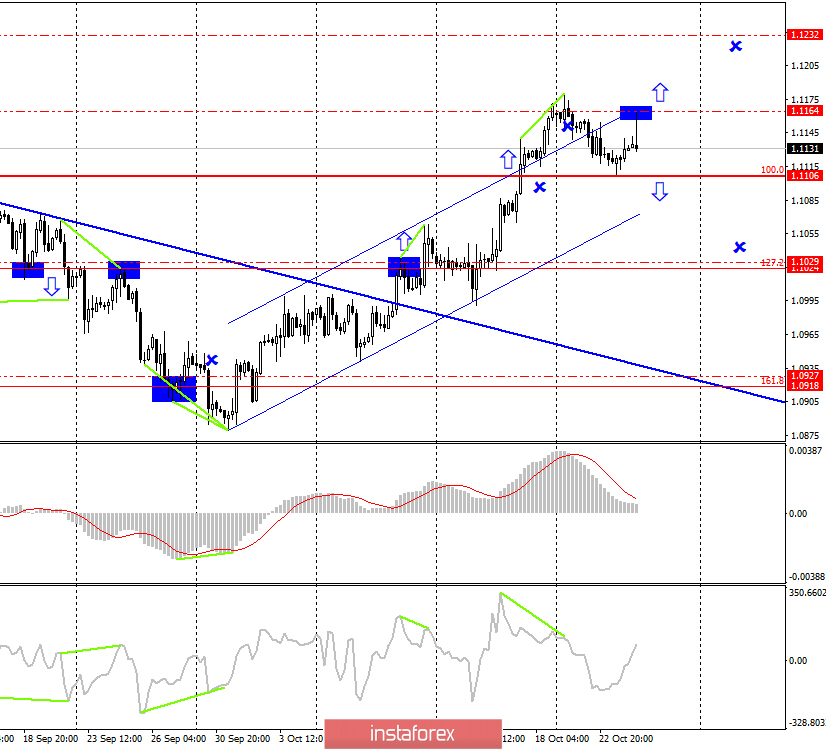

EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed a not too confident rebound from the correction level of 100.0% (1.1106), a reversal in favor of the EU currency and a return to the level of 1.1164, from which it also performed a rebound. Thus, a new reversal in favor of the US currency and the resumption of the fall in the direction of the same level of 100.0% may follow. Closing the euro/dollar exchange rate under the Fibo level of 100.0% will increase the chances of continuing the fall towards the next correction level of 127.2% (1.1024). Emerging divergences today are not observed in any indicator, and the fall of quotations allows even an upward trend channel.

On Monday, Tuesday and Wednesday, the EUR/USD pair were deprived of information feed. Not a single economic report for these three days was published either in America or in the European Union. Traders quite reasonably decided to use this time for correction, and this morning, they rushed to buy the European currency, as forecasts for all six indices of business activity in the services and manufacturing sectors of Germany and the European Union were higher than the values of September. However, optimistic forecasts were not destined to come true. Some indices were indeed higher than the previous value, but how can we call, for example, a positive factor business activity in the manufacturing sector in Germany, which increased from 41.7 to 41.9? In the German services sector, business activity showed a decline to 51.2, the composite PMI slightly improved from the previous month, but still worse than traders' expectations. In the European Union, the situation with business activity is approximately the same. In the manufacturing sector, no changes were recorded compared to September – 45.7, in the services sector – an increase to 51.8, which is still worse than the forecast of 51.9, and the composite index is 50.2. Even though these are not the final values for October, traders are still very sensitive to any deterioration in these indicators, as even Mario Draghi said that weak business activity in manufacturing will pull down other industries. Thus, suddenly in recent months, business activity indicators have turned from mediocre in importance indicators into significant ones.

Well, then the euro also does not expect anything good. In a few hours, Mario Draghi, the ECB Chairman, will give his last speech, which will sum up not only the two-day meeting but also his 8-year work. It is unlikely, given the weak economic reports from the eurozone, Draghi will find words of optimism when he talks about the economy and monetary policy of the European Union. Thus, the hope for bull traders lies in economic reports from America, where business activity indices in the services and manufacturing sectors will also be released, as well as reports on orders for long-term goods. Values worse than forecasts for these reports will return demand for the euro on October 24th.

What to expect from the euro/dollar currency pair today?

On October 24, traders may well expect to fall to the level of 1.1106 and even lower – to 1.1024. There will be plenty of news today, but traders will attach the greatest importance to the American reports. Mario Draghi's press conference may become a formality, the probability of surprises is small.

The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019.

Forecast for EUR/USD and trading recommendations:

I recommend selling the pair with a target of 1.1024 if the close is made below the level of 1.1106(100.0% Fibonacci). A stop-loss order above the level of 1.1106.

I recommend opening the pair's purchases with the target of 1.1232 and the stop-loss order below the level of 1.1164 if the closure is performed above 1.1164.