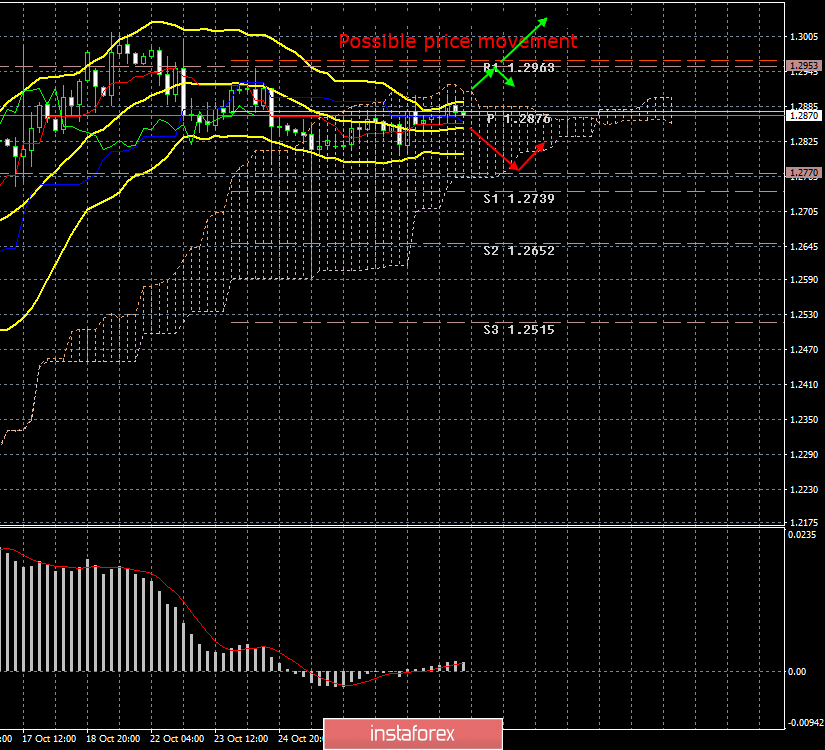

4- hour timeframe

Amplitude of the last 5 days (high-low): 80p - 161p - 59p - 64p - 98p.

The average volatility over the past 5 days: 91p (average).

What are the goals of the Conservatives, and what are the goals of the Labour Party? In fact, they are one and the same: winning as many deputy mandates as possible. Conservatives are eager to finally realize Brexit, while the Labour Party wants to cancel it or at least hold a second referendum, giving the British people the opportunity to determine what fate they want for their country. However, residents of the UK will have a similar opportunity much earlier, in fact, already on December 12. Indeed, future elections will have a certain hidden meaning, which, however, everyone will know. This time, the elections will mean the commitment of each voter not to a particular party, but to the outcome of Brexit, which each individual voter would like to receive in the end. This is the main problem of the entire Brexit process and future parliamentary re-elections. Often, the majority wins in any election, that is, the balance of power is distributed in the proportions of 30% - 70%, or with a wider gap. That is, based on the results of such elections, we can really speak with confidence about the majority opinion. Also, often the elections have such a system in which at the final stage of the voting there are only two possible options, or two candidates for whom you need to vote. But all this does not apply to parliamentary elections, where there will be at least seven options, and the votes can be distributed in any way. Who said the Conservatives would win a victory that would allow them to make individual decisions in the future? Theresa May also wanted to strengthen the position of the Conservatives in Parliament because of the lack of votes to approve her "deal" on Brexit, and eventually it backfired. Thus, we can even assume that some residents, opponents of Brexit, did not specifically vote for the Conservatives in order to prevent Brexit. And if the Brexit question was not so tough, then the vote would have been given to the Conservatives. The same effect can be observed now. Those residents of Great Britain who want Brexit can vote for Conservatives, while those who do not want are for Labour. Accordingly, the alignment of forces may not change much compared to the results of the re-election initiated by Theresa May and may not at all correspond to all the studies that give the calculation of the ratings of each party in the United Kingdom.

Thus, the main conclusion is as follows: the election results cannot be predicted, they can turn out to be very unexpected or even surprising and do not guarantee the resolution of the political crisis and the frank impasse faced by the British government in connection with the "divorce" from the European Union. As we mentioned earlier, the British currency almost stopped responding to any events related to Brexit. Yes, by and large, now there's nothing to react to. Brexit has again been postponed, and Parliament will soon be dissolved and will not make any decisions until December 12.

The technical picture of the pound/dollar pair implies a continuation of the flat. It is vital for traders to get any important fundamental data in the near future in order to move the pair off the ground. Maybe they will get them tonight, but maybe Jerome Powell's speech will be boring and uninteresting. It's best to sum up tomorrow.

Trading recommendations:

GBP/USD pair is part of the lateral correction. Thus, it is best now to wait for the situation to be clarified, the flat to be completed, the pair to leave the Ichimoku cloud, the expansion of the Bollinger bands in one direction, as well as the results of the Fed meeting and Jerome Powell's press conference. Only after all this, it will be possible to draw certain conclusions on the further trend of the pair's movement and consider the opening of the corresponding positions.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.