To open long positions on GBP/USD, you need:

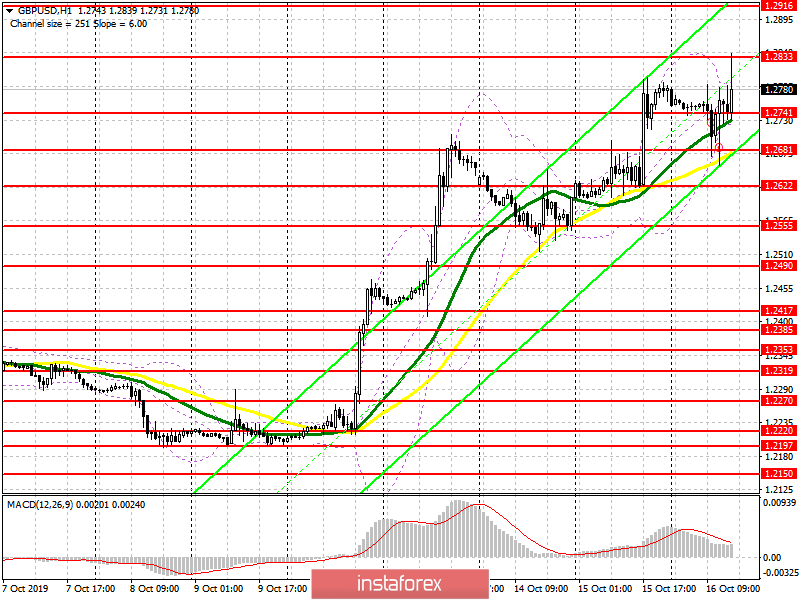

Today is expected to be a hot evening, as Prime Minister Boris Johnson will speak, during which he can inform about the details of the deal with the EU, which has been providing the pound with major support in recent times. Buyers of the pound today returned from the large support levels around 1.2680, which I spoke about in my morning survey, and continue to defend the support of 1.2741. However, the more important task is to break and consolidate above the level of 1.2833, which will open a direct path for the pound to the highs of 1.2916 and 1.2974. In the scenario of a downward correction, which can be formed after the negative statements of UK parliamentarians about the current Brexit deal, it is best to return to long positions only on a false breakdown from the low of 1.2681, or on a rebound from the levels of 1.2622 and 1.2555.

To open short positions on GBP/USD, you need:

Sellers of the pound were encouraged by Michel Barnier's statement that even though a deal is likely, the UK may need more time to exit, which would force London to ask for an extension. However, the test of important support levels in the first half of the day returned buyers to the market. At the moment, the task of the bulls is to keep GBP/USD below the resistance of 1.2833, and another unsuccessful attempt to break may again lead to a test of support for 1.2741, the breakdown of which will take place only on the negative reaction of the unionist party to the proposals of Boris Johnson. A breakthrough of 1.2741 will lead the pair to the lows of 1.2681 and 1.2622, where I recommend taking the profits. In the scenario of a larger growth of the pound above the maximum of 1.2833, it is best to sell after the test of the levels of 1.2916 and 1.2974.

Indicator signals:

Moving Averages

Trading is above the 30 and 50 daily averages, which indicates a possible continuation of the growth of the pound.

Bollinger Bands

In the case of decline, the pair will be supported by the lower border of the indicator at 1.2681.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20