Improving global risk appetite amid the de-escalation of the US-China trade conflict and progress in Britain-EU relations on Brexit have made the Japanese yen one of the outsiders on Forex. Back in August, it seemed that the currency of the Land of the Rising Sun could compete with the Canadian dollar in the struggle for the title of best performer of the year among G10 monetary units, but everything turned upside down in the fall. Washington and Beijing are ready to finalize the first part of the trade agreement and submit it for the signature to the presidents of the two countries, while London and Brussels have finally found a common language on the issue of the Irish border.

The three-month volatility of the yen fell to the lowest level since July, which increases investor interest in carrying trade operations, contributes to the sale of funding currencies and may put an end to the "bearish" forecasts of major banks for USD/JPY. In particular, Goldman Sachs recommended selling the pair with a target of 103, while BNP Paribas and Morgan Stanley saw it even lower. At around 102 and 101, respectively. Mathematically, the current level of volatility suggests that before the end of the year, the dollar is likely to trade in the range of £105.4-111 with a 75% probability.

Dynamics of USD/JPY and yen volatility

The yen rightfully claims to be the most interesting currency of the week to November 1 due to the saturated important macro statistics of the economic calendar, rumors of Boris Johnson initiating early elections in Britain and the development of the situation in the field of trade wars. Also, we are expected to meet the Fed and the Bank of Japan. The release of data on US GDP and the labor market should show a further slowdown in the US economy. Bloomberg experts expect its growth in the third quarter to decline from 2% to 1.6%, and employment in October will grow by less than 100 thousand.

Fears that the easing of monetary policy by the Fed and ECB will lead to a strengthening of the yen, contributed to the growth of rumors about additional monetary stimulus from the Bank of Japan. The currency of the Land of the Rising Sun did not revalue, so BoJ can afford passive behavior. Moreover, as practice shows, increasing the balance with QE is not the best way to accelerate inflation. In Japan and Switzerland, central bank balances exceed GDP, but the deviation of actual consumer price data from the targets is the most significant among regulators that issue G10 currencies.

The deviation of the actual CPI from target

Thus, further dynamics of USD/JPY will depend on the external background, macro statistics for the Thus, further dynamics of USD/JPY will depend on the external background, macro statistics for the States and meetings of central banks. If Jerome Powell after reducing the federal funds rate to 1.75% manages to convince the stock market that a pause in the process of monetary expansion is not a problem, the bulls in the analyzed pair will be able to continue the attack.

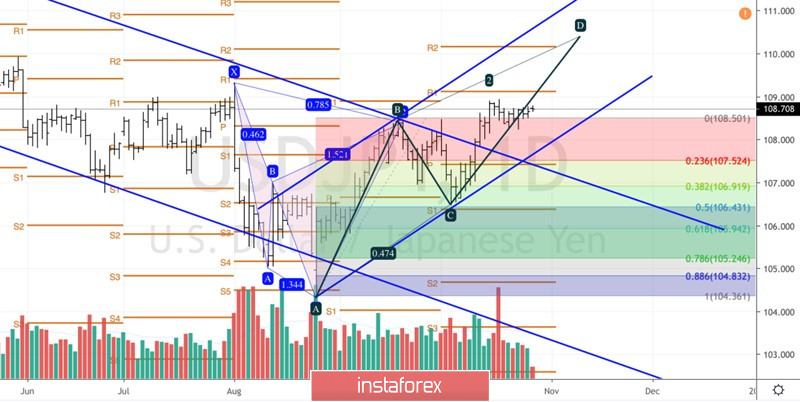

Technically, a breakthrough in the resistance of 108.9-109.1 will allow USD/JPY to resume the northern campaign in the direction of the target by 200% according to the AB = CD pattern. It is located near 110.4.

USD/JPY, the daily chart