EUR/USD

Unfortunately, we hastened to shift the local situation to medium and long-term prospects for strengthening the dollar. Risk appetite in the market is still strong, and after lowering the FOMC Fed rate, the dollar index fell 0.23% and the stock market grew 0.33%, while the euro added 40 points. But it should be noted that the markets began to fall immediately after the rate cut, and it only turned into growth on the comments of Jerome Powell, who did not look hawkish. As usual, Powell did not fall into the mood of investors. Instructions for taking a pause in the mitigation cycle were both in the accompanying statement and in the speech of the Fed chairman, but soft and inexpressive.

The preliminary signs that we paid attention to before the release of the Fed came out positive: in the private sector, according to ADP estimates, 125 thousand new jobs were created in October, GDP for the third quarter was 1.9% against the expectation of 1.7%. The Fed (primarily Powell) had reason for more hawkish formulations.

Risk appetite was strengthened by Donald Trump's announcement of progress in trade negotiations with China.

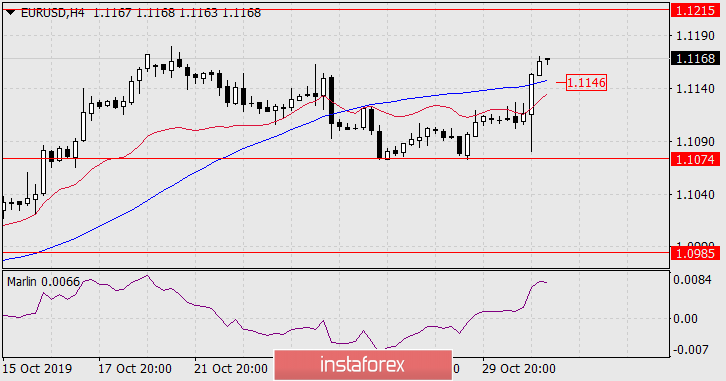

On the daily chart, the price went above the resistance line of 110.0%, the Marlin oscillator turned after the price, which indicates the organic nature of the current growth. As a result, we expect further growth to the Fibonacci level of 110.0% at the price of 1.1215.

On a four-hour chart, the price has consolidated above the MACD indicator line, Marlin is growing, the situation here is also increasing. As part of the growth, a local decline to the MACD line is possible at around 1.1146.