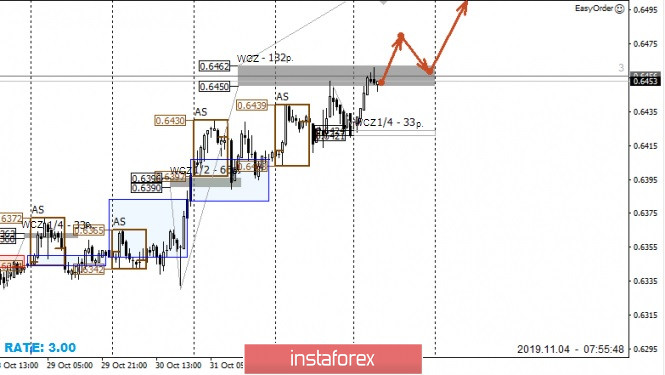

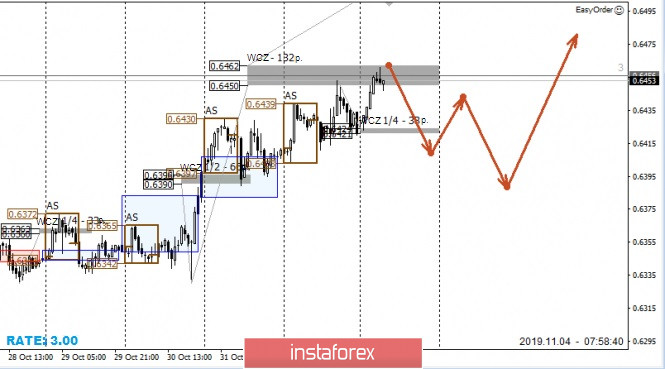

The main medium-term model is continued growth. Buying from the current levels will not be profitable, as the pair is testing the target weekly control zone of 0.6462-0.6450. The reaction to this zone will be decisive for further movement. In the case of consolidation above the zone, the growth will continue, which will allow keeping part of the purchases opened earlier.

The last three Asian sessions point to the strengthening of the New Zealand dollar. There are no prerequisites for the formation of a reversal movement.

An alternative model will be developed if the closing of today's US session occurs below the opening of trading. This will indicate the emergence of the interest of major players in the market sales of the instrument. This model will allow you to get more favorable prices for the purchase of the instrument.

Daily CZ – daily control zone. An area formed by important data from the futures market that changes several times a year.

Weekly CZ – weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ – monthly control zone. An area that reflects the average volatility over the past year.