The pound continues to grow solely on emotions, or rather an ineradicable desire to believe in the best. The words of the main negotiator from the European Union, Michel Barnier, that the negotiations are going so well that a version of the divorce agreement may be ready by Friday. And no one is embarrassed by the fact that the summit of the heads of the European Union countries ends before the indicated date. That is, it is not completely clear when the European Union will consider the possibility of its adoption. Thus, exclusively the belief in a happy ending moves the pound up.

However, faith has nothing to do with rational thinking, which can be clearly seen from how enviable persistence investors ignore data on the real situation. After all, data on the labor market were significantly worse than forecasts, which were not the most optimistic anyway. Thus, the unemployment rate did not remain unchanged, but rose from 3.8% to 3.9%. The growth rate of average wages, taking into account premiums, slowed down from 3.9% to 3.8%, while they were supposed to accelerate to 4.0%. Meanwhile, the growth rate of average wages, excluding premiums, slowed down from 3.9% to 3.8%, which can be perceived as a positive factor, since they expected a slowdown to 3.7%. In general, it is clear that the situation in the UK labor market is clearly deteriorating. So there are simply no fundamental reasons for the growth of the pound. Consequently, the higher emotions drive it, the more painful will be the fall, when everyone once again realizes that everything will be limited exclusively to chatter.

Unemployment Rate (UK):

At the same time, today, the pound can get a real reason for growth, as inflation is expected to accelerate from 1.7% to 1.8%. Although against the background of a slowdown in the growth of average wages. This indicates a decrease in the growth of real wages, and therefore, a decrease in consumer activity. However, inflation is a factor in the growth of companies' profit, which is very, very pleasant for investors so they will have reason for optimism. Unless, politicians begin to tell all kinds of tales about how spacecraft plow the expanses of the universe once again.

Inflation (UK):

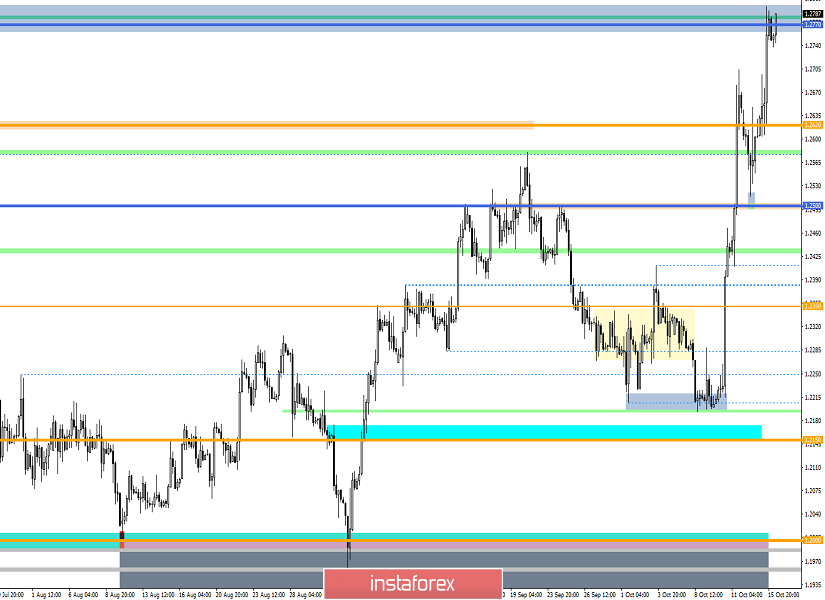

The GBP / USD pair which slowed down the movement within the level of 1.2620, managed to resist, working out the coordinates and drawing an impulsive upward move again towards the range level of 1.2770. In fact, we saw another rally of 170 points, where the result was a slight slowdown. Considering the trading chart in general terms, we see that the quote does not just draw upward impulses, there is a break in the existing cycles in the global trend. So, the existing emotional - upward mood managed to throw the quote up for a short period of time up to the second-order correction [06/25/2019], which is a signal of a possible change in trend. Now, the question is, how much is enough of these same emotions?

It is likely to assume that the fluctuation within the range of 1.2770 will not be delayed and we will see another price jumps soon, thereby working in this case on the basis of the breakdown of existing, variable boundaries. That is, the emphasis in this case is on the framework of 1.2735 / 1.2800.

Concretizing all of the above into trading signals:

- We consider long positions in terms of fixing prices higher than 1.2800, with the prospect of a move of 1.2860.

- We consider short positions in terms of fixing prices lower than 1.2735, with the prospect of a move of 1.2700-1.2620.

From the point of view of a comprehensive indicator analysis, we see that indicators have taken a single position on the current mood due to the impulsive upward movement. Thus, due to the strong information background, indicator analysis can be volatile.