To open long positions on EURUSD, you need:

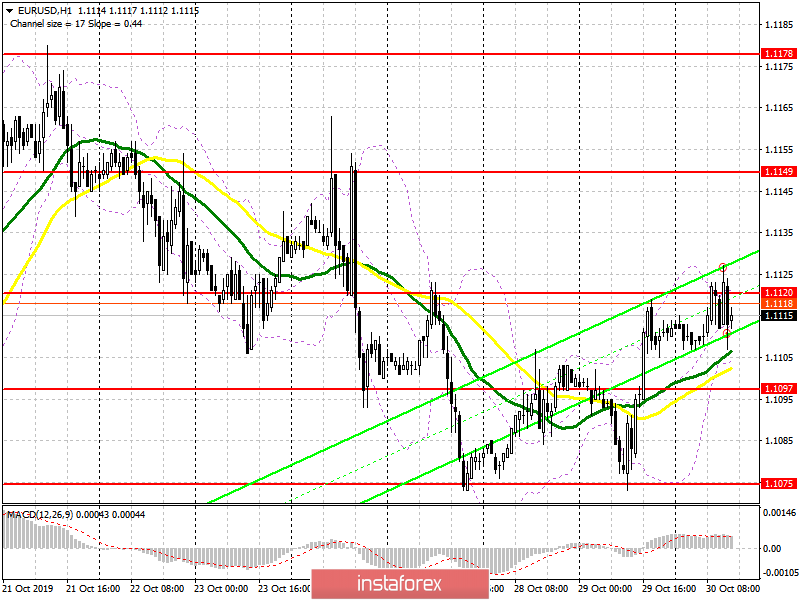

In the first half of the day, buyers of the euro attempted to rise above the level of 1.1120, however, good data on the German labor market were not enough. The decline in the sentiment index in the economy led to the formation of a false breakdown of 1.1120 and the return of sellers to the market. At the moment, the focus is on the US GDP report, but traders will pay more attention to the Fed meeting, at which the management can take a "technical pause" in lowering interest rates, which will support the US dollar. From a technical point of view, nothing has changed. If rates decrease, the bulls will try to break above the large high of 1.1120, which will lead to the resumption of the upward trend in EUR/USD and to the update of the levels around 1.1149 and 1.1178, where I recommend taking the profits. If the pressure on the euro persists, it is best to consider long positions on a false breakdown near the middle of the side channel – 1.1097 or buy on a rebound from its lower border of 1.1075.

To open short positions on EURUSD, you need:

Sellers of the euro waited for a false breakdown in the resistance area of 1.1120, which limited the upward potential of the pair. The nearest target is the support of 1.1097, however, a good report on US GDP growth may lead to a breakdown of this level and to further sale of the pair to the lower border of the side channel 1.1075, where I recommend taking the profits until the Federal Reserve decides on interest rates. Only the scenario of keeping rates at the same level will keep the demand for the US dollar, which will lead to a breakthrough of 1.1075 and a decrease in the area of lows 1.1050 and 1.1026. In the case of growth above the resistance of 1.1120, the levels of 1.1149 and 1.1178 can be considered for sales.

Indicator signals:

Moving averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market.

Bollinger Bands

In the case of a decline in the pair, a breakthrough of the lower border of the indicator in the area of 1.1097 will lead to a sell-off of the euro.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20