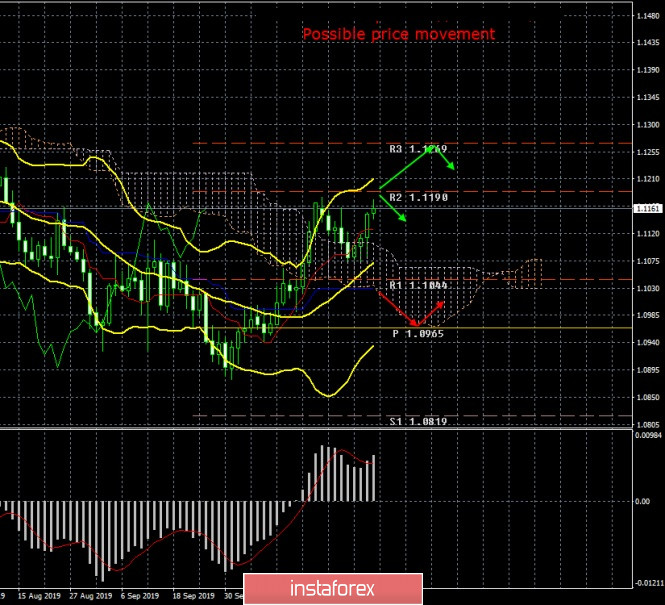

24-hour timeframe

October is possible to record the euro in positive. On October 1, the EUR/USD pair opened at 1.0898, and the quotes are located at 1.1156, and it is likely that around this level the month will close. Thus, the euro managed to rise in price for the month by about 250 points. Well, quite a decent result, given the two-year downward trend in which the pair was until this month. At the moment, traders for the second time came out of the Ichimoku cloud on the 24-hour timeframe, which gives reason to assume an upward movement in the next month. However, we believe that the bulls still have very little strength to continue to move the euro up. The previous local maximum of 1.1180 can easily keep the pair below itself, which can subsequently trigger the formation of a new downward trend. As for the foundation, it is still more interesting. In recent months, we regularly draw the attention of traders that all the hopes of the euro currency for growth are connected exclusively with the US economy. That is, in the European Union, the economic situation does not change for the better so that you can count on the strengthening of the euro currency. Moreover, economic indicators continue to fall, and inflation in recent months has slipped to a record of 0.7% y/y. Indices of business activity (especially in the industrial sector) continue to cause enormous fears, industrial production volumes continue to fall, only risks grow that the "epidemic" will spread to other areas of the EU economy.

The situation is fundamentally opposite in the States. Overseas, macroeconomic statistics also continue to deteriorate, inflation falls short of target values, business activity falls, and the Fed softened monetary policy three times in a row. However, this is what can play into the hands of the US dollar. The Fed has eased monetary policy three times, and this may be enough to stabilize the decline in the growth rate of economic indicators. Rates are lowered and inflation may start to accelerate again. The labor market is in good shape, there is no cause for concern. That is, the overall picture is as follows: the US economy is also experiencing some problems, but so far it is coping with them, and the space for active actions of the Fed should be enough to stabilize the situation and negate the possible stagnation and recession. So it turns out that the economic situation in America remains much more stable, and the economy – stronger than in the EU. The gap between ECB and Fed rates has narrowed, but this is unlikely to be enough for the euro currency to continue to rise in price. Thus, we believe that now either a "wide flat" is very likely, approximately in the channel between the levels of 1.13 - 1.10, or the resumption of the downtrend, which can be determined by fixing the price below the critical Kijun-Sen line.

Trading recommendations:

The trend for the euro/dollar pair is currently upward. Thus, we recommend now to wait for the update of the previous maximum and only, in this case, to consider new purchases of the euro currency following the signals on the 4-hour timeframe. We recommend that you return to selling the pair not before fixing the price below the Kijun-Sen line.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustration:

Ichimoku Indicator:

Tenkan-Sen – red line.

Kijun-Sen – blue line.

Senkou Span A – light brown dotted line.

Senkou Span B – light purple dotted line.

Chinkou Span – green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD:

The red line and the histogram with white bars in the indicators' window.