4-hour timeframe

Technical data:

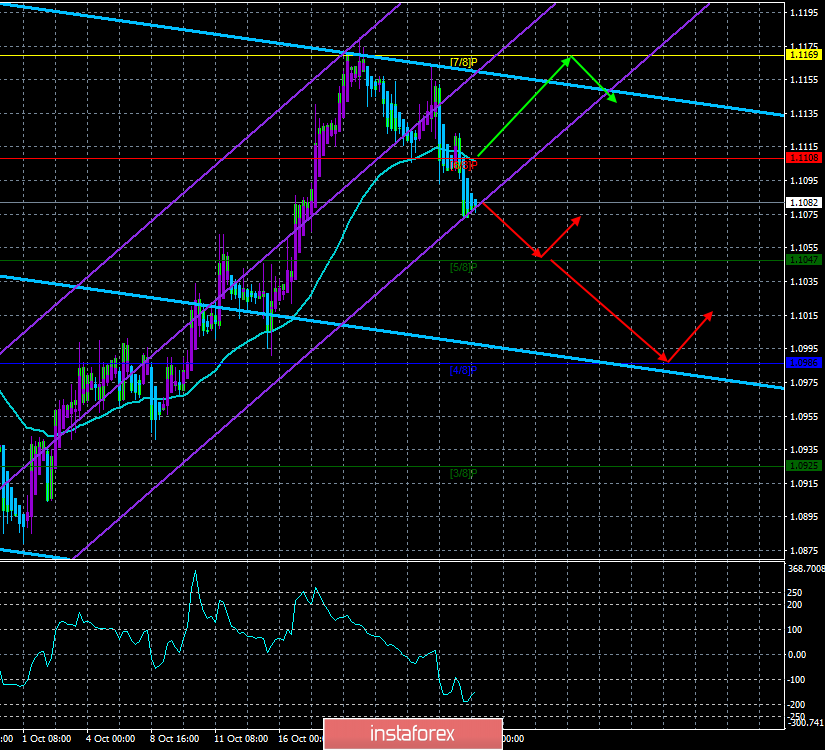

The upper channel of linear regression: direction – down.

The lower channel of linear regression: direction – upward.

The moving average (20; smoothed) – down.

CCI: -149.6726

Well, dear traders, a new week begins in the forex market, the last in October 2019. The euro managed to overcome the moving average line, thus, the trend for the EUR/USD pair last week changed to a downward one. Volatility remains fairly average, although at the end of last week it rose slightly from the values of 40-50 points, which we observed at the beginning of the week. However, we still believe that most of last Thursday's reports were not taken into account by traders. By and large, market participants reacted only to the speech of Mario Draghi, who will resign in a few days, and strongly hinted at a possible further rate cut by the ECB. Other macroeconomic reports in the euro area were no better, but also the macroeconomic statistics from the United States was a disappointment. Markit services and production sectors turned out to be more or less acceptable, and even those are only preliminary values. More important durable goods orders have frankly failed.

Today, Mario Draghi will again give a speech. Is it worth it to say once again that traders have a simple attitude to any statement by the current chairman of the European Central Bank: either Draghi will say something negative and "dovish", or he will not touch the topic of the EU economy and ECB monetary policy? So it turns out that any speech by Draghi is potentially a problem for the European currency, although, at the very beginning of his term, Draghi repeatedly noted that "saving the euro currency is his goal". Yes, for 8 years, the general economic situation has changed dramatically, now the entire world economy is on the verge of stagnation and/or recession due to the trade war. Thus, we need to make every effort to stimulate the economy, as well as to increase the competitiveness of exported goods on world markets. It is for this that cheap national currencies are needed, it is understood by both China and the EU, and the United States. In principle, it is no longer necessary to "save" the euro. That is, the central bank is now unlikely to have such a goal. What will Draghi say today? Hardly anything new. But even if he will "scare" the markets again, we recommend treating his words with a degree of distrust. After all, on November 1, Christine Lagarde will come to power and not many doubt that a completely different approach in the management of a huge organization will coincide with the approach of Draghi. Lagarde is noted as a specialist of a more radical persuasion, capable of harsh statements, criticism and active actions. Thus, it is now more important what Christine Lagarde will say in her first speech as ECB President.

Well, the key event of this week, in addition to the resignations of Jean-Claude Juncker and Mario Draghi, will be the next meeting of the Fed, at which traders will learn whether the key rate will fall for the third time in a row or the regulator will still take a pause? It is around the Fed meeting that all trade will revolve until Wednesday inclusive. According to experts, the rate will be lowered by another 0.25%. From our point of view, Jerome Powell is very much listening to Donald Trump, who at the end of last week criticized the Fed again. Also, macroeconomic statistics in the United States continues to deteriorate, so the easing of monetary policy will be due to several factors. Well, the rate cut should, in theory, harm the US currency, since it can no longer be interpreted as a "corrective decrease".

From a technical point of view, the euro/dollar pair can calmly continue its downward movement, since no important macroeconomic publication is planned either in the States or in the EU until the very beginning of the announcement of the results of the Fed meeting. Only the performance of Mario Draghi today and that's all. The smallest linear regression channel supports the downward trend, the Heiken Ashi indicator indicates a downward movement and the "intraday" plan.

Nearest support levels:

S1 – 1.1047

S2 – 1.0986

S3 – 1.0925

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1169

R3 – 1.1230

Trading recommendations:

The euro/dollar pair continues its downward movement. Thus, today it is recommended to sell the pair with the target of Murray's level of "5/8" - 1.1047. There are about 30 points to the goal, which is quite possible for traders to pass in one trading day, even when there will be little news. It is not recommended to buy the euro currency until the price is fixed above the moving average with the target of Murray's level of "7/8 " - 1.1169.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue line of the unidirectional movement.

The lower channel of linear regression – the purple line of the unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) – blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.