4-hour timeframe

Amplitude of the last 5 days (high-low): 41p - 39p - 34p - 70p - 50p.

Average volatility over the past 5 days: 47p (average).

The first trading day of the week for the EUR/USD currency pair was held in absolutely calm trading with a total volatility of 26 points. This is much lower than the instrument's average volatility over the last five days. Such low activity of market participants is not surprising, given the absolutely empty calendar of macroeconomic events. There is a feeling that the previous week continues, in which the fundamental events were only on Thursday. This week, of course, it's not that bad. News and macroeconomic reports will be received and published starting from Wednesday. Today was also formally an event that could have an impact on the course of trading in the US trading session, but, as we warned in the morning, this event was only with a loud name, and in fact nothing interesting has brought life to the Forex market. We are talking about the speech of Mario Draghi, who will officially leave his post this Thursday. Unfortunately, the last months of Mario Draghi's work were marred by a split in the ranks of the ECB's monetary committee, where not all members of the organization shared the initiative of its chairman to resume the asset purchase program, simultaneously filling the economy with cash. However, none of this matters. Today, according to many, this was Draghi's farewell speech and nothing interesting was heard. Now traders should expect the speech of Christine Lagarde, who previously promised to adhere to the policies of Mario Draghi, however, it is likely that there will still be some differences in the ways of managing the central bank. It is in this and should understand all market participants in the first place. To understand what policy Lagarde will follow and whether to expect the end of monetary easing or the ECB will adhere to the policy of "responding to changes in economic conditions". There's no point in guessing yet.

Although traders are likely to get answers to questions from the previous paragraph this week, the Federal Reserve meeting, the results of which will be announced late Wednesday, is more important. Why is this meeting so important? First, because the regulator can go for a third consecutive easing of monetary policy, and then no one can say that this is an accident, coincidence, correction of rates after a period of increase, and so on. And if such a statement is made by any of the representatives of the Fed itself, it is unlikely that market participants will believe it. Macroeconomic statistics in the United States are indeed deteriorating, but if the ECB reacted to the deterioration of its "figures" each time by lowering the rate, then we would now see figures of about -2% for the deposit rate, and possibly even lower. So we believe that the "Trump factor" works and it works perfectly. Yes, at first the Fed resisted, Powell said that he was not too interested in what opinion the US president holds, since the US central bank does not obey the president. Nevertheless, in fact, the Fed is following Trump's lead in the last three months. Secondly, because the euro currency moved away from two-year lows against the US dollar with great difficulty, but this is clearly not enough to declare the end of the downward trend. The euro and the bulls really need macroeconomic support. Without it, sooner or later, the bears will again begin to put pressure on the currency pair. After all, the situation in the eurozone is objectively worse than in the United States. Thus, even the euro's growth by two cents in recent weeks is not too justified. But if the Fed continues to cheerfully cut rates, then the euro will have global grounds for strengthening. Thirdly, because there will be a speech by the head of the Fed Jerome Powell, and this is always interesting. It is likely that Powell will again say nothing new, confining himself to listing the risks associated with trade wars and geopolitical tensions in some regions of the world, but in any case, attention will be focused on his words.

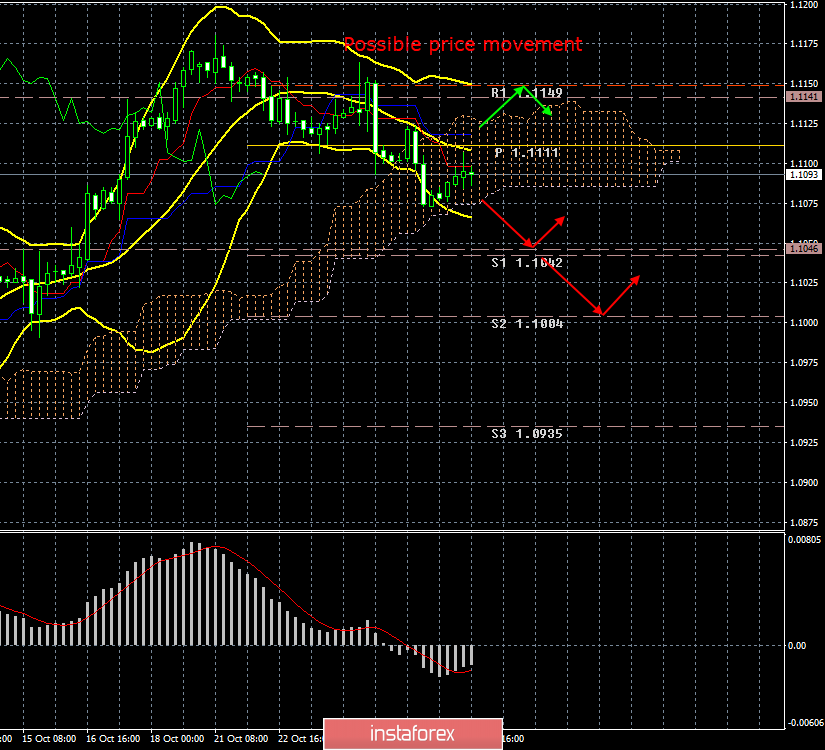

From a technical point of view, the euro/dollar began a small upward correction on Monday, October 28, but the volatility is extremely low and the price is located inside the Ichimoku cloud, so the general situation does not imply active trading. Overcoming the Ichimoku cloud will significantly improve the position and mood of the bears, which can persuade the pair to move down until Thursday (Wednesday evening). However, it is the Fed that can support the European currency if it lowers the key rate. Thus, the entire downward movement may end near the Senkou Span B line and receive the status of an extended correction.

Trading recommendations:

The EUR/USD pair began to adjust, being inside the Ichimoku cloud. Slowly you can look closely at euro sales, especially if the bears manage to overcome the Ichimoku clouds. However, ahead of the announcement of the results of the Fed meeting, we do not recommend opening large sales. The strengthening of the US dollar may continue if monetary policy is not changed in October. It is recommended to return to the pair's purchases no earlier than the bulls crossing the Kijun-sen line.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.