US retail sales fell 0.3% in September, which turned out to be worse than expected and put some pressure on the dollar, as consumers react to rising tensions and the threat of a negative outcome on trade negotiations.

At the same time, the overall US consumer demand remains steadily strong. On October 15, the IMF published an updated forecast for the global economy, which clarified its view on US GDP growth - + 2.4% in 2019, and + 2.1% in 2020, which also essentially means that the danger of a recession is not recognized, as consumer demand in the US provides 2/3 of the growth of GDP.

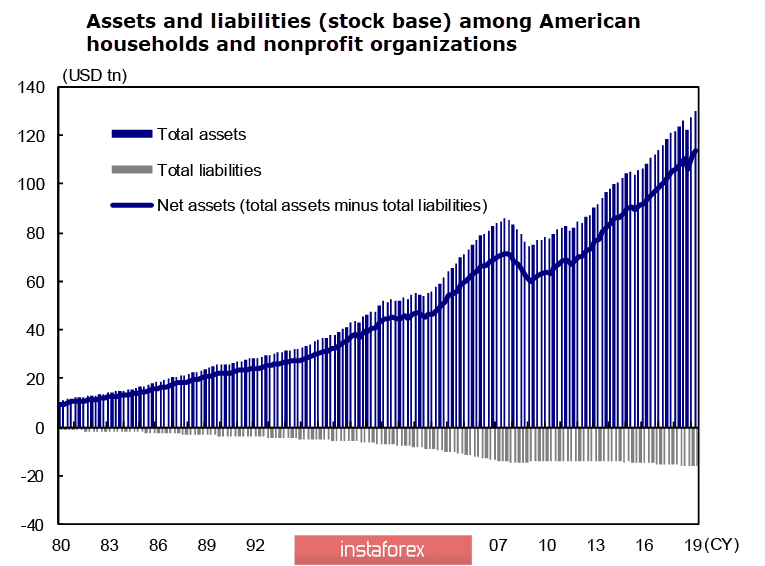

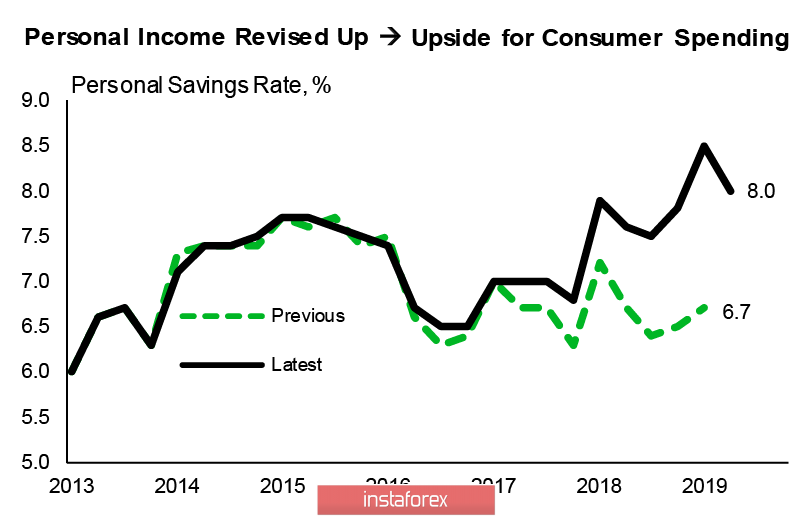

Despite the fact that the corporate sector is under strong pressure due to global growth, low rates have made household interest rates on disposable income at historically low levels, and the equity of households and nonprofits is growing steadily.

Low interest rates, favorable wage conditions, a strong stock market and high housing prices are linked into a single system of growth in consumer demand. As a result, the loss of any of these parameters can bring down the pyramid of consumption, and therefore, the scenario for the Fed and the government is completely transparent - the rate will continue to decline, the expansion of the Fed's balance (not QE4, but technical expansion, but this does not change the essence) will continue, the struggle for stock growth The market becomes dominant in the whole economic strategy.

As a result, the dollar cannot become strong in these conditions. In the coming weeks, the dynamics of the dollar will be mixed with a slight advantage of the bearish sentiment.

USD/CAD

The assumption that USDCAD will go up after the publication of the employment report for September was not justified - the report came out unexpectedly strong. The increase in the number of employed significantly exceeded the forecast, unemployment fell from 5.7% to 5.5%, and most importantly, the average wage rose significantly from 3.78% to 4.25%, which gives rise to inflationary expectations.

One event, and the assessment of the prospects for the "loonie" changes. The Canadian branch of Scotiabank notes that seasonal demand for the dollar turned out to be rather weak, the dollar as such is under strong pressure for several reasons, and the state of the Canadian economy looks even more stable than it seemed a quarter ago. On the other hand, Toronto-Dominion Bank draws attention to the fact that after a sharp increase in Canada's GDP in the 2nd quarter, a slowdown was expected, but it turned out to be softer than expected, credit growth was growing, and the inversion of the yield curve decreased slightly, which offset the risk of recession.

A slight change in the estimates allows us to conclude that most large banks prefer to take a wait-and-see attitude and cancel their forecasts for the dynamics upward of the USD/CAD. In September, the Bank of Canada left the rate at 1.75% and did not give any guidance to investors regarding its intentions, the forecasts for the labor market and inflation are also moderately optimistic, and, in fact, there are no internal reasons for lowering the loonies.

Meanwhile, the September inflation report for September turned out to be worse than expected. The expected growth from 1.9% to 2.1% y / y was not confirmed, but the basic index was unchanged, which allowed the loonie to maintain its position. The expectations for the rate has not changed, that is, on October 30. The Bank of Canada will confirm the position of "observe and analyze" and not act, and the weak bearish sentiment on USD/CAD remains. Resistance is found at 1.3250, while the medium term loonie aims to retest 1.3135.

USD/JPY

The intermediate success in US-China trade negotiations could not ignore the yen - the main protective currency is weakening due to the reduction of tension. In addition, negativity is added due to unexpectedly weak data, industrial production fell again in August, and the annual decline is 4.7%, which is consistent with previously published data on a sharp reduction in orders for engineering products.

USD/JPY has fixed above the support of 108.48, but still remains below the 200-day SMA. Until the end of the week, a weak bullish sentiment will continue. The nearest target is 109.32.