The wave of optimism subsided after reports that the US and China were unlikely to conclude a trade agreement in Chile on November 16-17. At the same time, US stock exchanges closed slightly lower, with the Nikkei and Shanghai Composite decline on Wednesday morning.

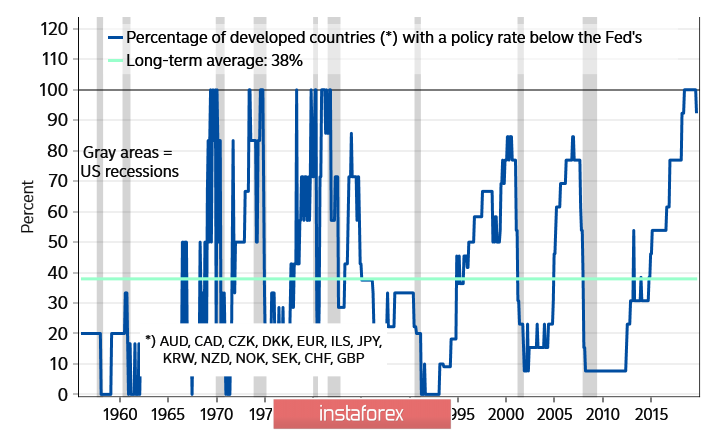

The focus of the day is directed to the Fed meeting. The main idea, which determines the weakness of the dollar in the short term, is that the Fed has more opportunities to reduce rates than the ECB and the Bank of Japan. To stop the recession, which obviously threatens not only the United States, but the whole world, players rely on cheaper dollars, both to hedge risks and to refinance current debts. This universal recipe has always worked in recent decades, thus, it will work now, if the Fed becomes more dovish.

As long as the Fed rate is higher than in the eurozone or Japan, the dollar will be solid even if the Fed continues to decline. Understanding this point may explain a possible "illogical" reaction of the market, in which the dollar could go up after the Fed cuts the rate.

Today, the rate cut, as the markets are quite sure, will not lead to a weakening dollar. Although the reaction may be triggered by a cover statement, but mainly just J. Powell press conference. Thus, only clear dovish notes can put pressure on the dollar.

EUR/USD

Today, the European Commission will publish updated indicators of the business climate in the industry and consumer confidence in October. There is no way out of the protracted fall. The recent PMI data from Markit came out worse than expected, the level of consumer confidence fell, ZEW and Sentix also do not see positive changes. Due to this, the probability of seeing growth from the European Commission looks low.

As acknowledged by the ECB, growth prospects remain bleak, risks are shifting towards a further decline, that is, by all parameters, the euro has no internal strength to resume growth and will be traded depending on where the Fed's pendulum swings. Resistance is 1.1130 / 35, where sales can resume if the Fed gives slightly softer comments, but the movement towards support 1.1072 with a target of 1.1060 looks more real.

GBP/USD

The main news that will determine the prospects of the pound in the coming weeks is the early parliamentary elections in the UK, which will be held on December 12. Boris Johnson was the initiator of this step, and the markets regard the adoption of the law on early elections as a victory for the conservatives.

This step, according to Johnson, will allow Brexit to break the deadlock. As it reached the necessary majority in parliament, conservatives expect to implement the agreement of October 17 and approve the UK's exit from the EU.

In conclusion, political news support the pound. As for the macroeconomy, the PMI in production is likely to grow this week, as British companies, preparing for Brexit on October 31, have accumulated significant stocks of products.

Moreover, consumer activity has also been kept so far at the necessary level which allows us not to be afraid of a sharp drop in inflation. Meanwhile, recent reports on housing prices show an increase and there was also an increase in applications for mortgage loans in September. In general, the pound began to look more confident, as the period of uncertainty comes to an end.

Positive political changes led to the fact that most banks began to predict continued growth of the pound amid a reduction in uncertainty. Support is 1.2835 / 40 and the first target is 1.2948, but movement will only begin after the Fed confirms the expectations of the market.