Although the United States had a holiday yesterday, which means European traders worked in proud solitude, they did not have to get bored. Usually, when there is a holiday in America or Europe, the market is extremely quiet and calm, but this is not about yesterday. Emotions overwhelm investors, although not just emotions, but fear and hope at the same time. The desire to seize even the illusory chance of a successful completion of epic with Brexit has led not only to the growth of the pound, but also to the single European currency, and to the banal overbought of these currencies. However, the week began with a confident pound campaign in the direction of weakening. The reason was the statement of Michel Barnier, who plays the role of the main negotiator from the European Union in this drama. He said that in its current form, London's proposals for the border between Ireland and Northern Ireland, pose a threat to the single European market. The point is that these proposals lack specificity, and in their current form, their implementation will only lead to a significant increase in trade and financial fraud, which will cause irreparable damage to the European economy. But the most terrible thing in his words is that he said them just four days before the summit of the countries of the European Union, during which they should consider a new version of the divorce agreement. In other words, they hinted that this time too, everything would end in nothing. Just another chatter about how now all the problems will be solved, but in fact nothing will change. Thus, it is not surprising that the pound was confidently losing ground.

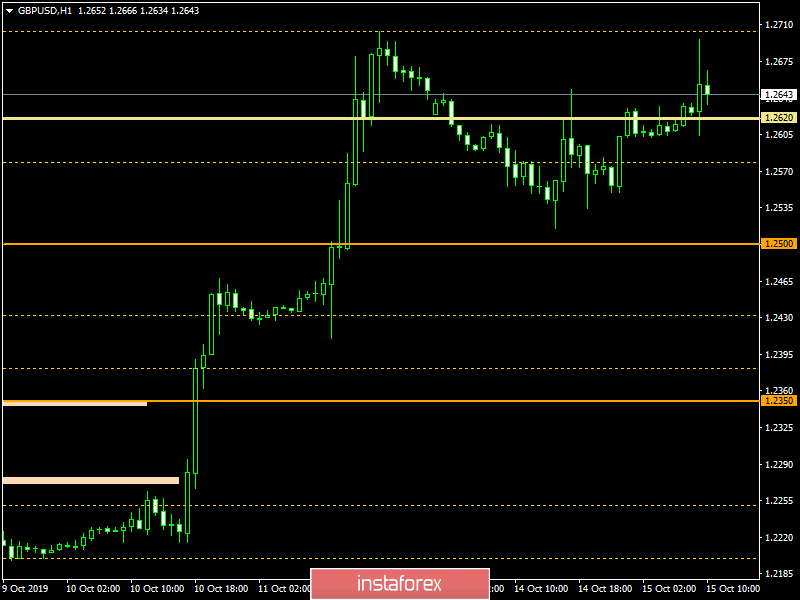

Surprisingly, unlike the pound, the single European currency, in fact, remained standing still, although it had much more reasons to weaken. Data on industrial production showed a deepening decline from -2.1% to -2.8%. At the same time, the decline has been going on for ten months in a row. Therefore, it's high time for European politicians to spit on all these negotiations, and lengthy speeches about possible future risks, and rolling up their sleeves, urgently addressing long overdue problems.

Industrial production (European Union):

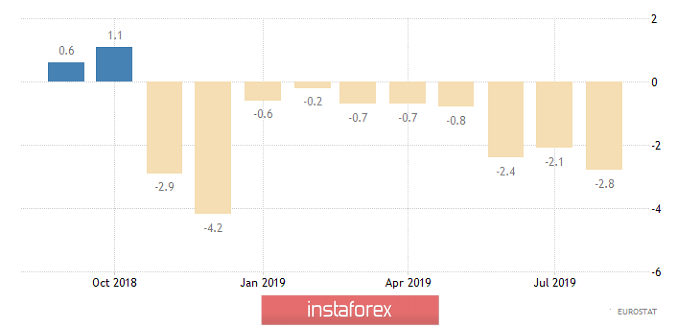

Today, the pound began to grow again. The reason was the words of the Prime Minister of Finland, Antti Rinne, who presides over the European Union. She said that negotiations would need to be continued after the summit of the heads of European Union countries. In other words, she said that there is no reason to panic yet, and the negotiators will still have time. So she gave the pound one more hope while everyone has already lost count in a row. However, this also indicates that, most likely, the informational background regarding Brexit will be rather moderate until Thursday. Therefore, it becomes possible to look more closely at the current state of things. Moreover, in the UK published data on the labor market. True, it would be better for the pound so that investors would not see them. The unemployment rate itself should remain unchanged, which cannot be said about salaries. Thus, the growth rate of average wages, excluding premiums, should slow down from 3.8% to 3.7%. At the same time, the growth rate of the average wage, already taking into account premiums, may slow down from 4.0% to 3.9%. So to be honest, even if the growth of the pound or the single European currency is possible, it is only because of the emotions caused by the next statement on the progress of the negotiations.

Average salary, excluding bonuses (United Kingdom):

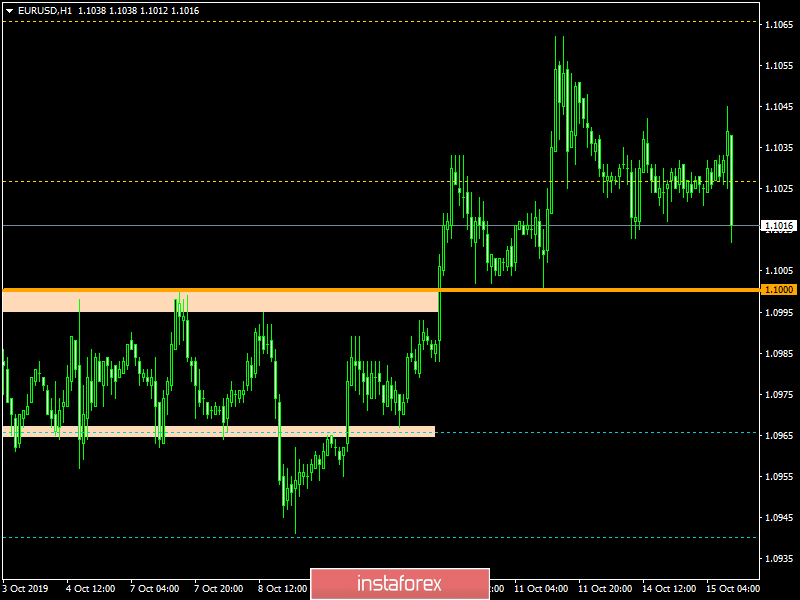

The previous day was quite dull for the euro / dollar currency pair. There was practically no fluctuation, forming as a fact, a local stagnation of 1.1020 / 1.1045. It is likely to assume that the current day will be a bit more active. The existing framework will fall and after all, decline into the psychological level of 1.1000 is possible. An alternative position will be considered only if the price is clearly fixed higher than 1.1062.

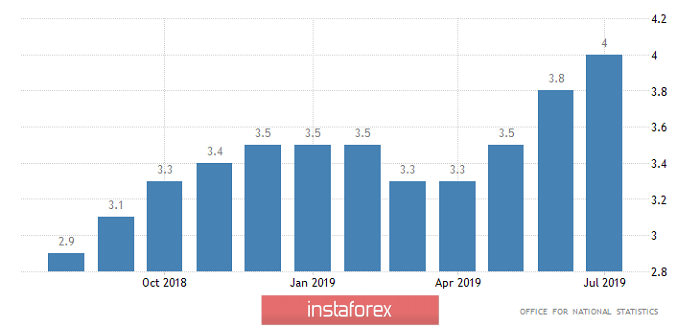

The pound / dollar currency pair continues to please with emotional jumps, bouncing to the maximum of October 11 once again. It is likely to assume that returning to the recently worked level of 1.2620 looks like a very realistic scenario.