From late May to early September, the value of gold rose by more than 20% due to a combination of three factors: expectations of a reduction in the federal funds rate from 2.5% to 1.75% for preventive purposes, the escalation of the US-China trade conflict and, finally, the growing likelihood of a disorderly Brexit due to the coming to power of Boris Johnson. The first of them is almost played (not many doubt that the Fed will ease monetary policy for the third time in October), Donald Trump is ready to sign an agreement with Beijing, without waiting for a meeting with Xi Jinping, and the chances of Britain leaving the EU without a deal are minimized. When you have played all the trump cards, you need to count on a deep correction against the backdrop of the closure of speculative longs, but the precious metal is not in a hurry to retreat.

When the Federal Reserve began to cut rates in the summer, Jerome Powell spoke of a mid-cycle adjustment and cited the experiences of 1995 and 1998, when the Central Bank used three acts of monetary expansion to keep the fire in a cooling economy. Nonetheless, in October, it became apparent: States could not escape the pain of trade wars. The weak statistics on retail sales, inflation, and business activity may be supplemented by negativity from GDP and the labor market. In July-September, the US economy is likely to slow down from 2% to 1.6%, which will be the second-worst quarterly result since Donald Trump was in power. If the Fed chairman leaves the door open for further rate cuts, no one will scold him. On the contrary, the owner of the White House will express his gratitude to him, because in this situation the American dollar will most likely weaken, and gold will rise.

The dynamics of gold and the US dollar

This is not to say that the situation with Brexit and the trade wars has become as transparent as possible. Despite the progress in relations between Washington and Beijing, the amount of duties imposed by the States on Chinese imports is higher than 3 months ago. Not the fact that they will be canceled after the meeting of the heads of state in November. Boris Johnson managed to achieve early elections, which increases uncertainty. If the Conservatives win on them, Britain will leave the EU on the terms proposed by the Prime Minister, Labor – we are waiting for a second referendum.

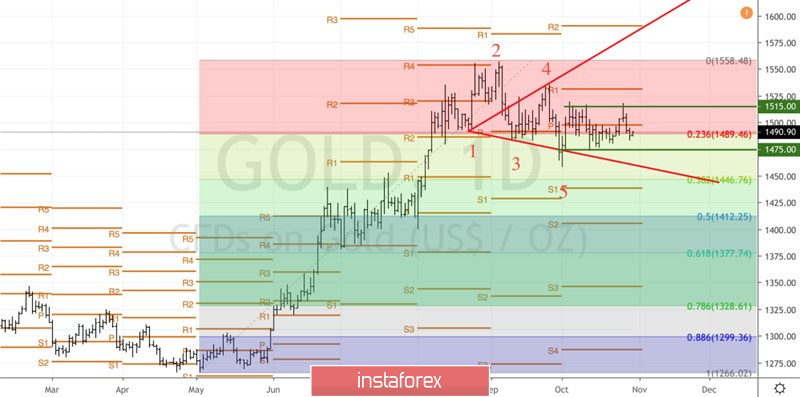

In such conditions, it is not advisable to run from long positions in precious metals. Everything can at any moment turn to face the "bulls" at XAU/USD. Gold went into consolidation in the range of $ 1475-1515 per ounce, and only the exit of quotations beyond its limits will clarify its fate. Buyers rely on the "dovish" rhetoric of Jerome Powell and the associated weakening of the US dollar, sellers – to reduce trade and political risks.

Technically, the "Splash and Shelf" pattern was formed on the daily gold chart. Falling prices below the lower limit of the consolidation range of $1475-1515 per ounce ("shelf") will create the prerequisites for the development of a correction to an upward trend in the direction of $1440-1450. On the contrary, a successful assault on the resistance at $1515 will increase the risks of implementing targets at $1545 and $1580 according to the "Wolfe Wave" model.

Gold, the daily chart