GBP/USD

Analysis:

In the last 3 months, a bullish trend has been forming on the pound chart. The current wave level allows us to classify its scale to the level of H4. Since the end of last week, the price is adjusted in a flat corridor between the counter zones.

Forecast:

During the next sessions, it is expected to complete the current decline, the formation of a reversal and the beginning of a price rise. Volatility is likely to increase if the exchange rate changes. A short-term puncture of the lower border of support is not excluded.

Potential reversal zones

Resistance:

- 1.3000/1.3030

- 1.2890/1.2920

Support:

- 1.2810/1.2780

Recommendations:

Sales of the pound today are possible only with intra-session trading of a reduced lot. It is safer to refrain from entering the pair's market until the correction is completed by tracking the buy signals at its end.

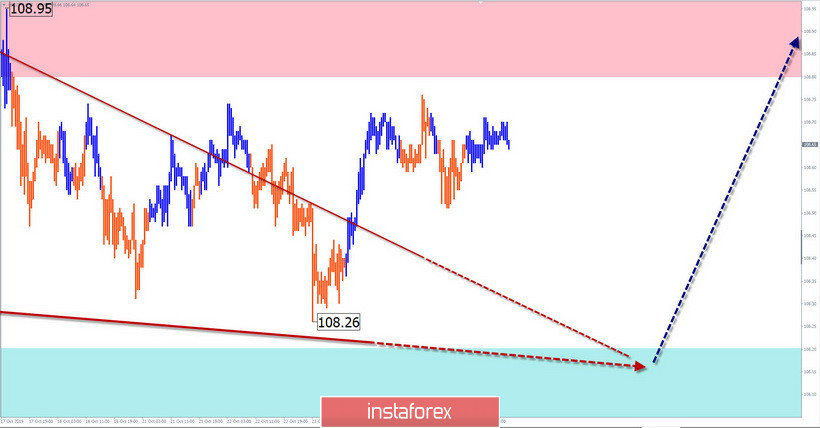

USD/JPY

Analysis:

Since August, the trend direction of the Japanese yen against the dollar is upward. The wave entered the final stage. Over the past week, the price formed a corrective plane, increasing its wave level.

Forecast:

Today, the pair is expected to continue moving in the sideways price channel. In the second half of the day, a downward movement vector is more likely. The beginning of the price rise can be expected at the end of the day, or at the beginning of the next week.

Potential reversal zones

Resistance:

- 108.80/109.10

Support:

- 108.20/107.90

Recommendations:

Until the current correction is completed, trading is possible only within the intraday. A lot more sensible to reduce. The priority is selling the pair. When the price reaches the support zone, it is recommended to look for entry points into long positions.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted – the expected movement.

Attention: The wave algorithm does not take into account the length of time the tool moves!