidation above the resistance of 1.1033, after the release of a good report on industrial production in the eurozone, returned sellers to the market, which are now aimed at a minimum of 1.0975. If the bulls try again to regain the level of 1.1033, it is possible to open short positions immediately on the rebound from the maximum of 1.1061, but the direction in the pair will depend on further negotiations between the US and China.

Indicator signals:

Moving Averages

Trading is conducted around 30 and 50 moving averages, which indicates further market uncertainty.

Bollinger Bands

In the case of a decline in the euro, support will be provided by the lower line of the indicator in the area of 1.1015, and sales are best viewed after the upper boundary test in the area of 1.1050.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20