4-hour timeframe

Amplitude of the last 5 days (high-low): 39p - 34p - 70p - 50p - 31p.

Average volatility over the past 5 days: 45p (average).

The second trading day of the week for the EUR/USD currency pair again passed in absolutely calm trading, without a pronounced trend movement. Volatility marginally increased compared to Monday, only by 20 points and no more. On the whole, the pair remained inside the Ichimoku cloud, for the second time, failed to overcome the level of 1.1075, along which the Senkou Span B line ran yesterday, and provided significant support today. The pair returned to the critical Kijun-sen line at the end of the day. All these movements from the pair in no way specify the current technical picture. The euro/dollar continues to be traded inside the Ichimoku cloud, which according to the guide to the indicator itself is considered an unattractive area for trading. As for macroeconomic publications during the day, we can note one - the indicator of US consumer confidence in October - which slightly decreased compared to the previous month and amounted to 125.9, and which did not particularly affect the course of trading, as is a secondary indicator. Thus, we can say that today nothing interesting in the fundamental sense for the EUR/USD pair has happened in the world.

But traders will really have something to turn their attention to tomorrow. We will not once again list all the events of tomorrow, we only report that, to the general disappointment of traders, the volatility of tomorrow may not differ too much from today. The problem is that most of tomorrow's macroeconomic events are either already taken into account by market participants or are preliminary. For example, data on US GDP for the third quarter. A slowdown is expected to grow to 1.7% YOY, but this value is not final and if there is no serious deviation from the forecast, then there will be no reaction. Furthermore, the report on the change in the number of employed in the private sector from ADP is an indicator characterizing the state of the US labor market, however there is NonFarm Payrolls, which is objectively more important and significant. In addition, the Federal Reserve meeting and it is very likely it would lower the key rate. The decrease is so likely that it is probably already taken into account by the forex market. Although this thesis is the most controversial. Given the fact that the US dollar has risen in price in recent days, even if this growth was corrective, then traders might still not have time to reject the possible easing of monetary policy. In this case, we can expect a serious strengthening of the European currency tomorrow. Another interesting indicator that might be ignored by traders on Wednesday is inflation in Germany, also a preliminary value for October. If the consumer price index slows down again, then pan-European inflation may be expected to slow down. Recall that inflation in the EU already breaks all the records of weakness in recent months and has slipped to 0.7% YOY. Well, the last one will be a press conference by Jerome Powell, from which one also can't expect anything new. The only thing that Powell can do to surprise the markets is phrases and hints of completing a short-term cycle of lowering rates. If this happens, then despite not even lowering the rate following the results of the October meeting, the US dollar can significantly strengthen its position. We almost forgot about another important event, which is not listed in any news calendar. This is a message from U.S. President Donald Trump on Twitter right after the announcement of the Fed's bid decision. It will probably be criticism again, and if Powell hints at a pause in easing monetary policy, Trump will definitely not leave it that simple.

In general, tomorrow's Fed meeting can easily become a passing one, despite even a rate cut, and can become a serious fundamental basis for a new dollar trend. The fact is that in the confrontation between the euro and the dollar, even taking into account the three cuts in the Fed's key rate, the balance of power has not changed much. The situation in Europe is still worse than in the United States, monetary policy is much "softer". Thus, the "softening" break announced by Powell could provide a strong additional support to the US currency.

From a technical point of view, everything remains quite lackluster. In order for the pair to be able to continue moving down, it is necessary to wait for the Senkou Span B. line to cross. In order for the euro to resume the upward trend, it will at least need to overcome the Kijun-sen critical line.

Trading recommendations:

EUR/USD continues to adjust, as it is inside the Ichimoku cloud. Slowly you can look closely at selling the euro, especially if the bears manage to overcome the Ichimoku cloud. However, tomorrow afternoon, we recommend that it be wary of opening any positions, as the results of the Fed meeting and the press conference of its chairman may bring surprises.

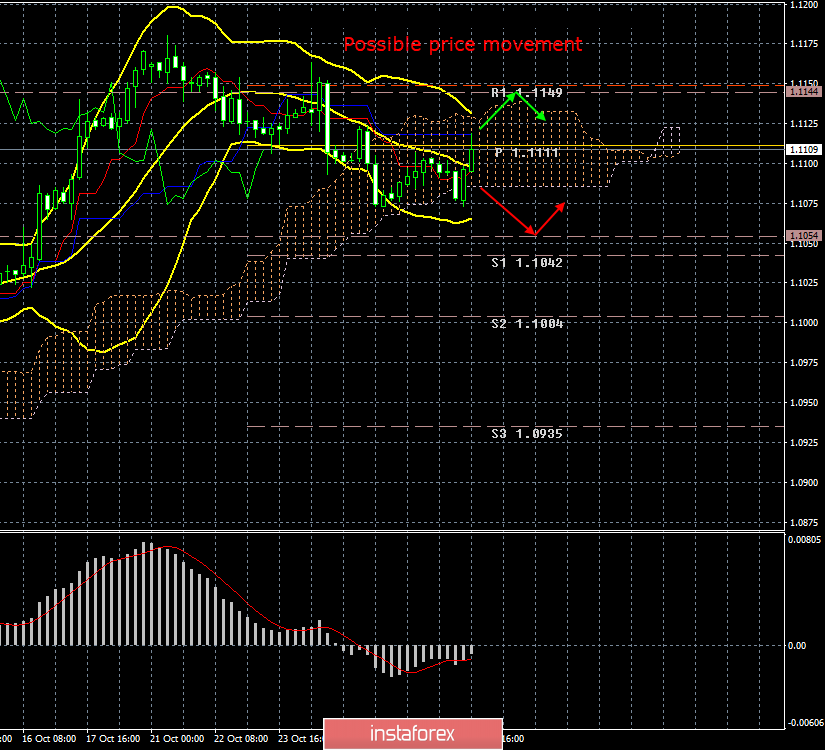

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.