There is a completely empty macroeconomic calendar, except for data on consumer lending in Europe, whose growth rates remained unchanged, although it should have accelerated from 3.4% to 3.5%. It also contributed to the implementation of the technical rebound. The single European currency, that the pound was able to slightly strengthen their positions, have lost over the previous few days, when market participants were seriously excited by another mess around Brexit. British politicians managed to confuse everything once again so that no one was able to figure out what was really happening. It seems that even the British political class itself does not understand anything. Fortunately, British politicians remained silent yesterday, apparently trying to figure out everything that they themselves had done.

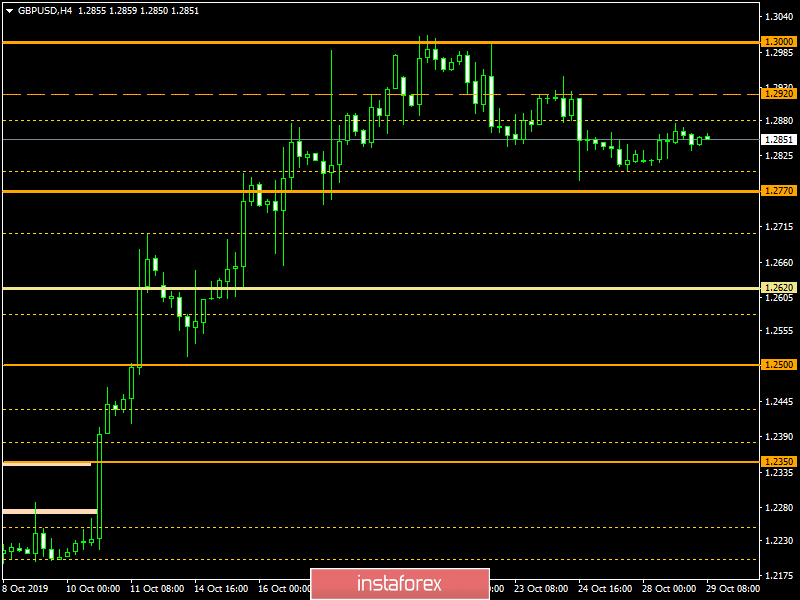

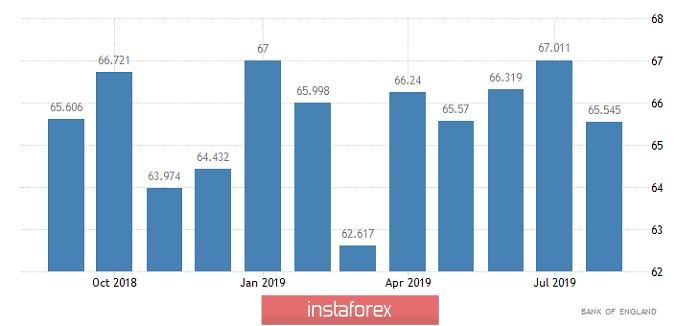

Today, the situation, at least with macroeconomic statistics, is somewhat better. Thus, Nationwide data has already shown that the growth rate of housing prices in the UK has accelerated from 0.2% to 0.4%. Thus, this is a definite positive for the pound, as the state of the real estate market is one of the main criteria for the investment attractiveness of the United Kingdom. However, there will still be data on the lending market, which can ruin the pleasant picture. The volume of consumer lending should reach 0.9 billion pounds which is exactly the same as in the previous month. This means that there is stagnation in the consumer lending market. Moreover, the number of approved mortgage applications can be reduced from 65,545 to 65,000. Therefore, we can say that British statistics today will be purely neutral.

Number of approved mortgage applications (UK):

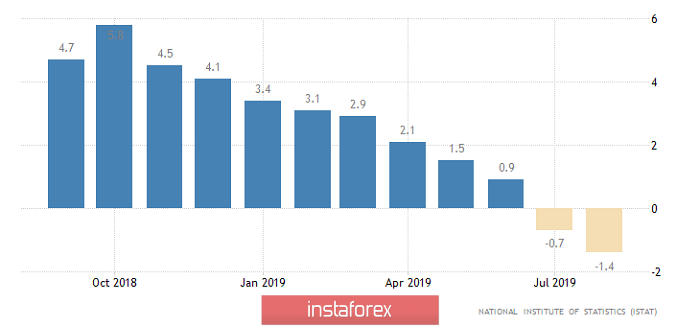

For the euro area as a whole, no data is published today. However, for a number of large European countries, some data is released. So, in Spain, and this is the fourth economy of the euro area, published data on retail sales, the growth rate of which should remain unchanged at 3.2%. In Italy, which is the third economy of the euro area, a slight improvement in the situation with producer prices is expected, since their decline should slow down from -1.4% to -0.9%. However, this is still a reduction in prices and the data itself is not so significant.

Producer Prices (Italy):

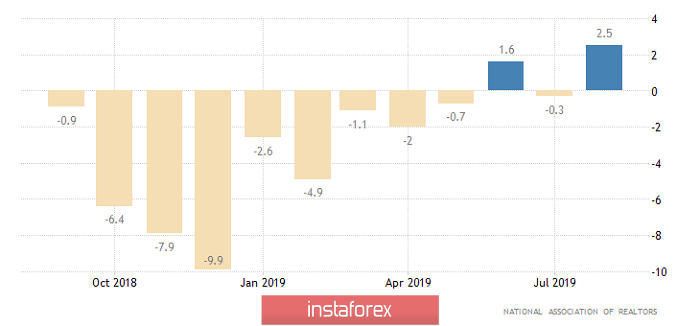

If we talk about the United States, then here, macroeconomic statistics will be neutral. On the one hand, S & P / CaseShiller data should show an acceleration in housing growth from 2.0% to 2.1%. But at the same time, the pace of growth in pending home sales transactions may slow down from 2.5% to 1.4%, which will indicate a decrease in activity in the real estate market in the future. In addition, do not forget that the results of the meeting of the Federal Committee on Open Market Operations will be known tomorrow, so that many market participants simply do not want to take risks.

Unfinished Home Sales (United States):

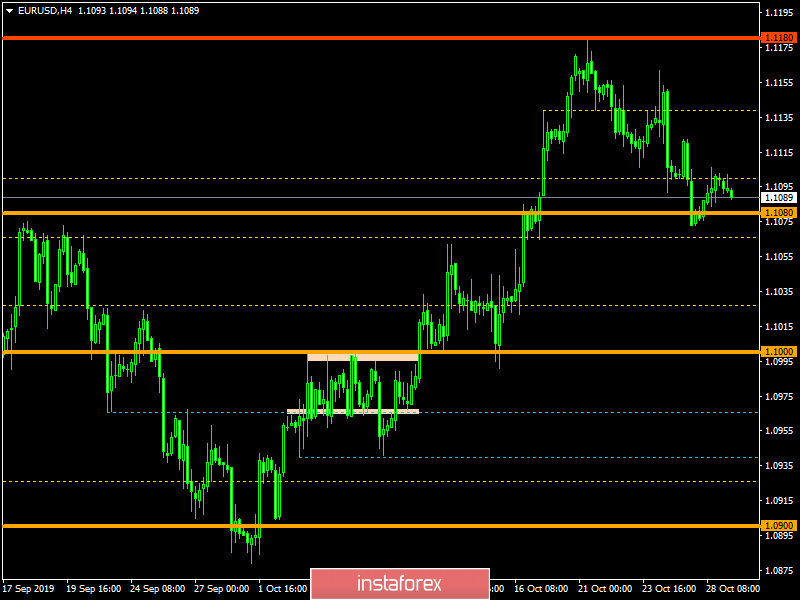

The euro / dollar currency pair moved into the pullback phase without showing high volatility after reaching the resistance level of 1.1080. It is likely to assume a temporary fluctuation within 1.1080 / 1.1105, where it is worthwhile to carefully analyze the price fixing points.

Recently, the pound / dollar currency pair has not shown sharp jumps, as well as high volatility. The only thing there is is a technical pullback, followed by a slowdown. It is likely to assume that a sluggish fluctuation within the 1.2810 / 1.2865 frames will still persist today, where in terms of analysis, we monitor the behavior of quotes and the points of subsequent price fixations.