Hello, dear colleagues.

According to BTCUSD, we follow the formation of initial conditions for the upward cycle of October 23; the level of 223.06 is the key resistance and the level of 206.77 is the key support for this structure. For Ethereum, the price is in the correction zone from the downward trend on October 11 and forms the potential for the development of an upward movement from October 23.

Forecast for October 25:

Analytical review of cryptocurrency in H1 scale:

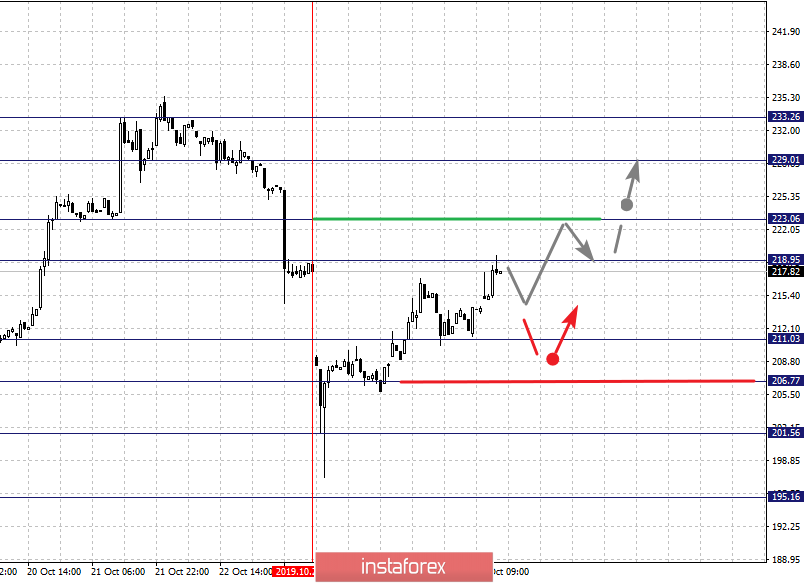

According to the BTCUSD instrument, the key levels on the H1 scale are 233.26, 229.01, 223.06, 218.95, 211.03, 207.77, 201.56, and 195.16. At the moment, we are following the formation of the initial conditions for the upward cycle of October 23. The short-term upward movement is expected in the range of 218.95 – 223.06 and the breakdown of the last value should be accompanied by a pronounced upward movement. The target is 229.01. The potential value for the top is the level of 233.26, from which we expect a pullback down.

The short-term downward movement is possible in the range of 211.03 – 206.77 and the breakdown of the last value will have to develop a downward trend. In this case, the first target is 201.56. We consider the level of 195.16 as a potential value for the bottom.

The main trend is the formation of initial conditions for the upward cycle from October 23.

Trading recommendations:

Buy: 219.00 Stop Loss: 211.00 Take Profit: 223.00

Buy: 223.50 Stop Loss: 212.00 Take Profit: 229.00

Sell: 211.00 Stop Loss: 218.50 Take Profit: 207.00

Sell: 206.50 Stop Loss: 213.00 Take Profit: 201.50

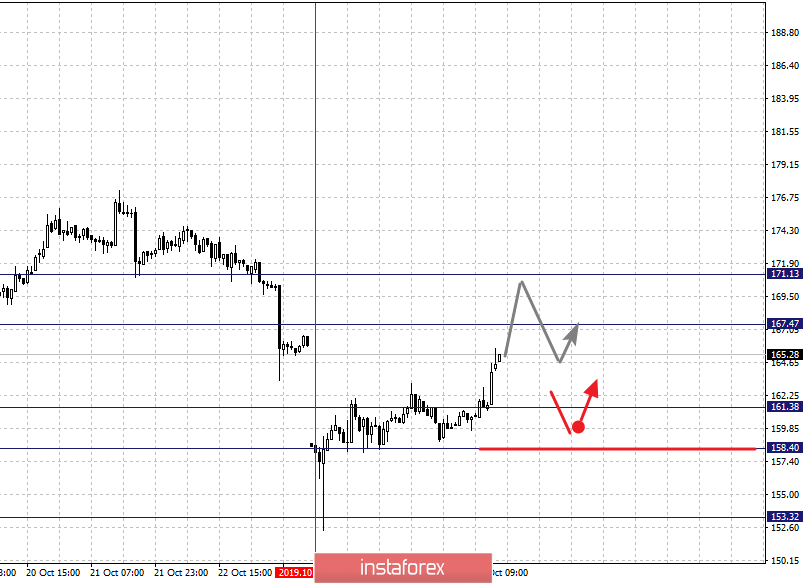

For the #Ethereum tool, the key levels on the H1 scale are 171.13, 167.47, 161.38, 158.40, and 153.32. We expect the execution of the expressed initial conditions for the upward cycle from October 23, which should occur to the level of 171.13 and in the area of 167.47 – 171.13 is the short-term upward movement, as well as consolidation.

A short-term downward movement is possible in the range of 161.38 – 158.40 and the breakdown of the last value will lead to the subsequent development of the downward trend from October 11. In this case, the first potential target is 153.32.

The main trend is the downward structure of October 11, the correction stage.

Trading recommendations:

Buy: 167.50 Stop Loss: 161.40 Take Profit: 171.10

Buy: 184.50 Stop Loss: 175.00 Take Profit: 193.00

Sell: 161.00 Stop Loss: 164.50 Take Profit: 158.50

Sell: 158.00 Stop Loss: 161.50 Take Profit: 153.50