Donald Trump has returned to put pressure on the Federal Reserve after yesterday's statements by the European regulator on the need to further soften monetary policy. Data on manufacturing activity in the US returned demand for the US dollar after its decline against the background of a weak report on orders for durable goods.

EURUSD

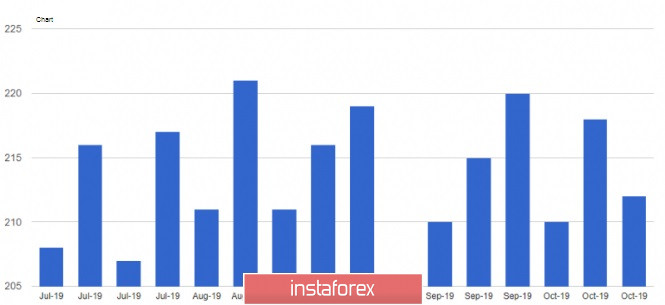

The number of Americans looking for work in the United States fell last week. According to the US Department of Labor, the number of initial applications for unemployment benefits for the week from October 13 to 19 was reduced to 6,000 and amounted to 212,000. Economists had expected the number of applications to be 215,000. The number of secondary applications for the week from October 6 to October 12 fell by 1,000 and amounted to 1,682,000. The data indicate that the market continues to be at its historic lows.

The US dollar was pressured by a weak report on durable goods orders in the US, which fell in September, which is not good news for the economy. Reduced orders indicate a more selective household approach to spending, which could negatively affect economic growth topics. However, a one-time decrease in orders is not a reason for concern, since before that there was a three-month increase. According to the US Department of Commerce, orders for durable goods in September decreased by 1.1% compared with the previous month, while economists expected a fall of only 0.8%. The main drop in overall orders was due to a decrease in demand for transport equipment.

Also in September in the United States, there was a decrease in sales of new homes compared to August. According to the Commerce Department, sales in the primary housing market fell by 0.7% compared with the previous month and amounted to 701,000 homes a year. Economists had expected sales of 709,000. The median price of a home was $299,400, compared to $328,300 a year ago.

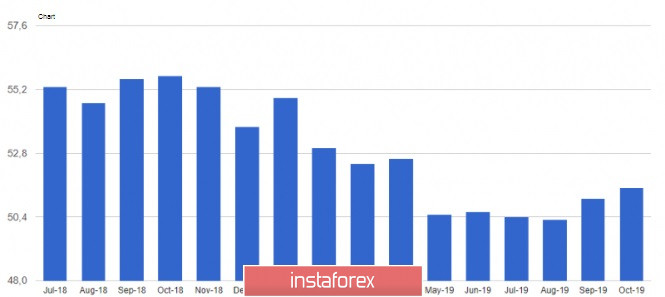

As noted above, good support for the US dollar was provided by data on activity in the US manufacturing sector, which was due to the growth of production in the manufacturing industry. According to the IHS Markit statistics agency, the PMI for the US manufacturing sector in October was 51.5 points versus 51.1 points in September. In October, the PMI for the service sector returned to a 3-month high in the region of 51 points, against 50.9 points in September. IHS Markit's preliminary composite purchasing managers' index (PMI) for the United States rose to 51.2 points. However, Markit remains concerned about the spread of weakness from the manufacturing sector to the service sector.

Manufacturing activity in the area of responsibility of the Federal Reserve Bank of Kansas City fell in October. The report indicates that the composite index of the Fed-Kansas City on October 2019 amounted to -3 points, compared to -2 points last month.

Yesterday, the American president on his Twitter published another series of criticisms of the Fed. Trump said that the Fed will evade its duties if it does not lower interest rates and does not provide a new amount of stimulus to the economy. In his opinion, the committee raised rates too quickly in the past and lowered them too slowly now. Statements were made immediately after the president of the European Central Bank, Mario Draghi, yesterday spoke out on the need to further stimulate economic growth and inflation in the eurozone.

As for the technical picture of the EURUSD pair, the bulls need a resistance return of 1.1120, since only after that, it will be possible to count on a larger uptrend to the maximum region of this month 1.1180. The likelihood of continued pressure on the euro is also present, but much will depend on the development of the situation around Brexit.

GBPUSD

Yesterday, British Prime Minister Boris Johnson called for a general election on December 12. This was done to exert the necessary pressure on the EU to decide in favor of providing a shorter deferment of Great Britain to exit the EU. If such a delay is approved, demand for the British pound will return. If the EU leaders agree only to a 3-month delay, then most likely the pressure on the pound will increase, since in this situation Boris Johnson has repeatedly promised that he will withdraw the country from the EU on October 31 with or without an agreement.

However, in the absence of a majority in the Conservative Party, Johnson needs support in parliament, as opposition legislators must also vote for him. Also yesterday, the Prime Minister noted that he agreed to provide Parliament with more time to study the Brexit agreement, but only if the elections are scheduled for December 12.

As for the technical picture of the GBPUSD pair, in the short term, the market is on the side of the pound sellers. An unsuccessful attempt to return the resistance bulls of 1.2860 may lead to the formation of another downward wave in the trading instrument with updating the lows of 1.2760 and 1.2600. If the bulls manage to overcome the level of 1.2860 today, we can expect purchases and an update of the resistance of 1.2950.