Trading week on the foreign exchange market began quietly: major pairs continued last Friday's trend, without any sudden movements. The Asian session was held in a flat - both for the EUR/USD pair, and for other major pairs of the forex market. But such a calm price will not last long - the current trading week promises to be "hot". Key macroeconomic reports will be published in Europe and the US, the Federal Reserve will hold its penultimate meeting this year, and the Brexit topic will get its temporary outcome. All this suggests that after the calm a volatility storm will come, which will determine the further movement vector of dollar pairs, including EUR/USD.

With a high degree of probability, we can assume that before the Fed meeting (the results of which we will find out on Wednesday, October 30), traders of the euro-dollar pair will react to political battles about the prospects of Brexit. The "party" will begin today, when the British Parliament will consider holding early elections on December 12. Let me remind you that Boris Johnson, who at the end of the week put an ultimatum to the House of Commons: postponement of Brexit in exchange for re-elections, should submit the corresponding legislative initiative on Monday.

In turn, Europe is in no hurry to grant London an "automatic" delay: the French president has blocked this decision, and now Brussels awaits the outcome of today's vote in the British Parliament. If deputies of the House of Commons nevertheless agree to early elections, this will be a victory for Johnson: according to the latest opinion polls, the Conservative Party of Great Britain increased its rating last week and now has a 16% advantage over the opposition Labour Party. Therefore, as a result of the re-election, Johnson will most likely receive an absolute majority in Parliament and will be able to agree on a Brexit deal. Thus, a positive outcome of the vote on this issue will support both the pound and the euro.

According to most experts, the UK will receive a respite in any case - the only question is its duration. If the deputies agree to the election, Brussels will extend the negotiation process until January 2020, if not, then the postponement may be more limited (Macron offered to give the British only a month, until November 30). But on October 30, the attention of EUR/USD traders will switch to the Federal Reserve, which will announce the results of its October meeting. According to the consensus forecast, the regulator will reduce the interest rate by 25 basis points. This step of the Fed has already been largely taken into account in current prices, so the main intrigue of the meeting is to determine its further actions. According to some currency strategists, regulator members will hint at the completion of the interest rate adjustment cycle. If this scenario is realized, then the dollar will receive strong support throughout the market, despite the decrease in rates in October. But if the regulator does not exclude further steps towards easing monetary policy, the EUR/USD pair will significantly grow, up to the 12th figure....

In addition to the Fed and Brexit meeting, quite important macroeconomic releases are expected this week, which will also affect the dynamics of the EUR/USD pair. For example, an indicator of US consumer confidence will be published tomorrow, October 29. After a significant decline in September, this month it should slightly recover - up to 128 points.

A very important release for the pair will be published on October 30, that is, on Wednesday. This is a preliminary assessment of US GDP growth in the third quarter. According to general forecasts, growth will significantly slow down to 1.6% (after falling to 2% in the second quarter). If this forecast is true, it will be the weakest growth rate since the fourth quarter of 2015. By the way, according to the updated forecasts of the Federal Reserve Bank of New York, the GDP indicator will come out above the forecast level, namely at around 1.9%. In any case, this release will be considered by traders through the prism of possible actions of the Federal Reserve, the meeting of which will take place on the same day. If the indicator comes out much worse than forecasted, the likelihood of soft rhetoric from the Fed will increase, putting pressure on the US currency.

But on Thursday, November 1, important data will be published for the European currency. First of all, we are talking about inflation. The general consumer price index has been gradually decreasing since June, and in September reached 0.8%. In October, negative dynamics are also expected - according to analysts, the indicator will drop to the level of 0.7%. Core inflation should remain at one percent level, although according to some experts, the core index will also go in the red zone, at around 0.9%. On the same day, data on the growth of European GDP for the third quarter will be published. There is also expected negative dynamics: on a quarterly basis, the indicator should decrease to 0.1%, and in annual terms - to 1.1%. In this case, the indicators will update multi-month lows, thereby exerting strong pressure on the euro.

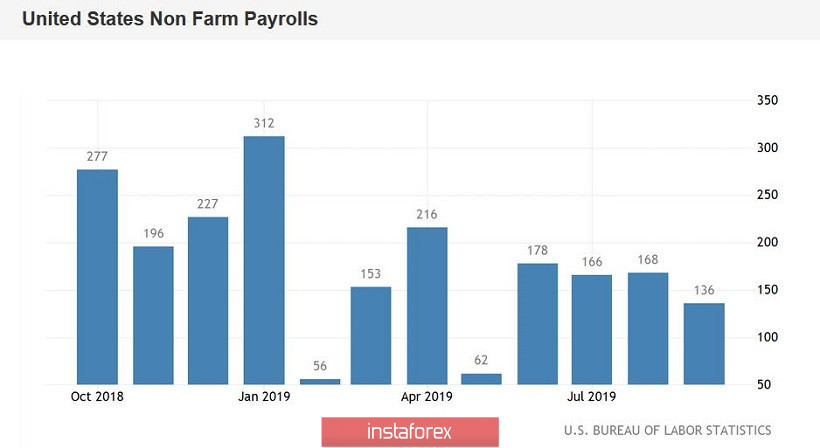

The final chord of a busy trading week will be the Nonfarm report. According to preliminary forecasts, conflicting data on the labor market may undermine the greenback's position. Thus, the unemployment rate should slightly increase - up to 3.6%,amid a very weak increase in the number of employees (total +90 thousand). But here is a separate line worth noting the growth rate of the average hourly wage. Experts expect the indicator to recover - in annual terms, it should grow to a three percent mark (after falling to 2.9%), and in the monthly terms - to 0.3% (after falling to zero). If salary data is in the red zone, it will be difficult for dollar bulls to keep their positions occupied by that moment.

Thus, the upcoming five-day trading will not bore the EUR/USD traders: if the Fed's rhetoric is more dovish-like amid weak macroeconomic reports (primarily Nonfarms), then the bulls of the pair can test the 12th figure, breaking the resistance level of 1, 1190 (the upper line of the Bollinger Bands indicator on the daily chart). The euro may also be supported by Brexit's issue if it is resolved in favor of prolongation. It is also worthwhile to identify the strongest support levels - firstly, it is 1.1030 (the lower boundary of the Kumo cloud, which coincides with the middle line of the Bollinger Bands), and secondly, the "round" mark is 1.0900 (the lower line of the Bollinger Bands).