The pound is tossing from side to side, like a fit, against the background of constantly changing statements regarding Brexit. From the very beginning of the week, it was under pressure after Michel Barnier, the chief negotiator for the European Union, said that London's proposals could seriously damage the single European market, as they did not contain any specifics regarding the border between Ireland and Northern Ireland. According to him, in its current form, the option proposed by Boris Johnson to resolve this issue will only lead to massive trade and financial fraud, which will cause enormous damage to the European economy. In addition, he made this statement just four days before the start of the European Union summit, during which the new version of the divorce agreement was to be considered. So no wonder that the pound began to lose ground. However, today, the pound has received unexpected support in the form of other representatives of the European Union. Thus, Finnish Prime Minister Antti Rinne, chairing the European Union, said that negotiations would need to continue after the summit. She also made it clear that even on Thursday, the heads of the countries of the European Union could not consider a new version of the agreement, then the saga would not end there, to the delight of countless speculators who are endlessly delighted by the incredible ups and downs of the pound.

Most likely, the impact of the negotiation process on the pound will end today. Moreover, from discussions about a bright future, which is still unclear when it will come, it is nevertheless necessary to look at what is happening right now. In here, everything is terrible. Of course, the UK unemployment rate should remain unchanged. However, here, the growth rate of the average wage is likely to slow down. In particular, the growth rate of average wages excluding premiums may slow down from 3.8% to 3.7%. If we talk about average wages taking into account premiums, then its growth rate should slow down from 4.0% to 3.9%.

Salary excluding premiums (UK):

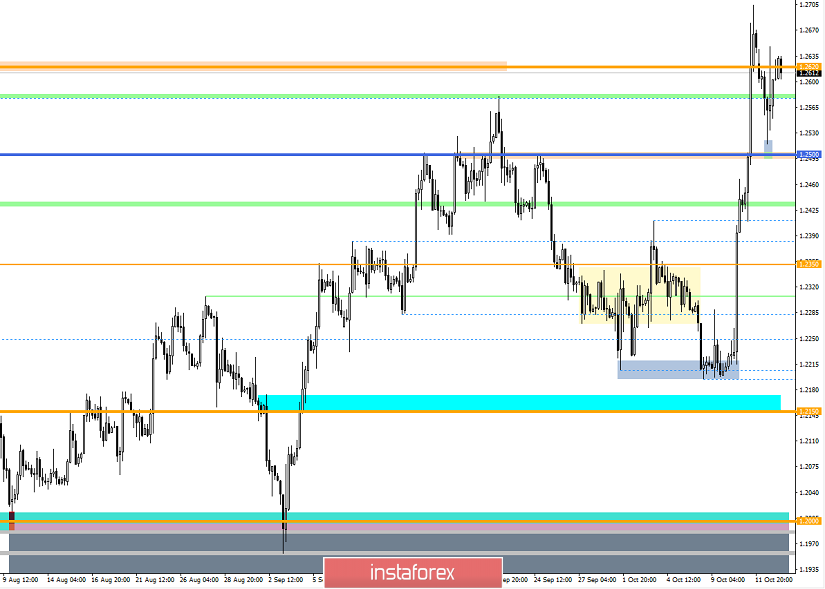

The GBP / USD pair returned to the boundaries of the level of 1.2620 again, forming a stagnation near it after the local return to the market of buyers. In fact, a distinct emotional mood is felt, which pours the quote up and down, while maintaining a distinct overbought. Considering the trading chart in general terms, we see that against the background of the past surge, the quotation not only flew to the maximum of 1.2704, but it almost reached the peak of the second-order correction, which could characterize as a change in global interest. It is not worth making hasty conclusions, since, perhaps, it is most likely in the matter of the emotional behavior of market participants.

It is likely to assume that the fluctuation within the level will continue for some time, but if the price is fixed lower than 1.2600, sellers may return to the market with a movement of 1.2535-1.2500.

We concretize all of the above into trading signals:

- We consider long positions in terms of clear price fixing higher than 1.2650, with the prospect of a move of 1.2700.

- We consider short positions in terms of fixing prices lower than 1.2600 with the prospect of a move of 1.2535-1.2500.

From the point of view of a comprehensive indicator analysis, we see that indicators keep an upward interest against the background of recent leaps, and only the short-term outlook is trying to work downward.