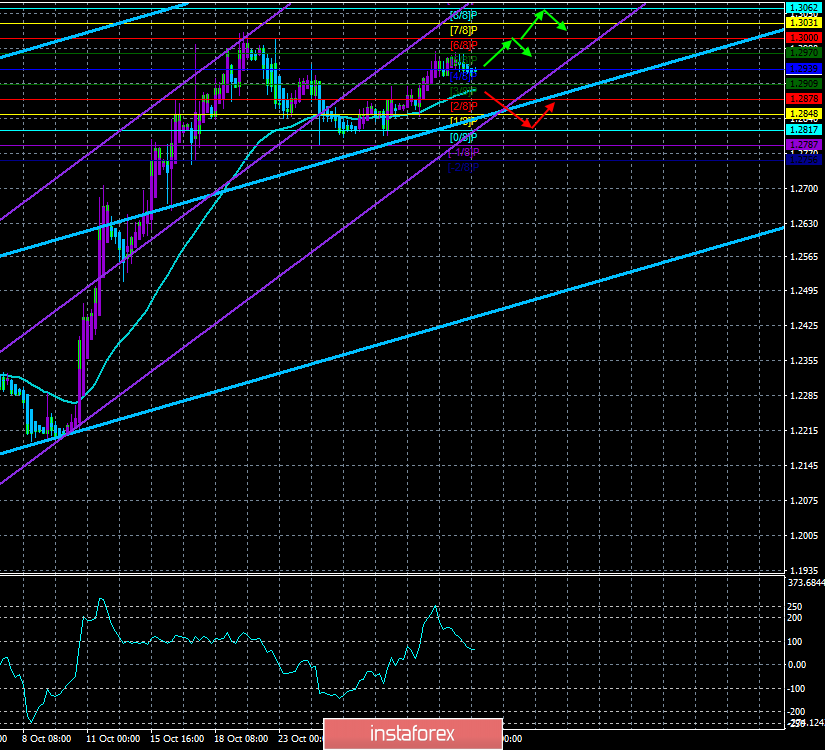

4-hour timeframe

Technical data:

The upper channel of linear regression: direction – up.

The lower channel of linear regression: direction – up.

The moving average (20; smoothed) – up.

CCI: 64.5607

On Friday, the British pound paired with the US dollar moved as if there was no news that the day at all. We recall that on November 1, macroeconomic data on wages in the United States, the number of new jobs created outside the agricultural sector, as well as indices of business activity in the sphere of industrial production were published. However, the pound/dollar pair calmly reached the Murray level of "5/8" – 1.2970, calmly turned down and began a weak downward correction. If you don't know about all of Friday's economic data, you'd think it was a "boring Monday." In the UK itself, by the way, the index of business activity in the manufacturing sector was also published, which, although it exceeded the forecast values, remained in the "red zone" – 49.6.

What awaits the British currency in the future? As we all know, Brexit is once again put on pause. Moreover, this time the pause will last 5 weeks, during which there will be no new negotiations between London and Brussels, Johnson and the deputies. There will be only preparation for parliamentary elections on December 12, election campaigns, agitation. Thus, traders during this time will be deprived of the fundamental recharge, which "ruled" the pound/dollar pair in the last three years. Traders ignored the American macroeconomic statistics, and the British ones, too. There are only technical factors that still predict British pound growth. However, it is worth noting that the moving average line is very close to the price, and overcoming it will "pass the ball" to the bears, who can start attacking, as there are still no special reasons for further strengthening of the British pound.

Meanwhile, British Prime Minister Boris Johnson has issued his official apology for failing to implement Brexit on October 31. Also, Boris Johnson has radically changed his rhetoric and now paying all the attention of the electorate to his desire to implement Brexit with a "deal", which was nevertheless managed to be concluded with the European Union at the October 17 summit. That is, the wording with a "hard Brexit" has disappeared somewhere and is no longer considered by the government as a possible option. Although we all remember how many interviews Johnson gave, in which he said that the country will leave the EU in any case, under any scenario. Johnson also said that "the agreement with the EU is completely ready and after December 12 the new composition of the Parliament will vote for it." That's just what this composition will be.

While the UK cannot resolve its issues with a "divorce" with the European Union, Scotland wanted a similar "divorce". The main problem is that virtually all the people of Scotland voted against Brexit in 2016. The government, led by Prime Minister Nicola Sturgeon, believes that any Brexit will hit the entire economy of the Kingdom, including the Scottish one. Thus, the Scottish Parliament has already begun the legislative process for a new referendum, which is scheduled to be held in the second half of 2020. However, this is opposed by Boris Johnson, who rules out any second vote on Scottish independence while he is Prime Minister. According to Johnson, such referendums are held once in a generation, not every year. There was already one referendum in 2014. In turn, Nicola Sturgeon said that "blocking the independence referendum is unacceptable." It is difficult to say how the story of the second referendum in Scotland will end. Great Britain needs to deal with at least one "divorce" first. Moreover, it is far from the fact that the whole procedure will end in a truly "divorce". It is still possible that the Labor Party will come to power (even though there are few chances for it), or at least the Conservatives do not receive the necessary majority of votes in Parliament. In the first case, a second referendum in the whole of Great Britain will be put on the agenda, in the second, Brexit may drag on for another couple of years.

As for today, so far the Heiken Ashi indicator indicates a weak downward correction, but the upward trend remains. Important and strong macroeconomic data will not be published today, so the volatility of the pound/dollar pair may remain within 50-60 points.

Nearest support levels:

S1 – 1.2939

S2 – 1.2909

S3 – 1.2878

Nearest resistance levels:

R1 – 1.2970

R2 – 1.3000

R3 – 1.3031

Trading recommendations:

The GBP/USD pair started to adjust. Thus, traders are advised to continue to consider buying the British currency with targets of 1.3000 and 1.3062, but after the completion of the current correction. It is recommended to sell pound/dollar pairs not earlier than the moving average. However, the technical picture and the fundamentals now contradict each other. It is best to trade intraday now, not for the long term.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue line of the unidirectional movement.

The lower channel of linear regression – the purple line of the unidirectional movement.

CCI – the blue line in the regression window of the indicator.

The moving average (20; smoothed) – the blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.