The slowdown in consumer lending is very bad news for the Bank of England, which poses a threat to the UK economy.

A report was released today that stated that the number of approved mortgages in the UK remained virtually unchanged, while consumer credit growth slowed to a five-year low.

GBPUSD

So, the number of approved mortgages in September 2019 amounted to 66,000, while economists expected the indicator to be at 65,100. The figure was 65,680 in August. Net mortgage lending in the UK rose to 3.8 billion pounds in September against 3.7 billion pounds in August, indicating stability in the housing market.

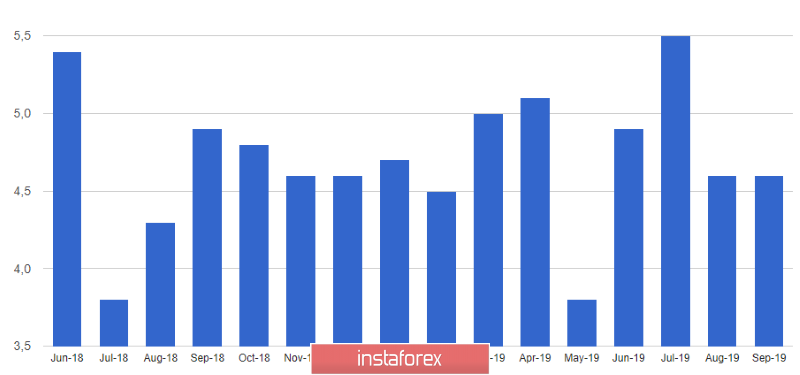

However, net consumer lending in the UK amounted to 4.6 billion pounds in September against the same figure of 4.6 billion pounds in August. Unsecured consumer lending grew by 6.0% year on year, representing the weakest growth since 2014. The report indicated that unsecured consumer lending in the UK increased by 0.8 billion in September pounds against 1.0 billion pounds in August, while economists had forecast it at 0.9 billion pounds.

The situation with Brexit leaves its mark on lending, which in general slows down for the third straight year, after a referendum at which it was decided to withdraw the country from the EU. The slowdown in lending suggests that consumers are worried about Brexit's economic impact, pushing them away from expensive purchases that require borrowed funds.

The pound managed to strengthen its position after the news appeared today that Jeremy Corbyn was ready to support the general election. In his statement, the head of the Labour Party said that now that the EU has granted Brexit a three-month delay, we can safely talk about choosing a date for the general election in the UK. Corbyn also noted that he was ready to launch the most ambitious company that the country had ever seen. They said at Downing Street that they were planning to hold general elections on December 12 in their bill, but they did not rule out the possibility of making concessions to the conditions proposed by liberal democrats and the SNP. It's about the elections the day before, December 11th.

As for the GBPUSD technical picture, the bulls confidently defended the level of 1.2800, not allowing the pair to go below the support of 1.2730 and 1.2660. Bulls still need to go above the resistance of 1.2870, which will lead to the demolition of a number of stop orders of sellers and will reach a high of 1.2950.

EURUSD

The euro also reacted with growth to Brexit news, but this did not lead to major changes from a technical point of view. A weak report on US retail sales put pressure on the US dollar. According to The Retail Economist and Goldman Sachs, the US retail sales index for the week from October 20 to October 26 fell immediately by 3.8%, but rose by 1.9% compared to the same period in 2018.

According to Redbook, US retail sales for the first 3 weeks of October remained unchanged, but grew by 4.3% compared with the same indicator in 2018. From October 20 to 26, year on year, sales grew by 4.6%.

It is possible that the euro receives support from how the trade conflict between the US and China develops, which is one of the key reasons for the slowdown in economic activity in the eurozone. Yesterday, Donald Trump was optimistic about this, which could add confidence to buyers of risky assets with today's decline in the pair in the support area of 1.1080.

From a technical point of view, the bulls will continue to seek to regain the resistance of 1.1120, which will lead to a more powerful upward impulse to the area of highs at 1.1150 and 1.1180.