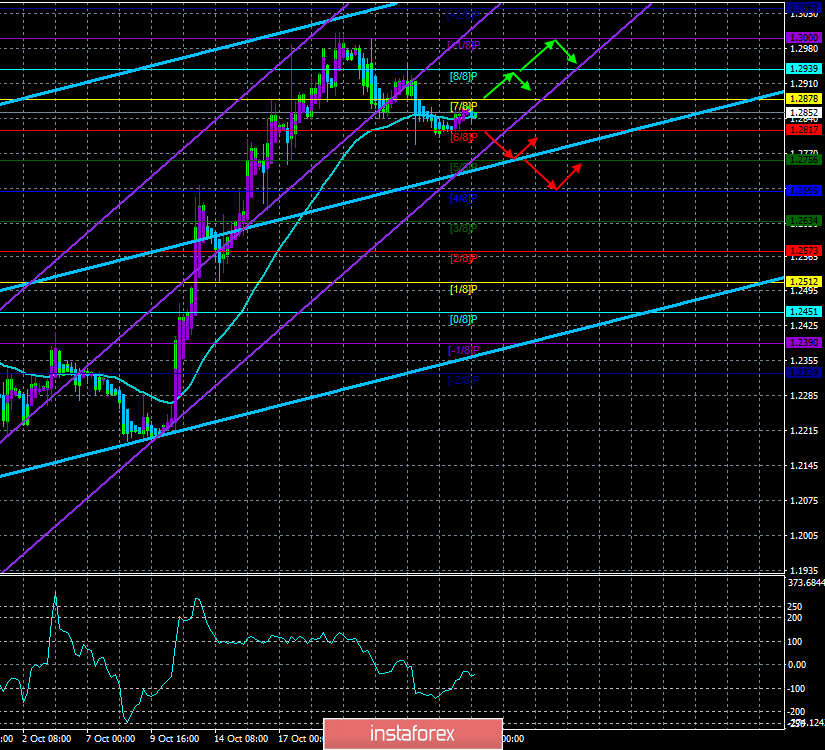

4-hour timeframe

Technical data:

The upper channel of linear regression: direction – up.

The lower channel of linear regression: direction – up.

The moving average (20; smoothed) – sideways.

CCI: -40.0972

Late last night, an event took place in the British Parliament, which, of course, was expected by many traders of the foreign exchange market. The fact is that the future of Parliament, the future of Brexit and the degree of Boris Johnson's "stiffness of hands" that does not allow him to win a single victory as Prime Minister of the country depended on yesterday's vote. If the Parliament had voted "yes" to hold early elections, the probability that the conservatives would have won them is very high. And the more conservatives get seats in the Lower House, the easier it will be for Johnson to make decisions alone, only with the help of his fellow party members. There was no intrigue or tension in the vote. 299 deputies voted "for" the conduct of the elections, 70 – against, the rest abstained from voting. Recall that for the initiation of parliamentary elections, 434 deputies voted "for" are needed. That is, 135 votes were not enough, that is, Boris Johnson suffered another devastating defeat. Yesterday, we said that the Parliament simply doesn't make any sense to follow Boris Johnson's lead, to fulfill his ultimatums, which can be easily canceled, blocked and not even taken into account. The Prime Minister is the highest government unit in the UK, but it obeys the will of Parliament, which Boris Johnson constantly forgets.

By the way, both Jeremy Corbyn (the leader of the Labor Party and the opposition) and Boris Johnson himself continue to "play" with each other. Earlier, Johnson offered the opposition a postponement of Brexit, which he agreed to yesterday after Brussels officially agreed to postpone the date of the Kingdom's exit from the EU under a flexible scenario (provides for the possibility of an earlier exit from the EU, if Parliament approves the "deal"), in exchange for an agreement to hold early elections. Yesterday, it became clear that the opposition would not take such a step, and Jeremy Corbyn said he did not trust the Prime Minister. Moreover, the leader of the Labor Party also poured salt on Johnson's wounds, saying "He does not fulfill every promise he (Johnson) makes. The prime minister said that he would withdraw us from the European Union by October 31, – so do it or die." Johnson said that he would initiate parliamentary elections in another way, which requires the support of only half of the parliament, and not 2/3, since "the current Parliament has ceased to be able to make decisions and benefit the people and the state." Also, according to Boris Johnson, it is the Parliament that "holds the country hostage and this should be changed." The downside of Johnson's new "genius" plan to hold early elections through the bill is that MPs from any party will be able to amend the bill. Accordingly, the Labor Party will, in any case, do everything to prevent the re-election and the conservatives from gaining the necessary majority of seats in Parliament. Moreover, even for this option, half of the Parliament, which is 325 deputies, will need support. Johnson gathered just 299 votes yesterday.

The British pound against the background of all these events froze in place and does not react to the next political war on the sidelines of Parliament. It is unlikely that such low-volatility movements will remain in the life of the British currency for a long time. We can say that the pound is now at the crossroads of two roads. On the one hand, a "hard" Brexit will not be soon and this is good. On the other hand, this information has long been worked out, and there are no new reasons for joy yet. Yesterday, the pound/dollar pair settled back above the moving average, but it does not indicate a desire to resume the upward trend. To date, no important macroeconomic publications are scheduled in the UK again.

Nearest support levels:

S1 – 1.2817

S2 – 1.2756

S3 – 1.2695

Nearest resistance levels:

R1 – 1.2878

R2 – 1.2939

R3 – 1.3000

Trading recommendations:

The GBP/USD currency pair started to move sideways on the background of the absence of important news. Thus, traders are advised to now wait for the consolidation below the Murray level of "6/8" to be able to re-consider short positions. Or fixing above the Murray level of "7/8" to become relevant purchases of the British currency with targets of 1.2939 and 1.3000. At the same time, the volatility of the pair remains reduced, which should be taken into account when opening any positions.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue line of the unidirectional movement.

The lower channel of linear regression – the purple line of the unidirectional movement.

CCI – the blue line in the regression window of the indicator.

The moving average (20; smoothed) – blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.